Independent Thinking®

Facing Facts: A Lifestyle Analysis

July 21, 2016

The Evercore Wealth Management lifestyle analysis is tailored to each client’s income and commitments. Inputs include income from all sources, such as salary, pension and Social Security income, if applicable, and all investment returns. Outflows cover measurable fixed and variable expenses.

The lifestyle analysis will gauge whether you will have enough assets to maintain your lifestyle and, if you wish, to provide a legacy. It can also be used to determine whether or not your current asset allocation is appropriate to meet those goals. The analysis, which is both quantitative and qualitative in its approach and is based on a range of assumptions, will also help guide your answers to questions such as: When can I retire? What happens if there is another market correction? Do I have enough capital to purchase another residence, start a business venture, or make more gifts to family members and charity?

A sensitivity analysis such as a Monte Carlo simulation that can vary the investment return assumptions could also be created to complement the lifestyle analysis. The Monte Carlo simulation provides an array of possible outcomes based upon the underlying lifestyle analysis assumptions and assesses the impact of risk, allowing for better decision-making.

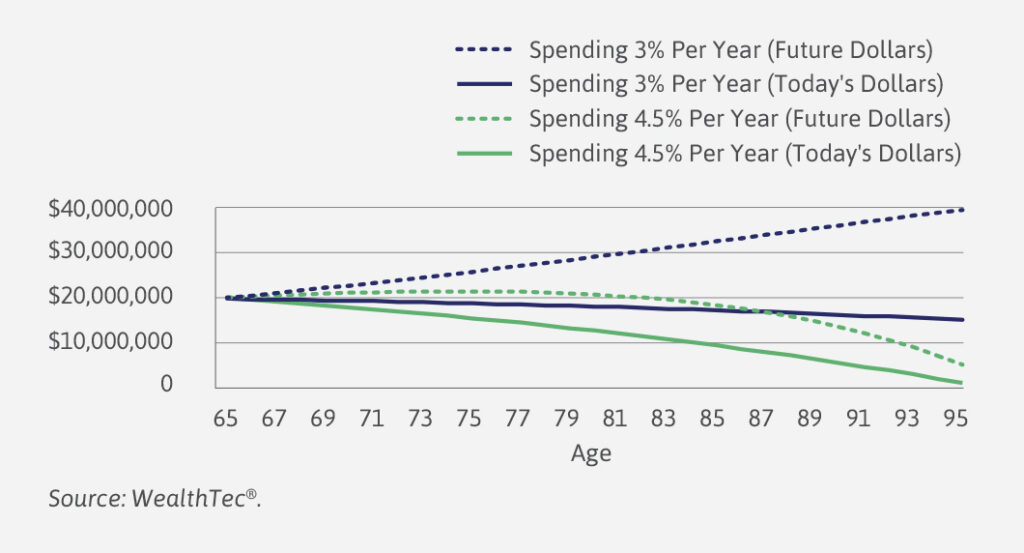

In this example, we assumed a starting asset base of $20 million and a 6% total pre-tax annual return on those assets. The first couple, the Blues, spends 3% annually of their initial portfolios, or $600,000 a year. The second, the Greens, spends 4.5% a year or $900,000 a year. We inflate spending by 3% a year, as the total spending rate of both couples will likely outstrip our basic assumption of 2%. (See Jeff Maurer’s article on page 18, which references inflation rates for discretionary consumption.) All four people are currently age 65 and are living in Florida, free from state income tax.

In 30 years, at age 95, the Blues will be left with $38.6 million (dotted blue line in the chart to the left), or $15.9 million in today’s dollars (solid blue line). The Greens will have seen their assets deteriorate, with just $5.1 million (dotted green line), or $2.1 million in today’s dollars (solid green line), to live for the remainder of their lives and leave to their heirs.

Please contact your wealth advisor for further information and to discuss your own lifestyle analysis.

Important Notice Regarding Analysis: The primary objective of this financial plan is to prepare an analysis of your current financial situation and evaluate alternative strategies in meeting your articulated planning goals and objectives. In compiling financial information, we have relied upon your representations and have not attempted to independently verify the accuracy or completeness of the information provided. Certain assumptions have been made in the planning process. Although we believe such assumptions are reasonable within their context, actual results will vary. If you have a material change in your life that could affect your financial plan, it is imperative that you keep us informed. The analysis, statements and projections may be incomplete or contain other departures from generally accepted accounting principles and should not be relied upon by third parties for any purposes other than the development of your financial plan. This analysis is not intended to provide complete accounting, insurance, investment, legal or tax advice. Past performance is not indicative of future results.)