Independent Thinking®

Investing as Disruption Accelerates

July 27, 2018

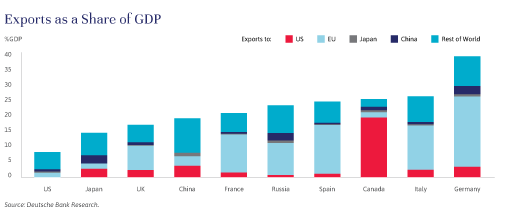

Powerful disruptive forces are all around us, as technological, political and demographic changes accelerate. For investors, the challenge is to detect meaningful messages amid the cacophony. Of immediate concern to investors is the disruption to international trade being caused by President Trump. The 50-plus year trend of generally falling tariffs thanks to multilateral trade agreements is being reversed. While the increase in total global trade resulting from the trade agreements is considered by almost all economists to be a net benefit to all countries, including the United States, the resulting U.S. trade deficit has become a political problem. A classic trade war featuring tit-for-tat tariff increases will have an impact on major U.S. exporters, although as a whole the United States has the lowest amount of exports as a percentage of GDP than any other major economy by a wide margin (see the chart below) and is therefore relatively insulated. But, of course, the conflict is about a lot more than just the trade deficit.

The Trump Administration’s real fight is with China for global leadership in technology. The United States is home to six of the world’s ten largest tech companies, with two of the others in China. China perceives itself at a strategic disadvantage that it plans to correct by accelerating its acquisition of home-grown intellectual property through “Made in China 2025,” a government initiative to upgrade the country’s industrial base. China also plans to ramp up semiconductor manufacturing to cut back on the $200 billion it spends each year importing these technological building blocks.

Big American technology companies and U.S. financial markets seem to be taking the burgeoning trade war in stride, at least so far. Indeed, several industry giants continue to grow at astonishing rates for their size. Just five technology stocks account for about 13% of the market value of the Standard & Poor’s 500 index, a concentration not seen since the height of the tech/telecom bubble that burst in 2000.

A crucial difference is that technology industry leaders are financially and commercially stronger than they were then. They seem better positioned to continue growing at a fast pace, at least until Washington counteracts their power through tougher trade regulation and, eventually, antitrust rules that could force some of them to break up. That will be a key signal. Reports of the extensive amounts of information that some large tech companies, notably Google and Facebook, compile on their users have raised concerns in many quarters that they are becoming too powerful a force in society. When Mark Zuckerberg, Facebook’s co-founder and chief executive, testified before Congress in June, it highlighted the growing disconnect between Silicon Valley, on one hand, and Washington and much of the rest of the country on the other.

While awaiting a shakeout, it’s important to own companies recognized today as successful disruptors in the United States and China. (See related article by Tim Evnin below.) It is at least as important to get out of their way, avoiding exposure to companies, and even whole sectors, affected by the disruptors. Media and retailing, to take just two examples, have changed beyond recognition in the last few years, and they continue to change at a pace that seems to us too rapid to discern many lasting winners.

Although purchases of music in physical form continue to decline, consumption measured by tracks streamed or downloaded has been increasing at a rapid pace and is at an all-time high. Global revenues, however, were nearly one-third lower in 2017 than in the peak year of 1999, according to the latest figures from the International Federation of the Phonographic Industry. Revenues from video consumption show an upward trend, but the amount of content consumed through digital downloads, streaming and other direct-to-consumer channels is soaring. While it may feel as if we are paying more for video services, we are getting far more for our money. If major media companies like Disney and Comcast compete more vigorously with leaders in the distribution of direct-to-consumer content, such as Netflix and Amazon Prime, it will only exacerbate the deflationary trend.

In retailing, prices of durable goods have been falling for decades. While global trade underpinned this trend in the 1990s and 2000s, the cause more recently has been the so-called Amazon effect, in which brick-and-mortar retailers are forced to cut prices to compete with the dominant online retailer. And the Amazon effect is likely accelerating. Because shoppers can easily compare prices before they buy any item and are becoming less brand sensitive, traditional retailers will either have to compete on price or have a specific draw to attract shoppers.

Technological advances in renewable energy are also gaining momentum. Solar and wind power, even without government subsidies, are comparable in cost with power generated from fossil fuels, and the cost of battery storage is coming down quickly, as well. It has been difficult until recently to invest directly in the disruptors in this field because of their dependence on shifting subsidies, but new opportunities are coming into focus. We recently invested in a private-equity fund, True Green Capital, that is building large, commercial solar power installations. And we’ve long avoided companies ripe for disruption, such as utilities dependent on coal; gas turbine manufacturers, such as General Electric, an original constituent of the Dow Jones industrial average in 1896 that was dropped from the index in June; and the mainline auto manufacturers.

Biotechnology and healthcare, like technology generally, are areas of rapid innovation where as much money has tended to be lost as gained by attempting to invest in disruptors. There are significant opportunities in these niches, as Joelle Kayden, the manager of Accolade, our recently selected venture capital investment fund, discusses on page 10. But the hoped-for advances often take longer than expected, and investors need to be selective and patient.

We are actively managing our client portfolios with our focus on the long-term consequences of the disruptions emanating from the technological, political and demographic upheavals.

John Apruzzese is the Chief Investment Officer of Evercore Wealth Management. He can be contacted at [email protected].

Investing in the Disruptors — and Companies that Avoid Them

by Tim Evnin

Major disruptors, the ones that are changing how we all live and spend, have an important place in our portfolios. So too do some of

the companies that are using disruptive technology to battle competitors. We also think it’s a profitable strategy to look for companies that other investors perceive to be at risk, and have priced accordingly, but that we believe will prove to be survivors.

Two of the big disrupters that are broadly owned in Evercore Wealth Management portfolios are Alphabet, the parent of Google, and Amazon. These companies continue to disrupt entire industries and don’t seem to be slowing down. Just recently, Amazon made a $1 billion acquisition of a private company in the pharmaceutical distribution business. On the announcement, values in other public companies in the pharma retail distribution business declined by a collective $14 billion in a single day’s trading. Google and Amazon continue to grow much faster than many smaller companies, and we believe they still have huge potential.

Technology and pizza seem an odd marriage but Domino’s, a recent addition to many of our portfolios, has over 100 software engineers and is using technology to grow faster than its peers.. Their sophisticated interactive online system allows customers to track their order from making to cooking to delivering on

a real-time basis. It also saves significant manpower costs.

Even brick and mortar retailers can survive and prosper if they play to their strengths and offer something that Amazon or other online only, or predominantly online, competitors cannot. TJ Maxx and AutoZone are two examples. We’ve owned both stocks for some time, but most other investors are just coming again around to TJ Maxx, after the company recently upgraded its growth and profitability forecasts. AutoZone is still in a “show-me” phase, as investors fear that Amazon will destroy their business. However, very little auto-parts business is conducted online and we don’t see signs of that changing anytime soon. We believe AutoZone will continue to grow and hopefully be rewarded by investors for its resilience.

Tim Evnin is a Partner and Portfolio Manager at Evercore Wealth Management. He can be contacted at [email protected].