Independent Thinking®

Better Together: Active & Passive Investing

April 21, 2017

Crack open the most effective portfolios and you’ll find both passive and active investments – and strategies that contain elements of both. Passive equity investments, which track an index such as the S&P 500, have earned their place through low fees and, for the past eight years, strong performance relative to active managers with similar benchmarks. Like most good investment ideas, this shift – rightly described by Vanguard founder John Bogle as a tsunami – is in danger of being taken to extremes. At an annual growth rate of about one percentage point, capital flows into index funds are driving up the valuation of large cap stocks, which already have the highest weightings in the indices. Stocks with low representation in the indexes are being overlooked, creating a latent potential to eventually outperform, net of active management fees.

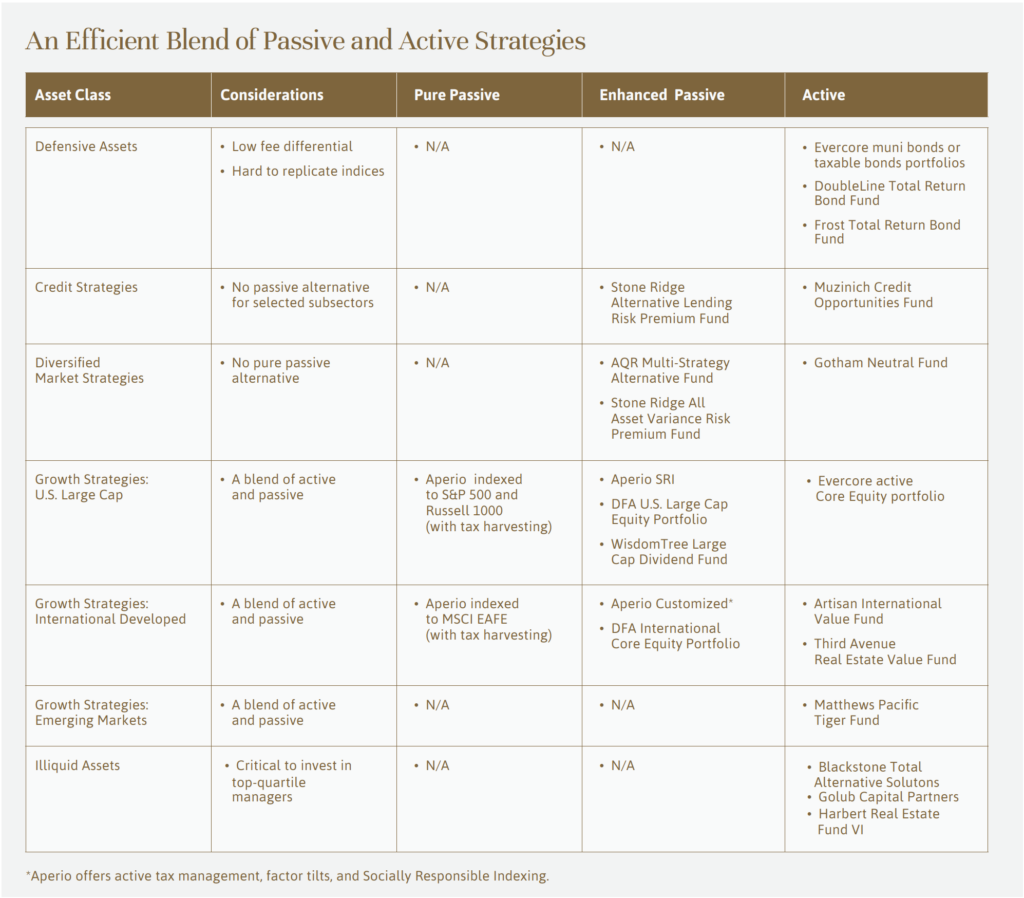

Investors need to consider the relative merits of both passive and active strategies for each asset class, along with the associated transparency, volatility, and risk characteristics, and after-fee returns, to ensure allocation to the optimal vehicle and the right measure of diversification. See chart below for our current recommended allocations.

Municipal bond and credit exposures are, in our view, best managed by hands-on investment managers. There are no universally accepted municipal bond indices, and those that exist are often not easily replicated. In a similar vein, the more interesting credit strategies, such as consumer lending and floating rate bank loans, do not have indices to replicate. For these reasons, we believe that the advantages of individually customized municipal bond and credit portfolios outweigh the (marginally) lower costs of passive strategies in these asset classes.

Equity opportunities are more complex, and we manage passive, active and blended portfolios in this asset class. Investors with single stock concentrations or significant exposure to a particular sector through their other investments and business interests require an active approach to diversification, as do all investors looking for alpha, and we customize and manage our active core equity portfolio accordingly. We employ what we describe as enhanced passive strategies for both domestic equities and developed international markets. We use the term enhanced because, although the funds reference an index, they will adjust security weightings by basic fundamental factors other than simply market capitalization, such as dividends or value.

At the extreme end of active management are hedge funds, which have suffered as an asset class since the financial crisis. Too much capital – $3.2 trillion at the height in 2015 – was handed over to global hedge funds, and they have for the most part competed away their advantage. Attempts to outsmart the market using proprietary security selection or other investment calls, such as market timing or sector rotation, no longer justify their very high-fee, high-turnover structures.

We continue to evaluate intriguing hedge fund strategies but generally take an enhanced passive approach to the alternatives market by selecting funds that provide exposure to a basic investment strategy, such as risk arbitrage, but do not attempt to provide the equivalent of proprietary security selection and therefore can charge lower fees. For instance, the AQR Multi-Strategy Alternative Fund aims to replicate the nine basic hedge fund strategies without making proprietary judgments or charging excessive fees, or carrying costs. In other words, we are in effect taking a passive approach to most of our liquid alternative investments. This is an unconventional but, in our experience, very effective strategy for high net worth individual, foundation and endowment portfolios.

Even if they could invest passively in illiquid alternatives, investors wouldn’t want to. The private equity and private real estate markets are far less efficient than the public markets and therefore provide real opportunity for active managers. Investing with a top-quartile manager is imperative. While past performance is no guarantee of future results, there is strong evidence that past superior investment performance in illiquid markets is persistent. We therefore look to invest through managers with excellent long-term track records.

It is our experience that, for high net worth private investors, endowments and foundations, the most resilient portfolios are diversified across both asset classes and investment styles. While we anticipate retaining a substantial exposure to both passive and active strategies, we also expect to see more hybrid investments in the future.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].