Independent Thinking®

Disruption and Deflationary Progress

July 30, 2018

Investors are so intent on finding signs of inflation – from accelerating wage growth in a strong economy, say, or rising prices on imported consumer goods suddenly burdened with tariffs imposed in a simmering trade war – that they can fail to see signs of deflation all around them. The population is aging and therefore saving more and spending less; industries are being deregulated; and tax rates have been lowered.

Perhaps the most significant force for deflation is technological disruption: innovation that is so sweeping and powerful as to do away with old ways of doing things and introduce new ones that are vastly cheaper and more efficient. So much in the world today seems new and different, but this sort of thing has happened before. The period roughly between 1870 and 1914, from just after the Civil War until the start of World War I, had an explosion of technological progress so profound that the era is sometimes called the Second Industrial Revolution.

Breakthroughs in communication, transportation and manufacturing were driven by brand-new inventions, including the telephone, radio and internal-combustion engine; improvements in existing ones that helped them to enter widespread use, such as electric lighting, steamships and steam locomotives; and new techniques in engineering and chemistry. These advances helped to create phenomenal economic growth and significantly improved the standard of living in America.

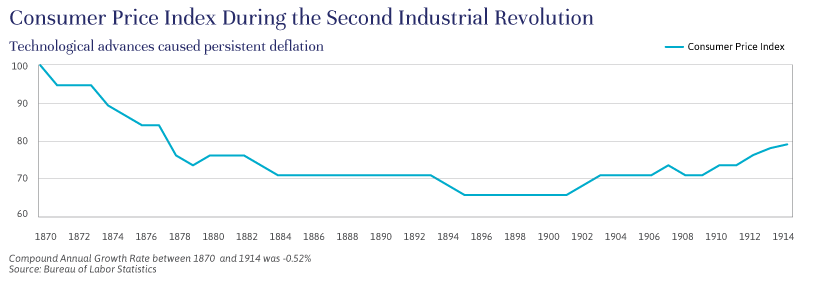

They also created deflation. Between 1870 and 1914, consumer prices were estimated to have fallen by 0.5% annually. (Please see the chart below.) It turns out that significant technological innovation can make goods and services significantly cheaper. The main catalysts for the price declines during this period were efficiencies inherent in much faster methods of transportation and communication – it’s cheaper, faster and easier to send a message via telegraph than on horseback – and enhanced manufacturing techniques, such as mass production using interchangeable parts. These efficiencies made it easier for supply to meet or exceed demand, reducing prices and stimulating new demand that led to a further increase in supply and economies of scale that brought prices down even more.

The ability to do much more for much less money is a signature characteristic of technology that is manifesting across many industries, as John Apruzzese discusses in his article, Investing as Disruption Accelerates. A list of physical items available on a single smart phone (which has more computing power than all of NASA during the Apollo days) provides a striking example of technological disruption and its deflationary impact: books, newspapers, cameras, dictionaries, encyclopedias, road maps, video game players, music players, scanners, computers, televisions and, of course, equipment for making phone calls. The combined cost of all of these items circa 2006 (the year before Apple brought the first iPhone to market) far exceeds the price of an entry-level smart phone today.

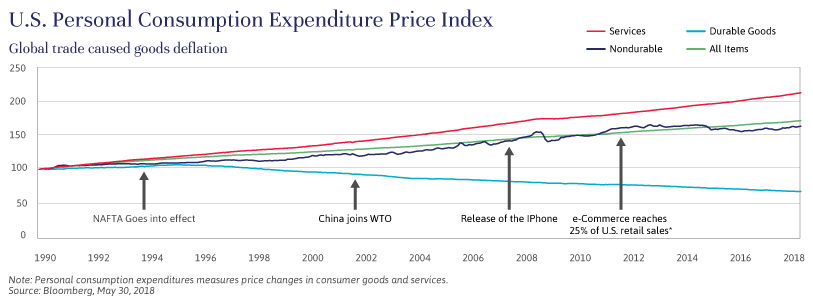

In fact, the price of goods in the U.S. has been stagnant since 1990, thanks to a combination of global trade and technology innovations. While global trade policy is less certain today, the direction of technology remains clear, as indicated by the chart below. Costs in most industries will continue to be driven down by automation and new technology. Driverless and electric vehicles will make transportation cheaper; more efficient use of big data in diagnostics and disease prevention will cut costs in health care; and artificial intelligence and deep learning technologies could push prices down in almost any industry by changing the productivity of labor.

We may not be at the forefront of a third industrial revolution as profound as the second one (or the first), but technological disruption is certainly impacting many industries, with significant investment implications that will affect portfolios now and in the future.

Brian Pollak is a Partner and Portfolio Manager at Evercore Wealth Management. He can be contacted at [email protected].