Independent Thinking®

Wealth Planning Strategies Ahead of 2019

November 7, 2018

Editor’s note: This is an extract from a briefing sent in early October to Evercore Wealth Management clients.

Planning is tailored to the unique circumstances of each individual and family. Please contact your wealth and fiduciary advisor to discuss these topics.

INCOME TAX PLANNING

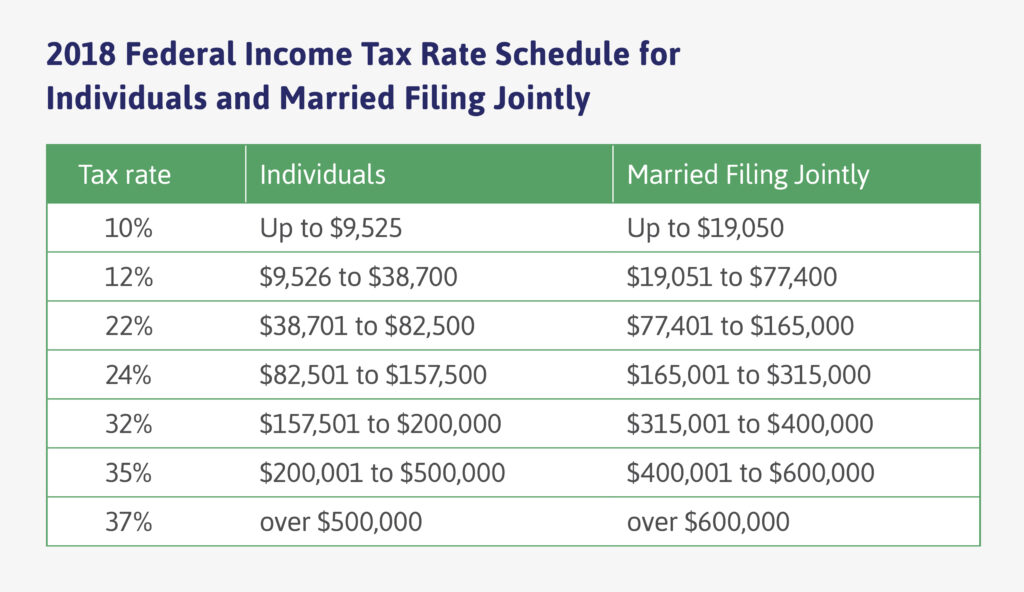

As of January 1, 2018, the top income tax rate was lowered from 39.6% to 37% for income over $500,000 for individuals, and over $600,000 for married couples filing jointly. The personal and dependent exemptions were eliminated, but the standard deduction was doubled to $12,000 for single taxpayers and $24,000 for married couples.

Although the overall limit on itemized deductions, which reduced deductions by 3% of adjusted gross income over a certain threshold, has been repealed, there is now a $10,000 cap on deductions for state and local taxes, or SALT, and personal property tax.

If you are considering a change in domicile to a lower or no income tax state, it is important to examine the personal and financial impact and discuss the topic with your advisors.

The Tax Cuts and Jobs Act, or TCJA, significantly increased the Alternative Minimum Tax, or AMT, exemption to $70,300 for individuals and $109,400 for married joint filers. In addition, the exemption amount phaseout starts at significantly higher amounts of $500,000 for single filers and $1,000,000 for joint filers, up from $120,700 and $160,900 respectively. The combination of these two increases and the cap on SALT taxes will result in fewer taxpayers being subject to the AMT.

The new tax legislation introduced the Qualified Business Income Deduction. This deduction allows pass-through entities, such as S-Corporations, partnerships, LLCs and sole proprietorships, to potentially deduct up to 20% of qualified business income, effectively lowering the top income tax rate for corporations of 37% to 29.6%.

CAPITAL GAINS/LOSSES

Capital gains and losses during the tax year should be netted against one another to minimize capital gains taxes. Capital losses can be used to offset gains taken earlier in 2018 or carried forward to future years. Net capital loss amounts in excess of $3,000 may be carried forward indefinitely. However, capital losses expire at death and cannot be transferred to the individual’s estate or to a beneficiary. We recommend reviewing capital gains and losses across all investment portfolios including business assets, LLC or partnership interests, as well as gains on the sale of any real estate.

CHARITABLE GIVING

The increase in the standard deduction and the $10,000 cap on state, local and property taxes for 2018 may make traditional charitable gifts less attractive from a purely income tax point of view. It may be more beneficial to combine several years of charitable donations into a single year by utilizing a donor-advised fund or private foundation.

RETIREMENT PLANNING

IRA owners who turn age 70½ during 2018 have until April 1, 2019 to take their first required minimum distribution and must take the second by December 31, 2019. IRA account owners already in distribution mode must take their annual RMD by December 31, 2018.

IRA account owners over age 70½ can make tax-free direct transfers (up to $100,000 in the calendar year) from IRA accounts to a charity and satisfy their RMD requirement. For those who have RMDs but are not itemizing charitable deductions, this can be an interesting alternative.

Please speak with your wealth and fiduciary advisor and tax advisor to determine whether the Charitable IRA Rollover strategy is appropriate or if you should instead consider gifts of appreciated stock.

IRA and Retirement Plan Contributions

The maximum combined contribution amount for both traditional IRAs and Roth IRAs is $5,500 per person for 2018. Roth IRA contributions are subject to eligibility requirements. Contributions may be made until April 15, 2019 and still be counted for the 2018 tax year. Individuals age 50 and over are eligible to make an additional $1,000 catch-up contribution. Contributions may be deductible, but phaseouts do apply based upon modified adjusted gross income thresholds.

The maximum salary deferral limit for 401(k), 403(b), and 457 plans in 2018 is $18,500. Individuals age 50 and over may contribute an additional $6,000 per year.

Those with self-employment income may also want to consider establishing a SEP IRA, Defined Benefit Pension Plan or other qualified retirement plan that may permit a higher tax-deferred contribution level.

For 2018, the contribution limit is up to $55,000 or 25% of self-employment income (whichever is lower) to a Defined Contribution Plan, and up to $220,000 subject to other requirements into a Defined Benefit Pension Plan.

Roth IRA Conversions

A Roth IRA conversion can no longer be undone through recharacterization, and there is no expiration for this provision.

WEALTH TRANSFER AND ANNUAL EXCLUSION GIFTS

The TCJA nearly doubled the lifetime federal gift, estate and generation-skipping tax exemption. Adjusted for inflation, the 2018 exemption per individual is now $11.18 million, and the maximum federal estate and gift tax rate remains at 40 percent. This allows individuals who had utilized all of their exemption in 2017 ($5.49 million) to make an additional gift of $5.69 million that is exempt from federal estate, gift and generation-skipping tax. The increased exemption amount is scheduled to expire at the end of 2025. Personal lifestyle considerations, what assets to gift, and the use of trusts should be discussed when planning with the increased exemption.

Connecticut residents considering lifetime gifts should be aware that there is a separate state gift tax with an exemption of $2,600,000 in 2018. New York residents should be aware that through January 1, 2019, gifts made within three years of death will be added back into the estate for state estate tax purposes.

Those interested in transferring the future appreciation on assets, and not the principal, should find that still low interest rates (by historical standards, despite recent rises) make this an opportune time to implement certain wealth planning strategies. Intra-family loans, Grantor Retained Annuity Trusts and Charitable Lead Annuity Trusts should be considered in the context of an individual’s overall wealth planning objectives.

Annual exclusion gifts allow individuals to give up to $15,000 per year to anyone without paying gift tax (married couples may give up to $30,000).

TRUST AND ESTATE PLANNING

The TCJA increased the federal estate tax exemption amount to $11.18 million per person, adjusted for inflation.

Part of having a good financial and estate plan is having the right trustees in place. Who will serve as a trustee for children’s and grandchildren’s trusts? Should it be a friend, relative, advisor and/or an institution? If the trustee has already been selected, it is important to evaluate if they, whether individual or corporate, are still appropriate.

An individual co-trustee can serve along with a corporate co-trustee, such as Evercore Trust Company, N.A.