Independent Thinking®

What Happened to Inflation?

October 23, 2017

In the spring issue of Independent Thinking, we addressed the prospect of so-called Trumpinflation, noting that while there was a possibility of higher inflation and resulting increases in interest rates, powerful long-term deflationary forces were not going away. Inflation has since remained low, and we expect it to remain so for the foreseeable future.

Historically, there has been an inverse correlation between the unemployment rate and wage inflation, a phenomenon known as the Phillips Curve. This time around, however, inflation continues to hover below 2%, the Fed’s target rate (see the chart below).

It seems to us that four factors will collectively keep inflation low:

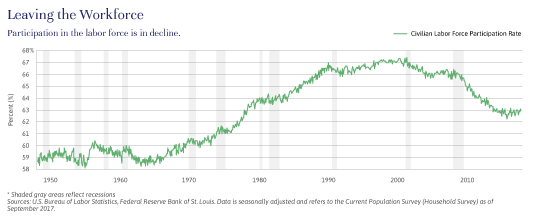

- Demographics. The oldest baby boomers are in their early 70s, and the youngest are in their mid-50s. Their exodus from the workforce exerts a downward pressure on the size of the labor force. As demonstrated below, the labor force participation rate has been in decline since the early 2000s. The shrinking U.S. labor force participation rate has created both a short-term and medium-term drag on inflation.

- Technological changes. Advances in technology will have a twofold impact on keeping inflation low. First, these gains improve efficiencies or cause disruptive changes in areas such as energy (horizontal fracking, solar/wind power, electric cars), goods manufacturing (3D printing), distribution (supply chain optimization), and retail (the Amazon effect). This reduces costs across many sectors of the economy, suppressing commodity and goods inflation. Second, while technology gains and other forms of creative destruction create opportunities, they also destroy jobs and further constrain inflation.

- Monetary policy tightening. The Federal Reserve began the process of raising interest rates nearly two years ago and is likely to begin reducing its massive balance sheet by the end of the year. Monetary policy tightening historically has worked to constrain inflation.

- Deregulation. Easing restrictions can increase supply and dampen prices across many industries. We expect more new business formation, increased drilling for natural resources, and infrastructure construction.

We believe the combination of these factors will make a significant move higher in inflation more difficult, and this will continue to support current valuations in the capital markets. As John Apruzzese writes in the lead article of this issue, prolonged low, but stable, inflation is positive for the stock market. When adjusted for the current inflation environment, today’s U.S. equity market valuations look in line with historical averages. Just as rising inflation erodes the future value of a bond’s coupon and principal, low inflation supports bond market valuations. Unlike equities, however, bonds remain susceptible to rising levels of real growth in the economy.

Significant unhedged bets on single outcomes are rarely in the best interests of investors. While inflation may stay low, supporting equities and bonds, it is not a defense against weakening economic growth, geopolitical risks, or monetary policy errors. We recommend exposure to diversified risks as part of our core investment strategy, and we are continually looking for uncorrelated return streams to make portfolios more robust. Further, we continue to believe that illiquid investments will earn a premium over liquid public markets.

Diversification and thoughtful investments grounded in fundamental analysis are still the best defense in a very uncertain world.

Brian Pollak is a Partner and Portfolio Manager at Evercore Wealth Management. He can be contacted at [email protected].