Independent Thinking®

A Longer Perspective: the Investment Outlook

February 9, 2018

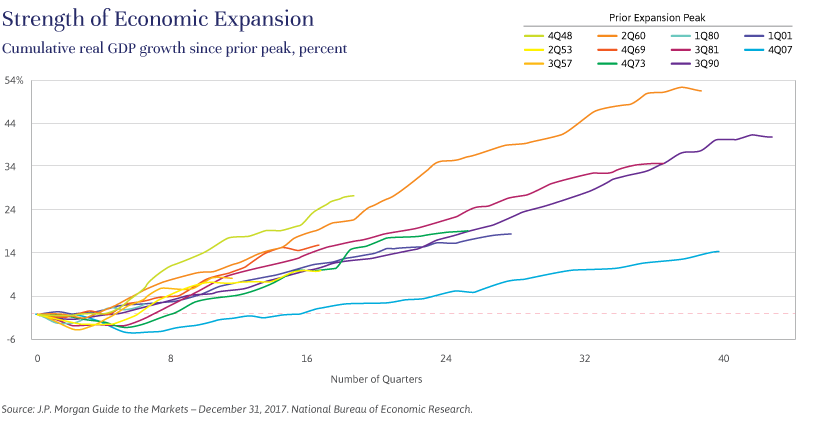

The current U.S. economic expansion may soon become the longest on record. The S&P 500 index has soared, up 400% since the bottom of the market in 2009, while other developed markets and the emerging markets have recovered and begun to catch up to the United States in what economists are describing as a synchronized global expansion.

Over the past 12 months, every one of our asset classes has contributed to total performance. So where do we go from here? Let’s consider the components of this extraordinary investing environment.

First, this expansion may still have room to run. Expansions don’t die of old age, they die because they overheat – and there is as yet very little evidence of excess. U.S. economic growth has been slow throughout this recovery, up a cumulative 15% since the fourth quarter of 2007, the peak of the last expansion, compared with cumulative growth rates of between 35% and 50% for the three strongest expansions since 1945. While interest rates remain relatively low, the Federal Reserve has been keeping a close watch on the punchbowl, raising rates four times over the past two years, and signaling at least another three rate increases by the end of next year.

Another exceptional aspect of this market, until very recently, has been its historically low volatility. Apart from 2017, only two years in the history of the U.S. stock market have had similarly low volatility – 1964 and 1995. In both years, returns were very strong and the market continued to make new highs for the next four to five years. It takes time for normal volatility and uncertainty to return before major trends are reversed, notwithstanding an extraneous shock. On that note, it is important not to overreact to headline geopolitical risks and become overly risk-averse. The only real protection is a well-balanced and diversified portfolio.

In short, U.S. stocks should continue to play a significant part of any well-diversified portfolio, and we are maintaining our standard policy allocation to equities.

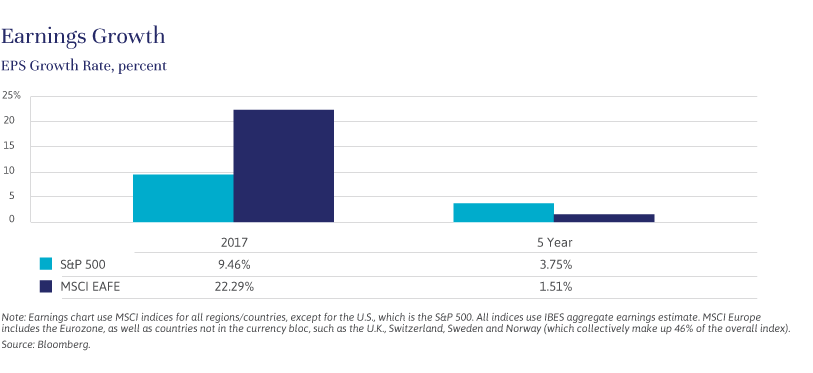

At the same time, the global stock market is being driven by strong economic and corporate fundamentals across all the major economies, apart from the United Kingdom, which is struggling to extricate itself from the European Union.

Our allocation to international equities is currently 30%, with approximately half targeting developed markets, and the other half focused on emerging market companies likely to prosper with the continuing rise of Asian consumers.

The municipal bond market returned 3.5%, and our investments in the credit markets returned about 5.3% gross over the last 12 months.1 In response to a dramatic increase in end-of-year supply, we increased our recommended allocation to municipal bonds slightly in the fourth quarter. Our allocation to credit strategies remains steady at about 8% for most portfolios. Importantly, we have had no direct exposure to any of the commodity markets, which have had annualized returns of -8.59% since May 31, 2008.2

It’s also important to note that valuation levels for all asset classes may not be as high as they seem, at least in this continuing low-inflation environment. As we argue in our white paper, A Reality Check for Stock Valuations, the equity market is actually at a historically average valuation level when adjusted for the current stubbornly low inflation rate of 2%, versus the post World War II average of 3.7%.3

Indeed, we may be looking at even lower inflation, as a direct consequence of the Tax Cuts and Jobs Act of 2017. Lost in the debate about whether the windfall from the tax cuts will go to business owners through more share buybacks and dividends and maybe some additional capital investment, or to labor through higher wages, is the third, rather likely possibility that it will go to customers. In a competitive business when there is a sudden drop in costs – in this case, taxes – there is a strong tendency to cut prices or, at the very least, not increase them as much as planned. This is contrary to the consensus view that inflation will increase as a result of the economic stimulus of the tax cuts.

We do believe that the tax cuts will add stimulus to an already accelerating U.S. economy in the short run, but we are not yet convinced on the longer-term economic benefits of the total tax package. Many of the provisions sunset within seven years, which causes uncertainty, while larger deficits will put pressure on government spending and economic inequality will be exacerbated – all of which will contribute to continued political discord.

In short, we do not see any major reversals to any of these trends in the near term, although no one should expect continued gains at recent levels. We remain optimistic, although we recognize that future stock market returns could easily disappoint, especially given generally bullish investor expectations. It’s important to note that we will continue to rebalance portfolios back to policy guidelines by taking some profits from the stock portfolio, and continue to invest in opportunities that look promising even if the stock market turns negative. (See our interview on reinsurance with the Pioneer ILS Interval Fund here.)

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].

1 The credit strategies return noted is net of third-party manager fees, but is gross of EWM advisory fees. The maximum investment advisory fee is 1% of assets under management.

2,3 Bloomberg.