Independent Thinking®

Investing in Thin Air

July 15, 2015

Radically easy monetary policy across the developed world, commonly known as quantitative easing, has successfully reflated all major asset classes, including equities, but has so far failed to boost economic growth to levels desired by policy makers and investors.

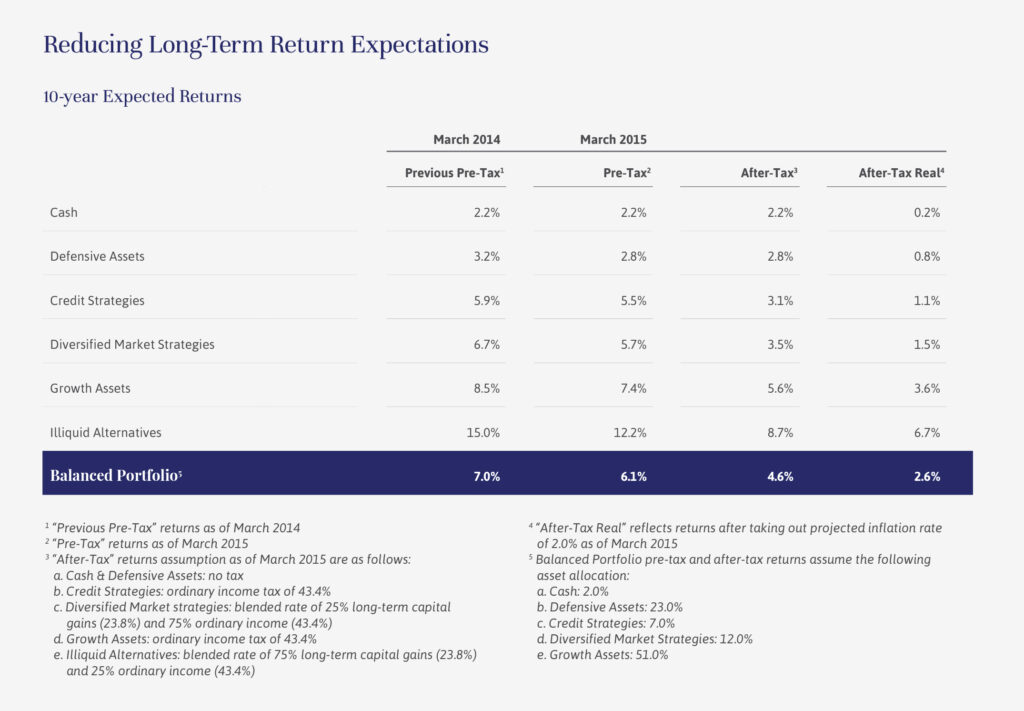

It is time to reconsider our long-term return expectations for both stocks and bonds, and to increase our exposure to uncorrelated and illiquid assets.

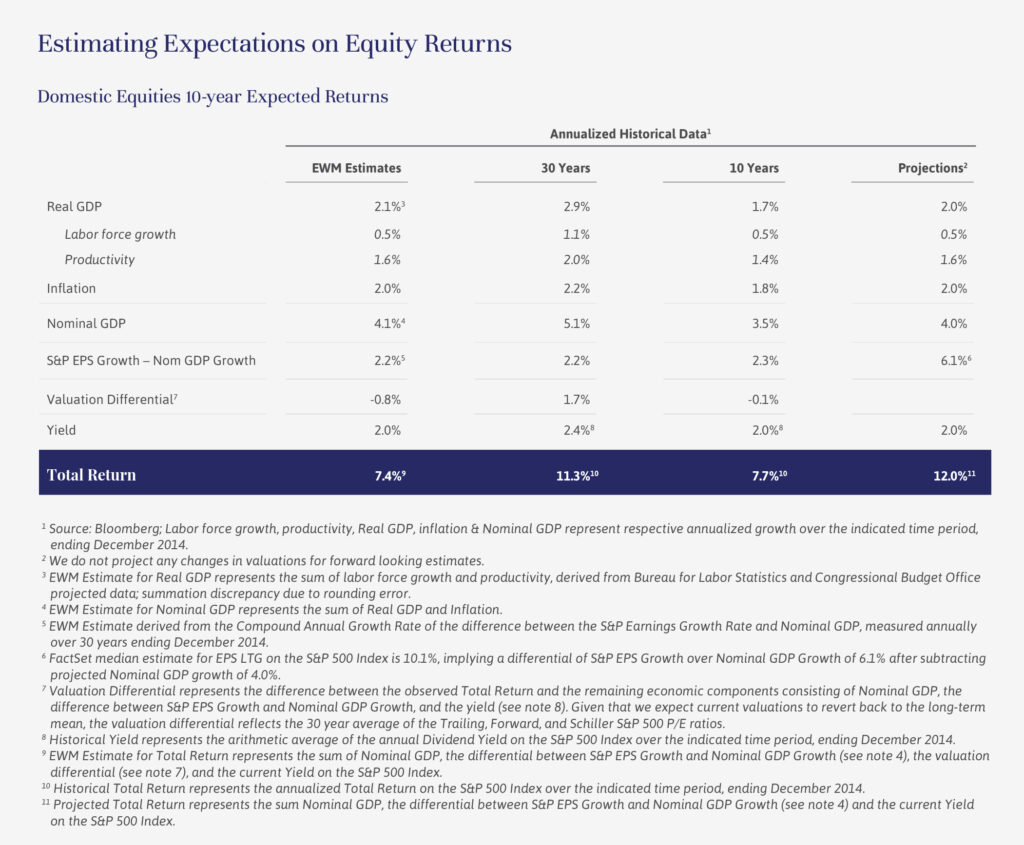

We have lowered our 10-year annualized expected returns on a balanced portfolio to 6.1% from 7%. This reflects our reduced expectations for public equities, now 7.4% down from 8.5%, in recognition of the high relative valuation of the market, which is currently 10% to 20% higher than the long-term average valuation to which we anticipate the market will eventually revert. In other words, to the extent that the equities in a client portfolio have increased faster than the rest of the portfolio, we are balancing back to the original allocation.

We are not reducing the allocation to equities beyond that, however. Stocks can remain at elevated valuation levels for extended periods of time, particularly in periods of low interest rates. We would need to see a significant tightening of global monetary policies or evidence of recession in the United States to make a tactical change in our equity allocation, neither of which is in evidence.

It is also worth noting that business cycles appear to be lengthening. The duration of the two previous economic expansions in the 90s and 2000s were considerably longer than the post-WWII historic norm. We are six years into the current expansion, which could also have quite a few more years to run.

At the same time, we are increasing our allocation to our diversified market strategies and illiquid alternative asset classes with the proceeds from the equity rebalancing. Diversified market strategies hold out the possibility of boosting portfolio returns during difficult periods for the equity and bond markets because they are exposed to risks and returns that are largely unrelated to the direction of the major markets. Illiquid alternatives are investments in inherently inefficient markets, such as private equity and private real estate, which allow for the possibility of returns significantly higher than average returns when investing with top quartile performers.

Longer term, high equity valuations need to be supported by strong economic growth. Unfortunately, dwindling population growth in general, and labor force growth in particular, take a major driver of growth off the table. Even inflation, despite the efforts of central bankers in developed countries around the world to reflate their economies, is not much help in terms of nominal economic growth.

That leaves productivity — the most important driver of economic growth and the only one that matters when it comes to real per capita growth. It is an interesting conundrum, however, that reported productivity is running below long-term historical averages (1.4% over the last 10 years versus 2% over the last 30), and yet we see anecdotal evidence of productivity all around us. Just think about how that smartphone in your hand has changed how you work and live – and that may be just the beginning. We may be on the cusp of a technological revolution that will rival its industrial equivalent in its impact.

Voice recognition, artificial intelligence and robotics are advancing at an accelerating pace. Driverless cars and drones could transform our lives, as our smartphones already have, and provide enormous new opportunities for investment. The cost curves for wind and solar energy production are threatening to fall below the cost of fossil fuel and continue to drive lower. And the payoff from decoding DNA is on the verge of coming to fruition. It may be that economists are underreporting productivity. While we remain diligent in rebalancing among our asset classes, to ensure that we are not overweight equities as an asset class, we continue to invest with conviction in companies that are driving positive and sustainable changes, and those that stand to benefit from these advances in technology.

We believe that we are building well-balanced portfolios that will protect our clients’ capital and benefit from opportunities in a low-return world.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].