Independent Thinking®

Evercore ISI on U.S. Corporate Sentiment

May 11, 2018

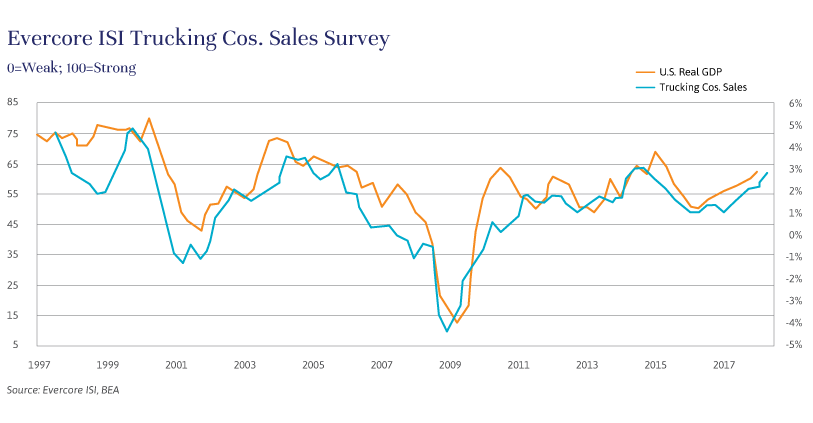

Evercore ISI Company Surveys and U.S. real GDP growth have rarely diverged for long. While both are measures of current conditions, our company surveys are produced weekly, while GDP is assessed quarterly. At present, our company surveys show that U.S. growth is strong and foreign demand remains solid.

Although many government data points suggest that growth stalled in the first quarter of 2018, our index recently surpassed its prior peak in 2015 when U.S. real GDP year-on-year growth was +3.8%, suggesting that underlying growth is currently quite healthy.

The industrial and transport surveys’ data are particular areas of strength. The improvement has come in part as U.S. capital spending has risen and the first of our semiannual surveys of capital expenditure, or CapEx, and hiring plans indicate continued strong growth. Much of current CapEx is focused on efficiency and productivity, enabling companies to remain competitive. As a result, spending in technology, automation, and on the Cloud are all priorities. In addition, spending in the energy and mining space has continued to recover from weakness in recent years.

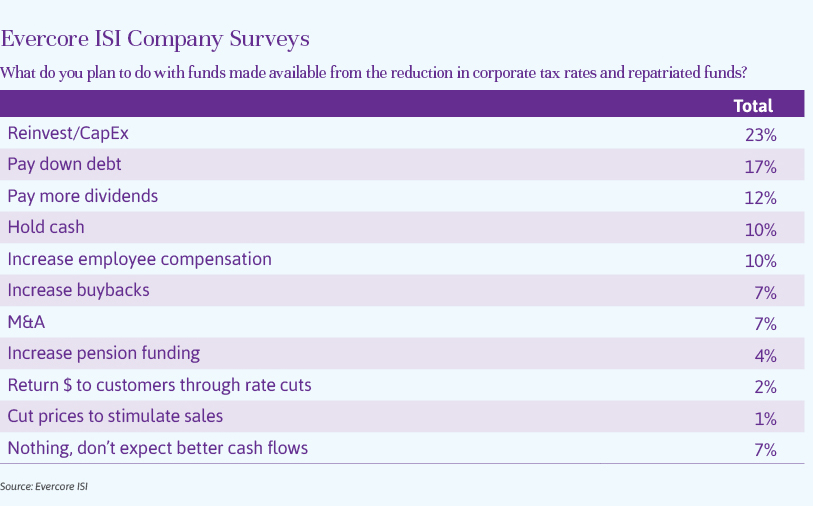

The passage of the tax bill late last year will likely add further to CapEx plans, CFO respondents say, as additional funds are made available through repatriation, lower corporate tax rates, and the full expensing of capital equipment.

Our surveys of Europe sales and China sales at U.S. multinationals also improved noticeably over the last year, thanks in part to accommodative monetary policy around the globe, and they remain solid so far in 2018. While a number of respondents have expressed concerns over the prospect of tariffs and greater friction to global trade, demand globally has so far remained quite healthy.

Consumer activity has strengthened over the last six months, with improvements in employment, wages, and consumer balance sheets contributing to more spending at retailers, home builders, airlines, and auto dealers.

What do companies worry about? CFOs most frequently listed higher material costs, compensation costs, and labor availability. Many companies experienced margin pressure last year amid strong increases in from energy and metals costs. In addition, with the unemployment rate at 3.9%, finding qualified workers for open positions is a big challenge in many industries, leading to rising wage pressures for new hires.

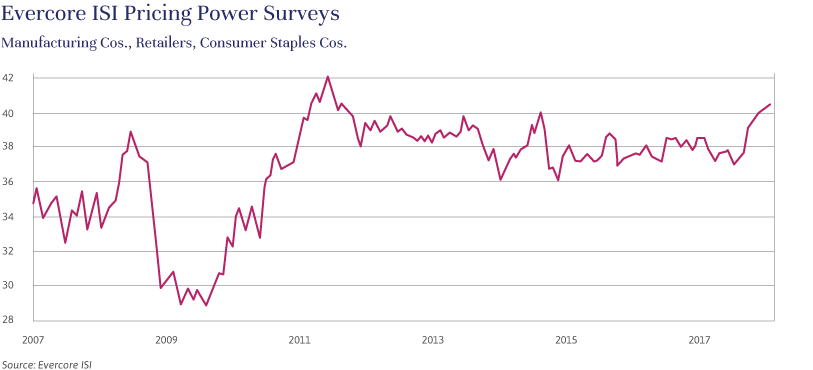

Many companies are currently trying to pass on those higher costs to customers. At the intermediate goods level, where energy or other commodity prices dominate the cost basis, such as chemicals, the price increases appear to be quite successful.

At companies further down the chain, however, the price increases are harder to secure. In our pricing power surveys, we have seen some improvement, but price competition remains fierce in many industries, especially with the increase in price transparency from online shopping.

Additional sources of concern mentioned by CFOs revolve around regulatory and legislative changes as well as political instability, both in the United States and overseas. In most industries, the related issues have so far been manageable.

For information on Evercore ISI research, please contact Evercore Wealth Management Partner and Portfolio Manager Charlie Ryan at [email protected].

Editor’s note: Oscar Sloterbeck is Head of Company Surveys at Evercore ISI, one of the sources of research considered by Evercore Wealth Management. The surveys are used by ISI’s macro and fundamental research teams to measure the evolving strengths and weaknesses of the U.S. economy. Executives, typically CFOs and Treasurers, at 340 companies across 29 industries provide an index rating based on their evaluation of the strength or weakness of recent sales adjusted for the time of year.