Independent Thinking®

Round One in the New Administration

January 19, 2017

Everyone has a plan, as Mike Tyson famously said, until they get punched in the mouth. For many advisors, the surprise election of Donald Trump, with his promises of big tax cuts and the repeal of the estate legislation, forced a rethink. This is the time to reconsider wealth planning, to make sure that families know what to expect in the new administration, as plans become policy – and after the real impact of taxes, fees, and inflation.

It is not, however, the time to unwind or even suspend wealth transfer strategies that could mean exposure to unacceptable risk. Strategic wealth planning, as it should be practiced, will remain at least as complex and as meaningful as ever in protecting and growing family wealth in this new environment.

As always, the devil will be in the details. A repeal of the estate tax, for example, is likely to coincide with higher income taxes on appreciated assets at, or even after, death, on a carryover basis. Without proper planning, the result could be at least as detrimental to a family’s total wealth as the estate tax, and possibly even more so.

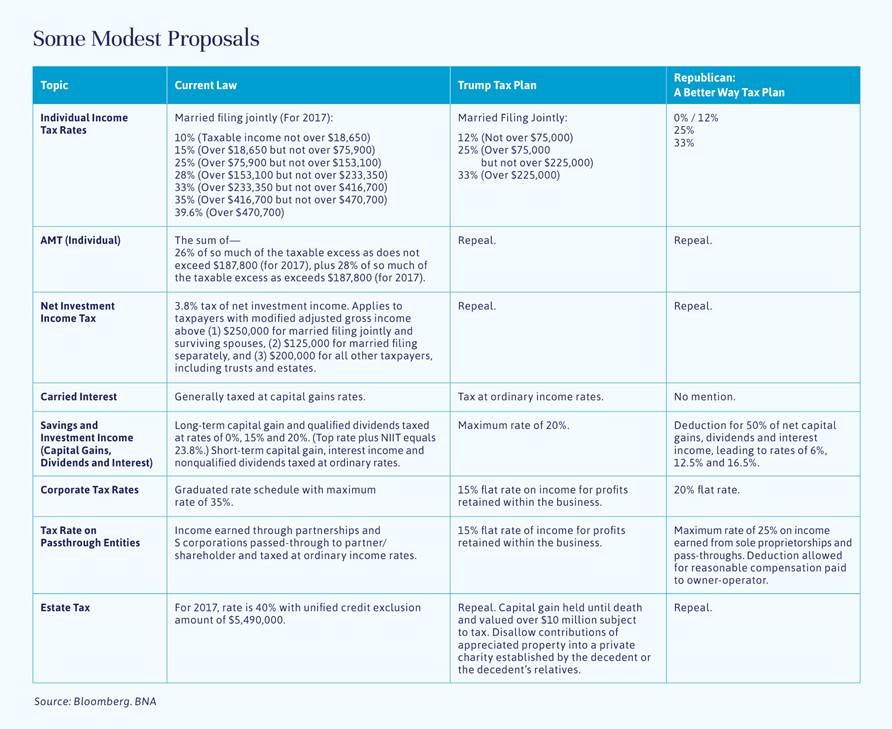

Let’s consider what we know so far and what we can reasonably expect in this year. While it does seem likely that headline income tax rates will be lower, there are several aspects of the proposed changes that require careful analysis specific to each individual’s tax situation. For instance, while the Trump plan eliminates the 3.8% Medicare surtax on investment income, the top tax rate of 20% on capital gains kicks in at $225,000 of income, not the $415,050 previously, for married filers. While the top marginal tax rate would be reduced to 33%, the various proposals offer limitations on itemized deductions either with a hard dollar cap (e.g., $200,000 for married taxpayers) or limitations on the type, such as charitable contributions, state and local income taxes or mortgage interest.

The Alternative Minimum Tax, or AMT, which specifically impacts higher and median income earners in states with high state and local income taxes (or who have significant deductions that are disallowed for AMT purposes) may be repealed. Sole proprietorships and pass-through entities may benefit from significantly lower income tax. But state and local governments may very well increase taxes. That could really hurt, especially in New York, Connecticut, New Jersey, California, and other already high tax communities.

Income tax planning becomes extremely important in this new tax regime. Maximizing annual charitable deductions and avoiding or deferring capital gains taxes are still essential. Long-term tax deferral and compounding, while eventually taxed, will still drive long-term asset growth, even though current tax rates may be lower. If deductions such as mortgage interest, charitable donations, property taxes, and state income taxes are curtailed or eliminated, individuals could find themselves paying as much tax as before, and tax deferral strategies will remain critical in preserving wealth and promoting legacies. Charitable remainder trusts are an example of a strategy that, depending on individual circumstances, could be utilized in conjunction with a highly appreciated stock position to create a tax-efficient, long-term income stream while providing a benefit to charity in future years.

As for an estate tax repeal, it may not be quite the windfall that many wealthy individuals and their families expect. Indeed, if repealed, the estate tax will likely be replaced with an eventual income tax on appreciated property by removing the current step-up in basis on assets at death. Under the Trump plan, there is a proposal to tax capital gains at death, with an exemption of $5 million for individuals and $10 million for married taxpayers. Other proposals call for the capital gains tax to be levied once the beneficiaries sell the asset.

At the same time, there has been little to no mention of any gift tax repeal. We will therefore need to see how the eventual tax legislation addresses the ability of individuals and couples to make additional gifts to heirs. If the gift tax remains at same level, families will still want to transition property carefully, to protect against a return of the estate tax in future administrations (or in the event that any tax legislation is forced to sunset in 10 years if certain corresponding revenue isn’t sufficiently generated to pay for it). Again, we will also have to see how state governments react. Currently, 19 states have estate or inheritance taxes. With no federal estate tax, states may look to either institute or increase their own form of a so-called death tax.

Limitations on gifts and bequests to charitable entities are also in play, either through the elimination or limitation of itemized deductions, or through further limitations on bequests to family-controlled charitable entities (there was a vague reference to this in the Trump proposal). The potential loss or diminution of the option to avoid capital gains on appreciated stock gifts to charity and also lower death tax costs may require forward-thinking strategies well ahead of final tax legislation.

Families considering wealth transfer planning should still take advantage of gifts that utilize their remaining gift tax exemption, as well as those that benefit from low interest rates to remove future appreciation from their estates. These include so-called freeze transactions such as grantor retained annuity trusts, or GRATs, sales to intentionally defective grantor trusts and intra-family loans, since all of these would avoid any material out-of-pocket gift tax costs. We would caution against any strategies that incur a gift tax until future tax legislation is more clearly defined.

Finally, while the potential repeal of the estate tax may raise the questions about setting up trusts or leaving assets in trusts, these will still remain important vehicles for high net worth families. Taking advantage of wealth transfer opportunities will require trusts to provide governance and asset protection around those assets for generations. Without a crystal ball, grantors will still want trusts to carry out their intentions under myriad economic and tax scenarios, and as family circumstances change and individuals live longer. The importance of establishing trusts with flexible terms in situses that offer the ability to decant a trust or otherwise modify it to allow trustees and trust protectors to address future legislation or changes in family circumstances has never been higher.

At Evercore Wealth Management and Evercore Trust Company, we remain on guard, working to ensure that our clients are ready for the coming changes – and staying on course to meet their goals.

Chris Zander is the Chief Wealth & Fiduciary Advisor at Evercore Wealth Management and the President and CEO of Evercore Trust Company of Delaware. He can be contacted at [email protected].