Independent Thinking®

Staying on Course in Volatile Markets

October 27, 2015

Now is always the hardest time to invest. It’s hard in bull markets, when investors fear that they are buying at the top, and in bear markets, which may have further to fall. It’s hard too in volatile markets like the one we are experiencing now, when competing forces obscure the investment outlook. There is nevertheless much we can do to manage risk and to seek to preserve and grow portfolios, even in turbulent times.

The risks troubling investors are mostly known. The Chinese economy has slowed, bringing expectations for global growth down to just 3%, according to the latest World Bank figures, the lowest level in decades apart from a brief period at the nadir of the Great Recession. Europe is careening from a Greek debt crisis to an immigration crisis. And the U.S. Presidential election is looking very much up in the air, with the distinct possibility of a nominee with no previous political office experience.

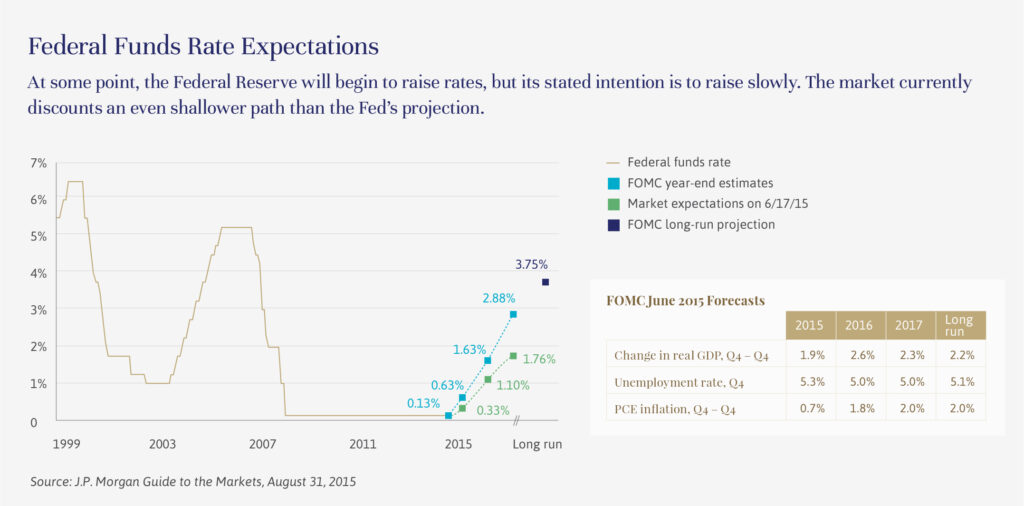

What is not known – and is driving much of the current market volatility – is when the Federal Reserve will finally increase rates. As the chart on page 4 illustrates, market expectations for the path of interest rate hikes do not agree with the Fed’s own expectations – and it’s worth noting that, so far, the market has been more accurate than the Fed. We’ve had three rounds of unprecedented quantitative easing and seven years of near rock-bottom interest rates. Proponents of continuing this policy, including the International Monetary Fund, have been very vocal about the risks of raising rates in this low-growth environment. Less discussed are the consequences of failing to do so. The markets have become addicted to artificially low rates, in a way that is neither healthy for the economy nor sustainable. Tough love from the Fed may cause some short-term pain, but it is time to start back on the path to a normal monetary policy.

Against this backdrop, the domestic picture remains relatively bright. Auto sales and housing starts are rising, unemployment at 5.1% is low, and the country continues to lead the world – by a long shot – in innovation. The U.S. stock market has corrected and is now selling for around the average historic valuation, which seems to us close to fair value in the current economic environment.

So, what can investors do, while waiting for the outlook to clear? Periods of volatility present opportunities in wealth planning (reviewed by Chris Zander on page 8), and in investing.

As discussed in the previous issue of Independent Thinking (and well before the 12% stock market correction in September and the market’s current volatility), we reduced our long-term return expectations for both stocks and bonds, and increased our exposure to uncorrelated and illiquid assets. To the extent that equities in client portfolios had increased faster than the rest of the portfolio, we rebalanced back to the target allocation.

The proceeds are invested in our Diversified Market Strategies and Illiquid Alternatives asset classes, both of which are anticipated to boost portfolio returns in volatile conditions.

Our Diversified Market Strategies asset class is expected to boost portfolio returns in these conditions because it is exposed to risks and returns that are largely unrelated to the direction of the major markets. The allocation currently includes investments in Gotham Neutral Fund, the AQR Multi-Strategy Alternative Fund, and Stone Ridge All Asset Variance Risk Premium Fund.

In a similar vein, the case now for illiquid alternatives seems appealing. Investments in inherently inefficient markets, such as private equity and private real estate, allow for the possibility of returns significantly higher than average returns. Stephanie Hackett discusses our approach to this asset class on page 17.

We remain positive on equities over the long term. Now that valuations have returned to more normal levels, following waves of indiscriminate selling, we are actively investing in companies with superior fundamentals, such as Blackstone, CBRE Group, and AutoNation.

It may take some time until the full impact of the Chinese slowdown is played out, in both the emerging and developed markets, but we are confident that the United States will remain on solid footing. The Federal Reserve will eventually raise rates and the concerns around the U.S. election will abate, hopefully by the primaries and certainly by the general election (although that may feel more like a lifetime than a year to those of us in heavily contested states).

In the interim, we remain focused on our clients’ long-term goals. Now may be a hard time to invest, but we are confident that we are building and managing well-balanced portfolios with the aim to withstand periods of volatility and benefit from opportunities in a changing economy.

John Apruzzese is a Partner at Evercore Wealth Management and the Chief Investment Officer. He can be contacted at [email protected].