Independent Thinking®

Investing in the Changing Economy

September 19, 2014

Strong corporate profits, fueled in large part by surging technological advances, suggest that the economy is healthy and the economic future is bright. But the Federal Reserve is preoccupied by the plight of the millions of Americans left on the side of the road in the recovery. This dramatic divergence between strong businesses and weak employment is rapidly altering the investment landscape.

It is our job to find and invest in the winners and avoid the losers that will result from the dynamic structural changes that are coursing through the economy. In addition to analyzing and forecasting aggregate U.S. economic activity, we like to dig into the data and its impact on industry sectors and individual companies.

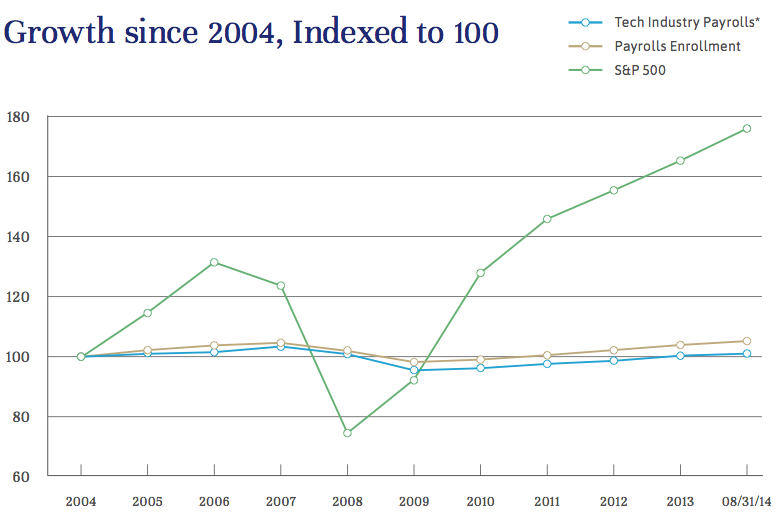

S&P 500 index aggregate profits now total just over $1 trillion, up from a pre-recession high in 2007 of $725 billion. This 50% increase in profits has been the fundamental driving force behind the bull market. The rate of growth is, of course, not evenly spread across the economy. Instead, the information technology and consumer discretionary sectors are the two main drivers of this recovery. Profits from both have more than doubled since 2007, to collectively account for almost a third of total corporate profits (with technology contributing almost double, at 20% of the total).

*Tech Industry Payrolls represents the aggregate of the following payroll sectors: Computer and Electronic Product Manufacturing, Electronics and Appliance Stores, Telecommunications, Data Processing, Hosting and Related Services, & Computer Systems Design and Related Services Source: Bloomberg and Capital IQ

Employment, in contrast, has languished. As Roger Altman writes on page 8, this represents a long-term threat to the economy. Even in technology, jobs are shrinking. That’s surprising, even after taking into account the loss of domestic tech jobs as companies move in-house computer operations to the Cloud and the millions of jobs created in China and elsewhere to manufacture the billions of smart phones and tablets sold in recent years. Total technology employment is actually down 2% since 2007.

The divisions today are as stark as they were in the Industrial Revolution, arguably even more so. Google, Facebook and other social media companies are simply generating profits relative to the numbers of their employees on a scale that has never been seen before. Google is currently generating $250,000 of profits per employee and Facebook is generating over $500,000 in profits per employee. And that’s just the beginning. The truly transformative power of technology is not so much the direct economic growth of the tech businesses themselves but the effect that they have on other industries, as innovations are disseminated and implemented throughout the economy.

As investors, we are constantly on the lookout for companies that are early adopters of technology or stand to benefit from technological innovation. American Tower, for example, is growing rapidly and reporting high profitability as it supplies consumer demand for bandwidth from ever-increasing smart phone usage. United Healthcare is a leader in a laggard’s race, as the healthcare industry finally joins the modern world. (The medical profession is the last to get rid of its paper files.) Very useful innovation does appear to be accelerating. The progress toward a driverless car, for example, is moving far faster than could have been imagined a few years ago and the ripple effects of that development are likely to be enormous. NXP Semiconductor is a leading supplier of specialized chips for many automobile applications including a future automobile direct communications network.

While innovation advances, jobs have not followed. The Federal Reserve remains preoccupied, as it generally has been, with employment. Investors are left a new landscape characterized by strong corporate earnings and very accommodative monetary policy. The recently confirmed Vice Chairman of the Fed, Stanley Fischer, who we expect will have significant influence over policy, observed that supply-side developments, notably the decline in the rate of long- term investment in capital stock by U.S. corporations, has been troubling, especially in the context of very low real and nominal interest rates. CEOs have been slow to commit to long-term investments and have preferred to spend free cash flow on stock buyback. This is helpful when prices are low, but counterproductive when share prices move above long-term averages, as is currently the case.

For us, the primary focus will be on future productivity growth, both in the United States and globally. An uptick in the long- term growth rate of productivity would justify the current valuation of the equity market and allow our economy to grow out of the debt overhang. Productivity will continue to generate increasing profits, even as it destroys more jobs than it creates, and the short and medium-term outlook is positive.

Although this imbalance would be dangerous, to our economy and our society, if it were to continue over the long term, history would suggest patience. The modern equivalent of the factory jobs that replaced the farm jobs in the Industrial Revolution will come. As Mr. Fischer says, it is unwise to underestimate human ingenuity.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].