Independent Thinking®

A Fine Balance: Managing Portfolios in Buoyant Markets

May 11, 2018

Is this market as good as it gets? Many important indicators are at or near their most bullish readings ever and would be difficult to improve upon.

The most notable and extravagant signs of economic health can be found in sentiment surveys – how people are feeling, not necessarily what they are doing. The economic outlooks and capital spending plans of corporate chief executives are at record highs, and measures of small business and consumer sentiment are at similar extremes. In short, animal spirits have been fully unleashed.

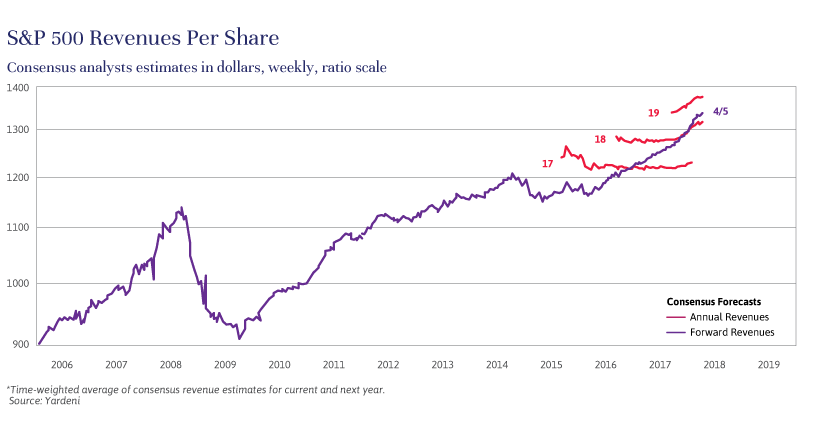

Expected corporate earnings and revenue growth rates, in the United States and abroad, have accelerated to levels rarely seen so long into an economic expansion. Earnings for the companies that make up the Standard & Poor’s 500 index are forecast to grow by almost 20% this year, propelled by corporate tax cuts on top of strong economic growth.

At the same time, inflation, a key variable in determining valuations, as described in our recent white paper, A Reality Check for Stock Valuations, remains low. (Indeed, it may be that corporate tax cuts ultimately prove deflationary, if companies compete by cutting prices.)

This is all fundamentally good news and could drive the market higher in the short term. Beyond that, there is a risk that a run of less sizzling growth could disappoint investors. A greater concern is that growth instead will accelerate to the point that the economy overheats, threatening higher inflation and compelling central banks to raise interest rates more aggressively. That almost certainly would increase the likelihood of a recession and cause the stock market to fall.

These are not the only risks that investors must factor into their thinking. The aggressive efforts by the Trump administration to rebalance trade could hamper the global flow of goods and services. This flow has served as an engine of prosperity during the last two or three decades, and indeed whenever it has been allowed to proceed unfettered. At their worst, the protectionist policies could incite a trade war. Many advocates of free trade accept that the United States would benefit over the long run from reducing its trade deficits with China and other large economies, but they warn that doing so probably would create pain over the short to intermediate term.

When gauging the potential impact of the simmering trade dispute, it is important to remember that the conflict with China is much larger than the dollars-and-cents trade balance figures would suggest. As Brian Pollak highlights in his article (click here to read), China is our main rival for global influence. Advanced technology will be as important to the competition between the two nations as are military and economic might. It appears that China has not just been buying American technology but acquiring it through coercion and sometimes theft. It has secured significant technology in automobile manufacturing, for example, by requiring U.S. and other Western companies building manufacturing facilities in the country to enter into joint ventures with Chinese companies. It is strategically important to limit these practices and to take other steps to protect advanced technology and intellectual property in general.

Other factors warrant a more cautious stance toward equities, including rising odds that the Democratic Party will command a majority in the House of Representatives after the midterm elections. That could amplify the discord emanating from Washington. It’s also important to note that Andres Manuel Lopez Obrador, the leading candidate in the Mexican presidential election to be held this summer, is from the extreme left. If he wins, it could destabilize a very important neighbor and trading partner. Current polls put him 20% ahead of his rival.

As usual, the economic and political backdrop is fraught with uncertainty, making forecasts for the stock market a challenging undertaking. There is no doubt that this has been a very long and rewarding bull market. At the same time, the yields on short- and longer-term fixed income assets are slowly becoming more attractive. We maintain relatively conservative and, we believe, realistic market assumptions, and will continue to diversify portfolios to protect and grow our clients’ capital.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].

To view the Evercore Wealth Management white paper, A Reality Check for Stock Valuations, click here or contact us to request a hard copy.

Core Equity Portfolio by Charlie Ryan

Stock market volatility, long dormant but back in force recently, is probably here to stay due to a number of reversals in macroeconomic fundamentals. Our goal in times like this is often to review our rationale, rebalance, and possibly introduce new positions when attractive entry points present themselves.

It is important to remember that our approach is always to identify the primary factors underlying a company or stock: the key drivers of the business, the competitive landscape now and in the future, and what the business is worth, now and in the future. If we understand these components, market volatility can often make our fundamental decisions more straightforward.

We also describe our process as unconstrained. In our core portfolio, which is actively managed and accounts for the majority of our allocation to domestic equities, we consider investments in companies across the market capitalization spectrum from $1 billion up. We also consider non-U.S. businesses, as we focus on where a company operates rather than where it is domiciled. This allows us to take advantage of volatile market conditions across different geographies and sectors that create unwarranted changes to equity prices.

Our strategy has a reliable and consistent philosophy of maintaining a limited number of holdings and minimizing turnover. The portfolio owns approximately 35 to 40 companies at any time. This allows individual names to have a meaningful impact on returns, while curtailing the drawdown from mistakes. Limiting the number of holdings is also consistent with our belief in sustaining a high “active share” in the portfolio. Active share is a measure designed to determine the extent to which the holdings in a portfolio deviate from those in the index against which the managers compare the portfolio’s performance. Maintaining 40 or fewer holdings, compared to the 500 in the benchmark index, the Standard & Poor’s 500, helps to ensure a high active share in our core equity portfolio. This will present more variation from month to month or quarter to quarter, but with thoughtful execution it has outperformed the benchmark index on a total return basis since the strategy’s inception in 2009, and we remain confident in our approach.

The equity markets have been more unnerving for investors in recent weeks than during the backdrop of lower volatility that prevailed for the previous several years. We view it as our mandate, as long-term fundamental investors, to sift through the daily noise and media rhetoric to identify solid businesses that our clients can invest in fruitfully for many years to come. We believe that sometimes volatility can be our ally in that cause.

Charlie Ryan is a Partner and Portfolio Manager at Evercore Wealth Management, and Co-Manager of the Evercore Equity Fund (EWMCX). He can be contacted at [email protected].