Independent Thinking®

Our Financial Journey

May 11, 2018

“Life’s journey is not to arrive at the grave safely in a well-preserved body, but rather to skid in sideways, totally used up and worn out, shouting ‘Man, what a ride!'” George Carlin, the stand-up comedian, actor, author, and irreverent social critic, died at just about the age I am now. And while I like to think that 70 is the new 50, I’m already on to some replacement body parts.

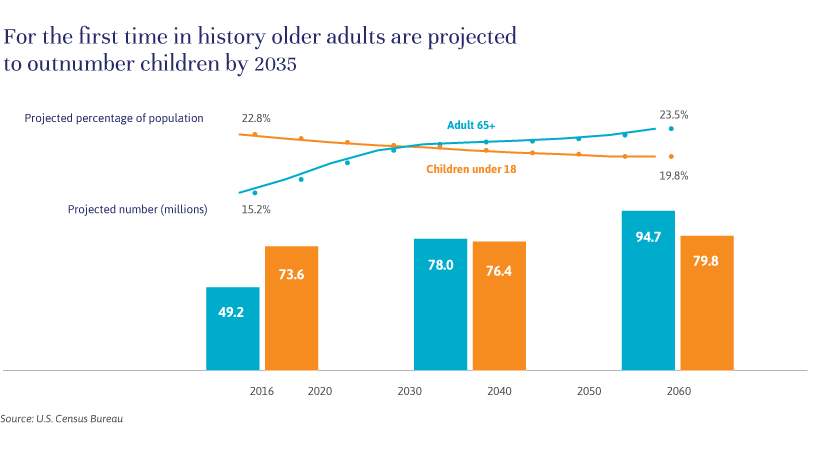

I have plenty of company. The youngest Baby Boomer will turn 65 in 2030, and by that time, one in every five Americans will be of traditional retirement age. Within another five years, according to U.S. Census Bureau projections, older adults will outnumber children for the first time in U.S. history. That has to – and indeed already is – forcing a sea change in how we think about aging, work and retirement.

Although I am of retirement age, I have no plans to retire. My 50 years of experience in wealth management helps guide our firm and clients through ever-changing markets and monetary, fiscal and tax policies. Whether we think of it as a roadmap or a GPS, we all benefit from some guidance to enjoy the ride to the fullest.

As wealth managers, our guidance starts with a conversation. Where are you heading? How secure is your income? What is your tolerance for risk? Do you have other constraints, such as a concentrated stock position or a closely held business? Are you planning to sell or transfer ownership of your business or other assets? Is your family experiencing change? Do you need to protect or manage assets in a trust, or to deepen your or your family’s financial knowledge? What are your aspirations, for yourself, and for the people and organizations you care for?

Once we know the goals, we prepare a lifestyle and cash flow analysis. The analysis compiles sources of income, expenses, assets and liabilities into a customized projection of financial sustainability. We use this analysis to assess our clients’ progress to providing for a safe retirement, determining the amount of assets to transfer today to longer-term trusts for family members, and assessing the scope and timing of a charitable gift program.

For our younger clients, the analysis helps determine savings rates required for goals such as college education, vacation homes and ultimate retirement. For those considering retirement, we look at market drawdowns measured against spending.

A lot has been written about the advantages of robo advisors and artificial intelligence. We keep up with the technology and take full advantage of it, but we remain focused primarily on listening to and understanding our clients’ concerns and objectives, now and as they evolve. My own financial journey is shaped by my family’s goals and measured against lifestyle analysis – and discussed by my wife and me with our Evercore Wealth Management advisors on a regular basis.

Don’t get me wrong, I am a technology-savvy septuagenarian who appreciates the navigation system in my 2014 Corvette 7-speed stick-shift and loves the ride. But I am prepared to override the suggested circuitous route that saves a few minutes on a two-hour journey. I’m not going to arrive at my grave with a well-preserved body. But I am – as I hope all of our clients are too – going to arrive with my family’s finances intact.

Jeff Maurer is the CEO of Evercore Wealth Management and the Chairman of Evercore Trust Company. He can be contacted at [email protected].