Independent Thinking®

Investment Outlook: Cautious Optimism

January 19, 2017

We all struggle to predict the outcome of specific events, let alone the future in general. Once a result is known, whether it is the performance of the markets this year or the votes last year for Brexit and Donald Trump, it is human nature to believe in the aftermath that the result was likely, or even inevitable – and to tell anyone who will listen that we saw it coming. However, attempts to predict the economy and financial markets mean addressing issues that aren’t subject to statistical analysis. In other words, not only is the outcome unknowable, but the odds of the outcome are also unknowable.

The term economists use to describe this type of exposure, as opposed to the more manageable world of risk, is radical uncertainty. As investors, we should strive to distinguish between the known and the unknowable – and to manage our portfolios accordingly. Investing requires subjecting current wealth to radical uncertainty in an attempt to preserve and enhance future purchasing power. We address this dilemma by employing well thought-out, time-tested investment principles.

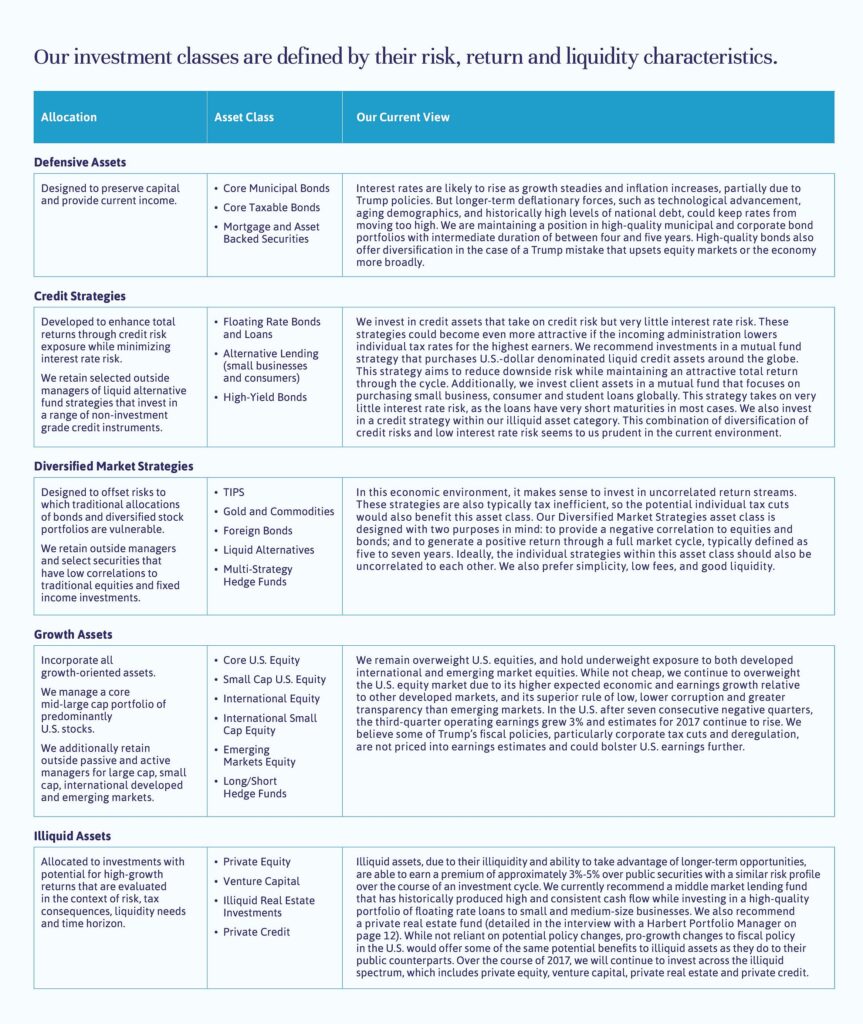

The first and most powerful principle is diversification. Because investment returns are radically uncertain, it is of paramount importance to expose capital to a range of risks that are as unrelated to each other as possible. That’s why we allocate assets across a range of investment classes defined by their risk, return and liquidity characteristics, as appropriate to meet each investor’s goals. (See the box below to view our asset allocation and a brief summary of our current thinking on each class.)

Our second most important principle is to commit as much of each investment portfolio as possible, given the risk tolerance of each individual or family investor, to growth investments in well-established, profitable businesses without excessive leverage, operating in a reasonably regulated free market economy with relatively low corruption.

In addition to publicly traded stocks, this allocation can include private equity to the extent that the associated illiquidity is tolerable. Very selective allocations to additional alternative investment scan further diversify the portfolio. (See our interview with one of our external managers, Jon-Paul Momsen at Harbert Management, here. While investments in real estate may seem counterintuitive as interest rates are rising, we like the opportunistic approach of investing in properties in smaller markets where they can add value.) Cash equivalents and high-quality bonds are added to the portfolio to help a portfolio ride out a financial crisis, as well as run-of-the-mill equity bear markets.

The events of 2008 demonstrated that a major financial crisis significantly reduces the power of diversification. It’s worth remembering that, as Mervyn King, the governor of the Bank of England from 2003 to 2013, wrote in his inspired book, The End of Alchemy: Money, Banking and the Future of the Global Economy, the basic money and banking system employed by all the developed economies is flawed, prone to crisis, and in need of reform.

The best defense for investors against a financial crisis is the right combination of diversification and liquidity – and the fortitude, or inherent optimism, to not panic. Indeed, we would argue that this blend constitutes the third principle in the management of robust portfolios.

So, why are we cautiously optimistic? We are optimistic in large part because we know that our approach in trying to achieve the best possible risk-adjusted returns, net of fees, taxes, and inflation, along with our close relationships with our clients and their families, has stood us in good stead.

We are also optimistic because we believe a relatively lightly regulated free market economic system in the United States will generate a healthy, growing economy and positive real returns over the long run. Consumers, small business owners, and CEOs all registered increased optimism after the election, and there is now a broadly held expectation of substantial policy changes friendly to businesses and investors. The most likely of these will be reform of corporate taxes and lower rates; deregulation of businesses, especially in the banking and energy sectors; and reform of individual income taxes and lower rates. To us, it seems unlikely that the potentially damaging policy changes concerning free trade and immigration will materialize in anything like the forms proposed during the election.

All these potential policy changes are inflationary, so market expectations of inflation have been boosted. At this point, the move in the stock market to relatively high valuation levels and a substantial increase in long-term interest rates, along with the expectation for two to three rate increases from the Federal Reserve this year, are largely priced into the markets. Still in the cards, however, is the possible revival of what John Maynard Keynes famously called animal spirits. In other words, sustained optimism can be self-fulfilling, causing an increase in demand and additional long-term investments – and each reinforces the other in a virtuous cycle.

It is therefore quite possible that we will have increased economic growth and no recession for the next two or three years, which is saying something, since we are eight years removed from the last downturn. While we remain guarded against excessive optimism in the aftermath of the election results that everyone (actually, just about no one) saw coming, it’s important to note that bullish sentiment is not as accurate signal of a market top as bearish sentiment is a signal of a market bottom. Optimism and its underlying drivers have a tendency to last far longer than fear and contraction.

We are cautious because, as discussed, we recognize that our money and banking system is flawed and prone to crisis. Of course, we are also cautious because the Trump presidency has no precedent. Would anyone really be surprised if it ended in tears? However, it’s important to remind investors that the U.S. economy and markets are more robust than observers of Beltway machinations may fear. We remain overweight the United States in our portfolios. The European Union continues to struggle with high unemployment and serious internal imbalances. Japan’s population continues to shrink, and the country, which has been unable to re inflate even though it has outdone the United States in relative monetary expansion, now appears to be aggressively devaluing the Yen. China, still the growth engine of the world, is struggling to keep its economic growth rate above 6% through unsustainably high debt growth. And India, which looked so hopeful just a year or so ago, has since inflicted serious self-harm in meddling with its own currency. There are opportunities, notably still in the rising consumer class in China, but we remain extremely selective in our overseas exposures.

In short, our balanced portfolios are designed to benefit from a continuation of the U.S. expansion, while limiting the associated risks as much as possible, mindful that we cannot know what we don’t know. We will continue to adhere to our established asset allocations and work hard to ascertain the winners and losers within each asset class as policies and circumstances change.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].