Independent Thinking®

Sustaining Investment Portfolios

January 19, 2017

There’s always someone richer, or thinner, or – as is increasingly the case – younger. And there’s always someone smarter. Some investment managers, somewhere, must have increased their equity exposure ahead of the U.S. election, especially in financial and defensive stocks.

Are we disappointed that we weren’t among them, given how things turned out? We are always disappointed when we fail to make the appropriate investment decisions for our clients. But this election cycle was not one of those times.

Most market observers believed that a Clinton victory would produce slow and measured financial growth and a continuation of the current market environment. Those same market soothsayers believed a Trump victory would produce a volatile market with a negative shock.

Most of our clients, reasonably enough, believed the polls and thought a Clinton victory likely, although some were worried that Trump could win and sought our advice on how to protect their portfolios. We examined hedging tools and determined it would cost 4%-5% of the equity value of a portfolio to protect that portfolio against a market drop greater than 4%. We advised those clients that the cost to hedge was far too great.

On the evening of the election when markets determined Trump was going to be our next president, the Dow futures fell nearly 900 points. No surprises there. On the next day, Wednesday, the Dow soared 257 points, or 1.4%, to brush up against an all-time high. (The S&P 500 and the Nasdaq also rose, albeit by not as much.) Very few saw it coming, and the ones who did are probably also very rich, very thin, and very young.

In short, our approach paid off. Not because we had a crystal ball – most of us expected Clinton to win too – but because thoughtful asset allocation is the best tool any investor has to meet their goals.

At Evercore Wealth Management, we evaluate each asset class based on their likely returns over the next 10 years (their return characteristics), on their riskiness (volatility), on how they fit together with other assets (correlation), and on how easily can they be sold (liquidity) and how they are taxed. Once we fully understand our clients’ goals and match them with a long-term asset allocation, we generally are slow to make changes to that asset allocation. We know that it is unlikely that we – or just about anyone else – will make the correct decision to sell an asset class right before it goes down and to purchase it right before it goes up. Most of our clients are individuals, and we also have to take into account the tax consequences of a sale.

Do we totally ignore markets? Of course not. We are always looking at relative valuations and economic conditions, and questioning our own capital market assumptions. But we try to have our clients fully invested in the appropriate asset allocation for their goals and risk tolerance, and to produce the best risk-adjusted and tax-efficient returns overtime. (See the list of our current asset classes and the accompanying article by our CIO here.)

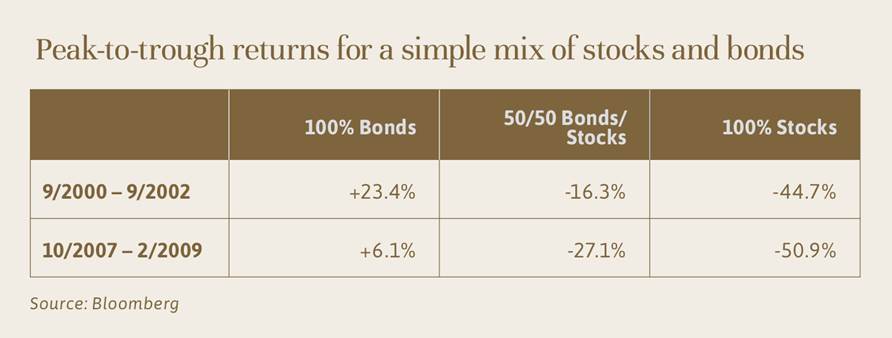

Drawdowns, such as those that occurred when the technology bubble burst and during the Great Recession, illustrated in the chart above, are unavoidable. Although we attempt to fine-tune our exposure, our clients’ portfolios will survive them. Indeed, if the allocations are kept intact, on average they should be ahead of the game again within 36 months of the drawdown.

As of this writing, we appear to be hovering around a peak or at least heading in that direction. Our clients, most of whom have a least 50% of their portfolios invested in growth assets, are enjoying the fruits of this post-election rally. And, as we discuss in several articles in this issue of Independent Thinking, it’s possible that the markets will stay elevated for some time. We are ready for that – and for the inevitable troughs.

Our world is far too complicated for us to imagine that we will always get it right. Appropriate asset allocation is how we deal with it.

Jeff Maurer is the CEO of Evercore Wealth Management and the Chairman of Evercore Trust Company. He can be contacted at [email protected].