Independent Thinking®

Thoughtful Giving to Heirs

May 11, 2018

How much? When? How, exactly? Families considering making gifts to heirs face some tough questions. Thinking strategically about taxes and trusts can help alleviate the pressure and prepare the beneficiaries. Large gifts involve many considerations, whether they are philanthropic or for family. First and foremost is to fund current and future expenses, especially as longer life expectancies increase the likelihood of healthcare costs and other costs rising over time. Even families with considerable wealth should work with their advisors to set aside the proper sums if they expect to maintain their current lifestyle.

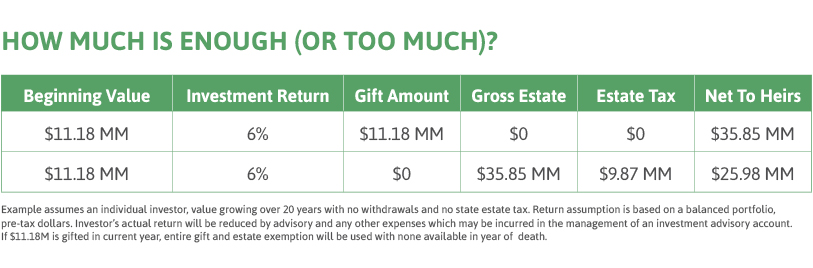

For families with substantially more than $22.36 million, the total exemption now afforded a couple1, the overarching issue is just how much to pass on to children and grandchildren. Some say they wouldn’t mind if their kids got all of the wealth. Many decide on a limit, with the excess designated for charities or a private family foundation. Warren Buffet’s rule of thumb about giving kids enough money that they could do anything, but not so much that they could do nothing, remains a benchmark for many wealthy families. However, even those who plan to leave all of their assets to their children want to do it in a thoughtful way. Their goal is to prepare heirs for the responsibility, without quashing their own goals and initiative.

Children in high net worth families usually are aware of their families’ wealth, although not necessarily its extent. This is where family discussions are crucial – early conversations around values, gratefulness and stewardship are a good starting point. Setting expectations is also important, especially in the context of limiting children’s inheritance. Silence on this topic can cause confusion and resentment. Families where these discussions don’t occur until much later can encounter real problems that may hinder wealth transfer.

As with anything, timing is everything. Many families realize that while they would prefer to see heirs embrace the family legacy, they also don’t want to saddle children with the responsibility before the heirs are ready. Conversely, they don’t want them to have the responsibility of inheritance come as an overwhelming surprise in the event of a premature death of a parent or parents. Some families decide to give their adult children a relatively modest amount of money to see how they handle it. If families see their children taking responsibility for their own lives and displaying healthy independence, they might gain the confidence to give more money over time. However, if the children act irresponsibly, families may change or restrict the amount and timing of any future wealth transfer.

It’s worth noting that there may be better uses of the increased exemption ($11.18 million free of federal estate tax, during a lifetime or at death, in 2018) than giving assets away outright. Forgiving large low-interest rate loans previously made to children or other family members could also be worthwhile.

Parents who want to utilize the increased exemption now, but worry that their children (who may be young, or not so young) are unprepared for the responsibility of such a large gift, could establish trusts rather than giving funds outright. By establishing and funding the trusts now, instead of at death, any appreciation on those funds is also removed from the donor’s taxable estate. This strategy not only protects the assets, but depending on the language in the trust agreement, could allow for control over the distributions and use of the funds until the children become better stewards of wealth.

Trusts offer families ample flexibility in choosing how to transfer assets to heirs. For instance, a trust could include a provision stating that the trustee not disclose the trust’s existence until a later date. Trusts could also be drafted to allow the donor to continue paying income tax on the activity in the trusts, which acts as an additional tax-free gift to beneficiaries. Further, trusts could be set up by both spouses for each other’s benefit in the event they need financial support in the future. These spousal limited access trusts, or SLATs, require special care when drafting so as not to run afoul of the reciprocal trust doctrine, which applies to interrelated trusts that have not actually impacted the economic position of the donors.

While there is time to make decisions, the increased exemption amount of the 2017 Tax Act is slated to sunset at the end of 2025. That date will come more quickly than anticipated for many families, and a change in the political landscape could bring about an earlier deadline.

In the meantime, at least one other gifting opportunity is worth remembering. The annual exclusion gift amount has increased to $15,000 in 2018. This continues to be an efficient way to transfer wealth to family (or anyone else) without gift tax consequences. Taking advantage of the annual exclusion gift amount may buy parents and grandparents time to decide how much is enough to give to heirs.

Pam Lundell is a Partner and Wealth & Fiduciary Advisor at Evercore Wealth Management. She can be contacted at [email protected].

1 The previous issue of Independent Thinking explored potential strategies for the recently doubled lifetime estate, gift and generation-skipping tax exemptions, as well as related aspects of the Tax Cuts and Jobs Act of 2017.