Independent Thinking®

Baby Boomers and Drawdowns

October 27, 2015

Around this time seven years ago, I was very excited. I had been working on creating a new wealth management firm for most of the year and had recruited a dozen former colleagues from U.S. Trust to become the founding partners of Evercore Wealth Management. We were scheduled to launch our new venture in a few weeks, after the vacation I had promised my wife, knowing that we would be working flat out once our doors opened.

Although economic storm clouds created by the subprime credit crisis were all around us, I was hopeful that the government would help Lehman Brothers find a partner, as it had for Bear Stearns, and that we would avert a global liquidity crisis. When we arrived in Positano, however, we learned that Lehman had filed for bankruptcy.

My wife and I had a keen interest in the developments, on behalf of my soon-to-be new partners and their clients, and for ourselves, as most of our own assets resided in accounts at Lehman Brothers Trust Company. I had entered my 60s, and we knew that it becomes more difficult to replace lost assets as we age. As the situation unfolded, I relied on my years of experience for guidance.

I knew that assets held at a trust company are not subject to the claims of creditors of the firm, but there is nothing like a real crisis to prove the law. The law was correct, and our assets were not impaired. I was less concerned about our balanced portfolio withstanding a drawdown, although I didn’t foresee that the S&P 500 Index would register a drawdown of close to 50%. That experience helped shape some of the guiding principles that my partners and I established for Evercore Wealth Management.

First, the safety of our clients’ assets is paramount. We recommend that our clients custody their assets at Evercore Trust Company, N.A., which segregates them from the firm’s assets so that they are not subject to claims of our creditors, in accordance with the law.

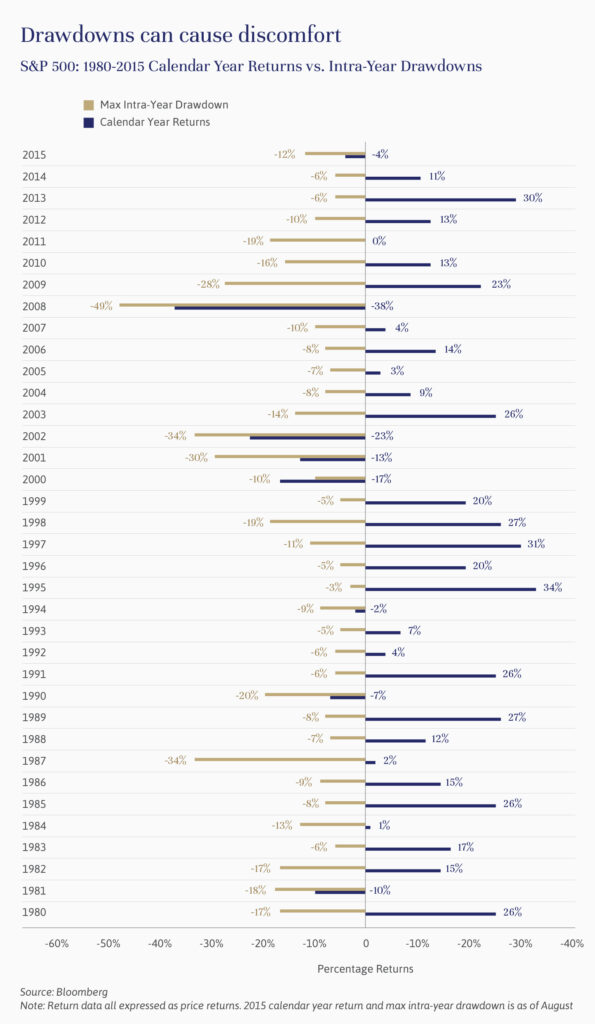

Also, we decided that standard measures of volatility were not sufficient for our clients; after all, our generation had experienced three statistically impossible market events. That is why we prefer to discuss drawdown risk in client portfolios in terms of dollars, as well as probability. We believe that our clients should be aware that circumstances similar to 2008 can occur again, and we want to make sure that they can live with the potential risk of a meaningful drawdown.

We work directly with our clients to prepare a lifestyle analysis, laying out a long-term plan based on our return assumptions, proposed asset allocation, and our clients’ spending requirements. That’s relatively straightforward in a strong market, but in a low-return environment, we often have to make harder choices between return and risk. Sometimes we express the choice, somewhat facetiously, as between eating well or sleeping well. If this summer has cost you sleep because of market volatility, it may be time to revisit your lifestyle analysis to make sure your asset allocation remains appropriate for your required return, level of risk tolerance, and age.

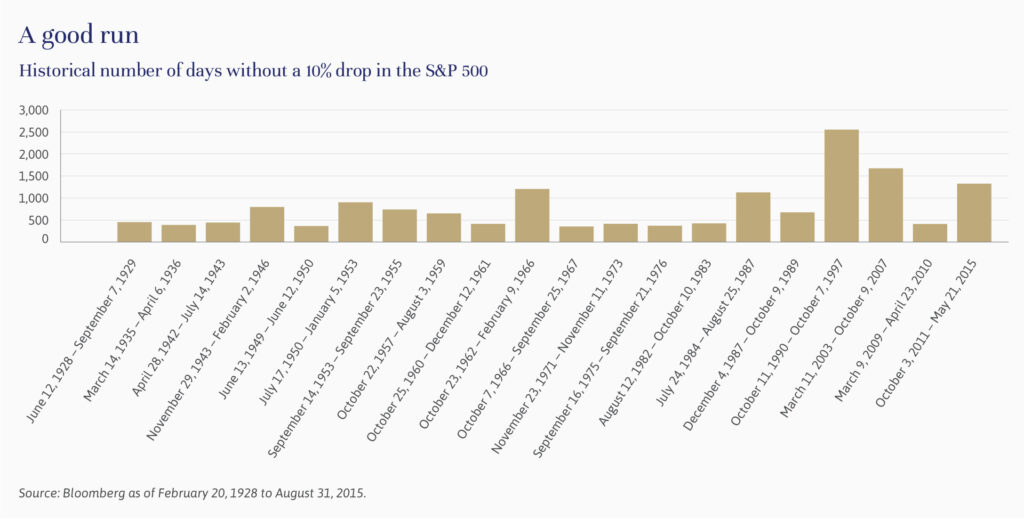

As illustrated in these charts, times have changed. From October 3, 2011 until May 21, 2015, for some 1,326 days and a total cumulative return of 93.8%, the S&P 500 did not experience a 10% drop. Now, we have seen volatility return to the markets. Since 1980, the S&P 500 has averaged intra-year drawdowns of 14%. It takes on average 30 days to recover from drawdowns in the 5%-10% range, 53 days to recover from drawdowns in the 10%-15% range, 72 days to recover from drawdowns in the 15%-20% range, and 1,081 days to recover from drawdowns 20% and greater. Most recently, it took 1,604 days for the market to recover from the Great Recession.

We launched our firm, just a few weeks later than we originally planned and in the middle of the Great Recession. Our clients who kept to their asset allocation throughout that period have more than recovered the drawdown. Periods of volatility do pass, but there is no question that drawdowns can cause discomfort, especially for those of us with less time to recover from losses. Our goal is to work with our clients to achieve a balanced asset allocation and to make sure they can live with potential drawdowns.

Jeff Maurer is a Partner at Evercore Wealth Management and the Chief Executive Officer. He can be contacted at [email protected].