Independent Thinking®

Charitable Giving & Tax Reform

April 21, 2017

For charitably minded families, this may be the year to step up in a meaningful way to support nonprofits. While no one knows what tax reform will look like or, if it comes to pass, whether it will be retroactive or delayed to 2018, it’s important to note that the current plans could significantly impact both donors and their causes. In addition, highly appreciated stock values make this an opportune time to maintain or accelerate giving.

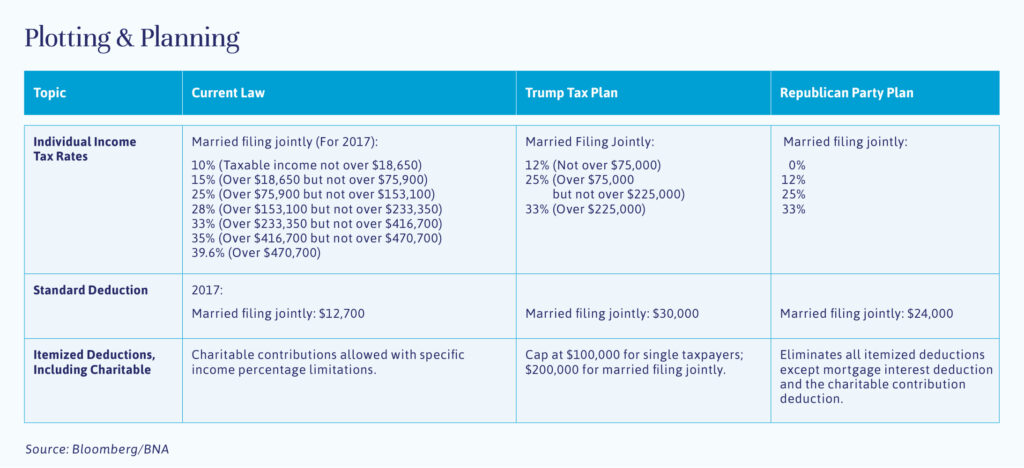

At the extreme end of the plans now on the table, the top individual income tax rate for married couples filing jointly will be reduced to 33% from 39.6%, and all itemized deductions, including those for charitable gifts, will be capped at $200,000 today. For those with mortgage interest, high state income taxes and property taxes, this could severely limit or even eliminate the ability to deduct charitable gifts. The chart below illustrates both the current Trump and Republican Party proposals.

These changes lead to uncertainty for nonprofits of all kinds that rely on charitable donations. In addition, some charities are facing political as well as fiscal pressure. While the challenges facing well-known organizations such as the National Endowment of the Arts and the American Civil Liberties Union get a lot of press – and have reported record donations since the election – the interdependencies of nonprofit funding and government policy are complex. For example, the American Lung Association receives grant funding through the Environmental Protection Agency.

All donors eager to bolster their favorite cause should first consider contributions of qualified appreciated stock. The current fair market value of shares held for more than one year before contribution can be deducted, subject to adjusted gross income, or AGI, limitations, in addition to avoiding the capital gains tax otherwise due on the appreciation in the event of a sale. That’s a significant consideration after 10 years of an average 7.5% annual gain in the S&P 500.

Additionally, for IRA account holders age 70½ and older, donating a portion or all of the required minimum distributions (up to $100,000) directly from an IRA to charity remains an attractive option for avoiding income tax on the distribution (which is generally at ordinary federal and state income tax rates), especially if the charitable deduction is cut. There is no charitable income tax deduction in this scenario. If the charitable deduction is not limited, evaluating the double benefit with gifting low-basis stock and avoiding taxes on the gain and achieving an income tax deduction – versus solely avoiding income taxes with an IRA charitable contribution – merits analysis based on the specific circumstances.

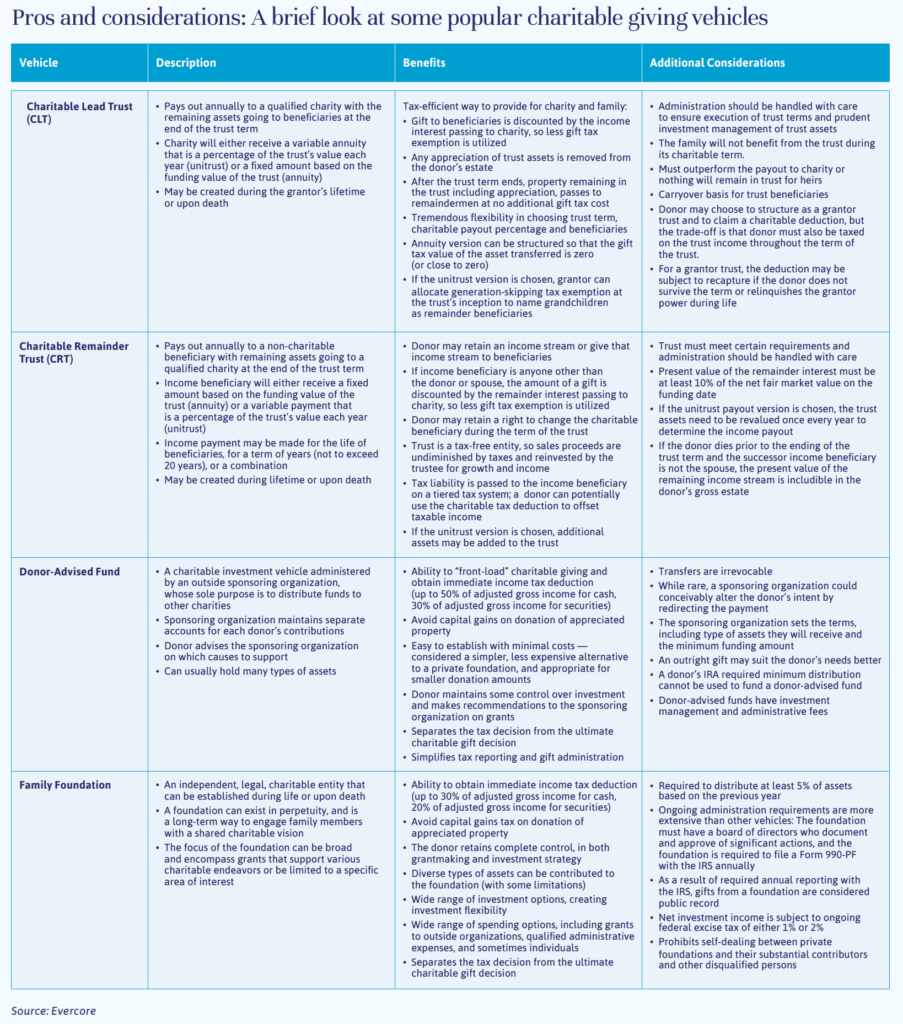

For donors focused on making a long-term, sustainable impact and on engaging younger generations in the family’s philanthropy, it may make good sense to make a large gift this year through a planned giving vehicle. Again, it’s important to stress that we don’t yet know if and when tax reform will materialize and whether it will be retroactive. These strategies should be considered in light of each family’s full circumstances, including available deductions.

For families with considerably appreciated stock holdings that are looking for a tax-efficient way to diversify, create an income stream for life (or a term of years), and leave a charitable bequest at the end of the period, a charitable remainder unitrust is a potentially effective solution. The donor would obtain an upfront charitable deduction based on the present value of the projected remainder interest to charity. However, at today’s low rates, that present value is smaller than if rates trended higher.

Families who would like to provide for their next generation over the longer term, but also benefit charitable organizations in the interim, may choose a charitable lead annuity trust (CLAT). This type of trust provides for fixed payments to a charity over a term of years, with the remainder passing to family members. In today’s low interest rate environment, the relative value of the charitable deduction with a CLAT is high. Depending on the outcome of tax reform, these can be structured either with an upfront charitable income tax deduction for the grantor (a grantor CLAT), or an annual charitable deduction within the trust (a non-grantor CLAT).

The strategy that could be impacted significantly by limitations on charitable deductions is the large one-time gift (or series of gifts) to a donor-advised fund, or DAF, or a private family foundation. Typically, this option enables donors to give appreciated stock to the DAF or foundation, diversify immediately, and take advantage of a full charitable income tax deduction in years of relatively higher income, say the year of retirement or the sale of a business (subject to AGI limitations). Furthermore, it allows time for the donor to develop a multi-year giving plan from the DAF or foundation to the charities they (and their families) wish to benefit.

However, a limitation on the charitable deduction (or even just a lack of clarity) should prompt a rethink. Donors can deduct charitable contributions in the year of the gift and for five years thereafter if there is a carryover. Once the eventual tax reform plan is known, individuals should work with their advisors on a multi-year income tax projection to determine whether the deductions related to their charitable giving can be reasonably absorbed during the allowable time frame. (See the chart below for a brief synopsis on the pros and cons of each approach.) Combinations of these strategies may also make sense.

It is important to think ahead, because the planning and implementation of these entities requires time and work, with wealth advisors and the family’s attorney and tax advisor. With changes anticipated in both income tax rates and the charitable deduction, now is a good time to be thinking about charitable giving, and how best to maximize a family’s tax benefits and the charitable impact of a gift.

Editor’s note: This is the first in an occasional series on private philanthropy and its tools – the family foundation, donor-advised funds and charitable trusts, among other techniques. For further information on philanthropy, trusts and family wealth services at Evercore Wealth Management, Evercore Trust Company, N.A. and Evercore Trust Company of Delaware, please contact your advisor.

Keith McWilliams is a Partner and Head of West Coast Region at Evercore Wealth Management. He can be contacted at [email protected].