Independent Thinking®

Crunching the Numbers on Changing Domicile

February 9, 2018

This is the time of year that the thoughts of many of us turn to the sunny south. Now there’s even greater incentive – for Californians, as well as residents in the Northeast and the Midwest – as tax reform adds to already high state and local tax burdens. In addition to living through some bitter cold spells this winter, we are having SALT provisions poured in our wounds.

The impact of the loss of all but $10,000 in combined state and local tax, or SALT, deductions have to be measured differently for those who were subject to the alternative minimum tax. And the charitable deduction remains. Nevertheless, it appears many of us will be paying more tax.

Tax reform did bring most high net worth families good news on the estate and gift tax front, doubling the estate, gift, and generation-skipping transfer exemption for all three taxes to $11,180,0001 per person without making any other changes to the law. The 40% rate and the “step-up” in income tax basis to fair market value at date of death remain. The law also continues the current gift tax exclusion for annual gifts, now up to $15,000 per donee, and continues to permit tax-free gifts for unlimited transfers directly to educational institutions and healthcare providers.

However, this provision sunsets in 2025 and reverts back to current law, so those who don’t take advantage in the interim by making gifts or, alas, dying, may incur no benefits from these changes. (See Helena Jonassen’s article here.) The current state of partisan politics means that none of us can count on anything more than death and changes to our taxes.

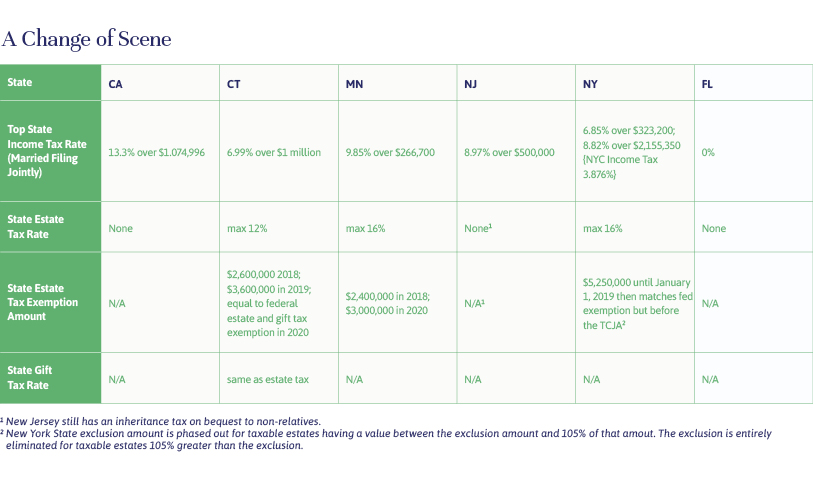

Several years ago I wrote in this journal: “If we choose our vacation homes carefully, we can consider converting the vacation home to a permanent residence for tax purposes, enjoying significant opportunity to save money on income taxes and on gift and estate taxes, while still spending time in both places.” I’m glad I took my own advice, as my wife and I now have the option of changing our domicile to Florida, where Evercore Wealth Management has a growing office, and where there are no state income or estate taxes.

To revisit our example of a few years ago in the current tax context, a couple in their 60s residing in New York State with an estate of $25 million and adjusted gross income of $1 million is charged an effective tax rate of 40.2%, paying $64,812 a year in state income tax alone by our calculations. That’s in addition to the $337,587 that they owe the federal government each year. If the same couple established their domicile in Florida, they would cut their annual tax rate to 33.8%. Even though the federal basic exclusion amount has been doubled, they will still be able to reduce the tax by that number.

That’s a significant savings, even before factoring in the generally lower cost of living in Florida. But is it reason enough to up sticks? It’s hard to say, because there are so many factors to consider, in addition to tax and weather, and the process can be complicated. For us, as for most people, family and work are the biggest considerations, which is why far more people talk about changing domicile than actually do so. It’s certainly worth examining the potential financial impact and discussing the possibilities in depth with your advisors.

Jeff Maurer is the CEO of Evercore Wealth Management and the Chairman of Evercore Trust Company, N.A. He can be contacted at [email protected].

1 updated figure