Independent Thinking®

High-Yield Credit: Time to Catch a Falling Knife?

January 28, 2016

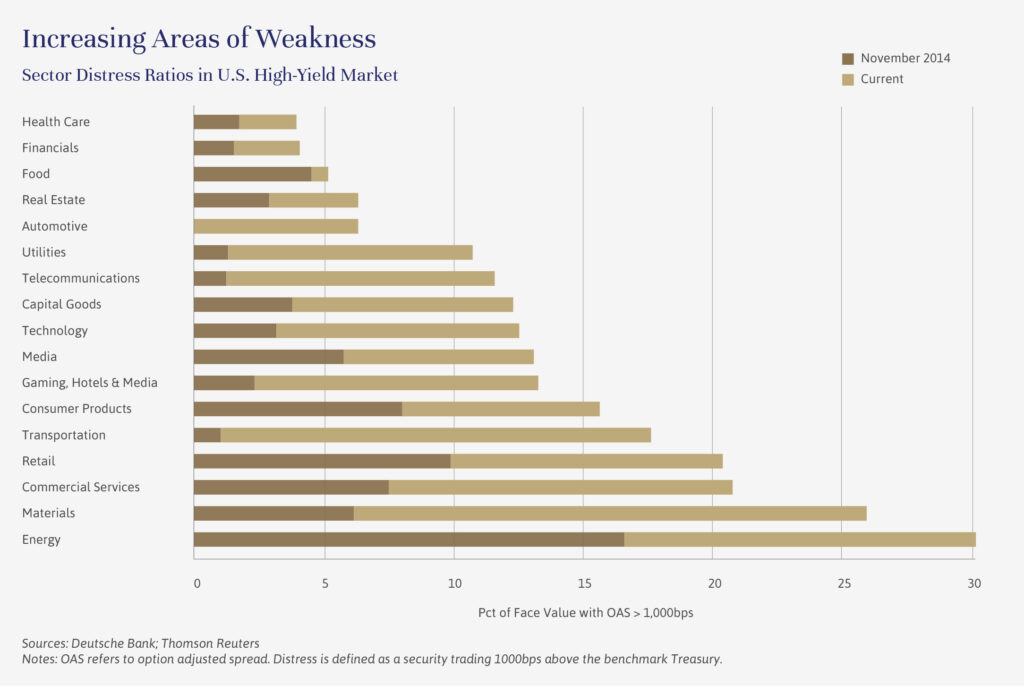

The high-yield credit market, after suffering its worst year since 2008, is off to a rocky start in 2016. The weakness that originated in the commodity-focused credits has spread to high-yield sectors as diverse as retail, gaming, media, consumer products, technology and capital goods.

In each of these areas, more than 10% of securities are trading at above 1,000 basis points, or 10%, over Treasuries – the distressed threshold. According to a recent Deutsche Bank report, the high-yield distress ratio is 19% today (led by a 30% rate in the energy sector), up from just 4.7% in June 2014 and the highest level of distress in the U.S. bond market since the aftermath of the 2007-2008 credit crisis.

This situation has been some time in the making. Years of historically low interest rates driven by ultra-easy monetary policy made borrowing large sums of money for projects that relied on high commodity prices commonplace, flooding the market with new high-yield debt. In addition, the aftermath of the 2007-2008 credit crisis and the subsequent increase in government regulation, which limited the amount of high-yield bonds that banks and brokers can hold on their balance sheets, caused a lasting decline in liquidity. Traditional asset management firms and other institutional investors effectively became the liquidity provider of last resort.

At the same time, mutual funds and exchange traded funds, or ETFs, became a much more significant portion of the market, now accounting for $374 billion of assets in the $1.32 trillion high-yield market, or 28.3%, up from 13.5% in 2008.1

Essentially, in a market where liquidity has decreased on the underlying assets, a majority of the growth (about 66%) has been in vehicles in which investors can redeem on a daily basis. That’s a classic asset and liability mismatch, as evidenced by the December 2015 suspension of investor redemptions in Third Avenue Focused Credit Fund, a 40-Act mutual fund with an aggressive portfolio of distressed and illiquid securities. (Evercore Wealth Management has never owned shares in this fund.)

Continued redemptions from high-yield mutual funds could certainly put further pressure on the market. However, it seems to us unlikely that a rash of similar events will follow. The Third Avenue fund had far more distressed securities and less liquidity in its portfolio relative to almost all other funds in the high-yield category.

Increased risks can also present opportunity. While we expect further dislocations in this market and are proceeding with caution, there are some reasons for optimism. A positive, albeit slow, economic growth rate in the U.S. should be supportive of less cyclical and more consumer-focused high-yield sectors. While we expect default rates to move higher, the likely increase is already reflected in current yields. At the same time, to the extent the Federal Reserve continues to hike interest rates, the high-yield market, with significantly more spread cushion, should be less sensitive to further rate increase than higher quality bonds. As a result, we see some attractive investments. Credit investments currently represent 5% of our recommended asset allocation to balanced portfolios.

Notable among these opportunities is senior secured middle market debt with an illiquid structure and less exposure to cyclical and commodity sensitive sectors than the broader market. (David Golub of Golub Capital, one of our external managers, makes the case for this market on page 5.)

We also see opportunity to invest with good managers focused on liquid investments who have the disciplined credit selection and the flexibility to be dynamic and tactical in their allocation to credit investments. We are extremely selective, however, as mutual funds in this space are under a great deal of pressure. An investment in more traditional high-yield funds will make sense at some point, but we believe it is worth waiting to pick up the falling knife until it hits the ground.

Brian Pollak is a Partner and Portfolio Manager at Evercore Wealth Management. He can be contacted at [email protected].

1 2015, Bloomberg, JP Morgan