Independent Thinking®

Q&A with Tim Evnin and Charlie Ryan

September 19, 2014

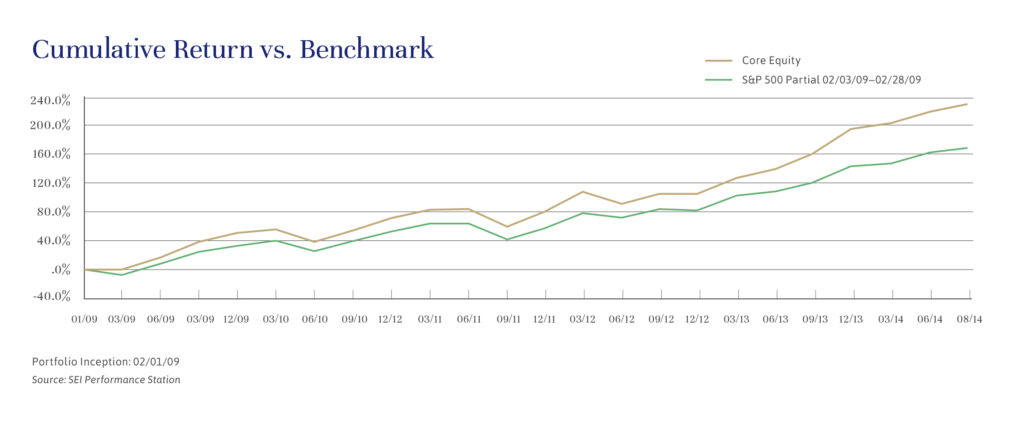

Editor’s note: Tim Evnin and Charlie Ryan are co-managers of Evercore Wealth Management Partners Account, the firm’s representative core equity portfolio. The portfolio, which currently holds 41 securities, has since its inception in February 2009 outperformed the S&P 500 and returned 30.37% net of fees in the past 12 months through August 31, 2014 (compared with 25.25% for the S&P 500). Tim and Charlie are also the co-managers of The Wall Street Fund, an equity mutual fund advised by the firm.

Q: How do you manage the firm’s core equity portfolio?

TE: The selection process is rigorous, with each new idea championed by one of Evercore Wealth Management’s portfolio managers. We are fundamental investors, so it is critical that we understand the key drivers of each company presented and its management’s views on capital allocation. We are also long-term investors. If we are doing our job correctly, we should have low turnover and be tax efficient.

Q: How would you characterize your investment style?

TE: We use the fundamental process to analyze a business and think about what it is worth. This is as much an art as a science, and an approximation rather than an exact number. We then use this work to look at how the business is priced by the market. This gives us a sense if it’s right for our clients’ portfolios. Just because it is a good business does not mean it is a good stock to own. We are trying to find that gap between what we think a business might be worth and how the market is pricing it, absolutely and relatively to similar businesses.

Q: Does market capitalization matter?

CR: It does to some extent, but we will look at companies as small as $1 billion and up to the largest. At present we own both Apple, the biggest company by market capitalization, and AMC Networks, our smallest holding at about $4.5 billion. We do not believe that size is necessarily a determining factor in how a company should be analyzed or how it will perform in the market. It could be, but it is not always an important driver. There are simple big companies and very complicated small companies.

Q: Are client portfolios at Evercore Wealth Management customized?

TE: We customize, but there is a high degree of commonality among the portfolios. We have developed a priority list of companies, which totals about 55 at present. These all represent ideas that have been championed by one of our portfolio managers. It is their responsibility to keep their partners up to date on developments.

CR: It is from this list that all securities are generally selected for client portfolios. Client portfolios usually have 35-45 holdings. The flexibility to pick within the list allows for customization depending on a client’s other holdings, exposure through closely held businesses, biases, and the attractiveness of a company at a point in time.

Q: The investment performance of the portfolio has been strong. Why do you think that is?

TE: While it may sound a bit like an oxymoron, our portfolio is concentrated but also diversified. This, combined with the low turnover and the willingness to have very different industry exposure than the benchmark, is what we believe led us to outperform.

Q: Could you expand on that?

TE: Our view is that if you own too many companies or have industry weightings that hug the benchmark, it is very hard to have performance that is different from the market. We are willing to rely on our fundamental analysis and own the companies that are attractive to us, irrespective of industry or size. We are also happy to own companies that are not in any of the benchmarks. In our portfolios, with about 40 companies approximately equally weighted at cost, each holding is large enough to impact the portfolio as a whole if we are correct, but not so large as to undermine it if we are wrong.

We are careful in our portfolio construction and experienced enough to know that there are things we don’t know. So we will seek to make sure that we own companies at different stages in their life cycle and across different end markets and different industries. To us, this is intelligent diversification rather than diversification driven by a benchmark.

CR: Last, we mentioned low turnover. We try to be very patient. It seems that there is still a lot of money that sloshes in to and out of stocks based on short-term events, whether market- or company-specific. For us, this volatility gives us an opportunity to buy into companies we like at prices that are reasonable if we maintain our long-term view.

Q: Can you give an example of this volatility at work?

CR: Just recently the tower stocks – the companies that own cellular towers and lease the space to carriers – were downgraded by an analyst who extrapolated a few data points into the future. The stocks fell. But if you have a long-term view and thesis about rising demand – and the incredible quality and franchise that these businesses have – a few data points about last month’s trends are just not persuasive.

Q: Is there anything else you would like to add?

TE: The equity markets have been strong these last few years, and we are very grateful that we have been able to outperform for our clients. We are encouraged that we continue to find good investments in this market.

Tim Evnin and Charlie Ryan are both Partners at Evercore Wealth Management. They can be contacted at, respectively, [email protected] and [email protected].