Independent Thinking®

Stuff Happens: Managing Life’s Major Transitions

January 8, 2019

“You can be young without money, but you can’t be old without it.” Most of our clients would agree with Tennessee Williams on that score, which is why retirement is a major area of focus at our firm. However, it’s important not to lose sight of other, often competing concerns.

Marriage or remarriage, selling a business or receiving a significant inheritance, managing illness, living alone, and changing domicile; these are significant transitions that can shape our future financial lives.

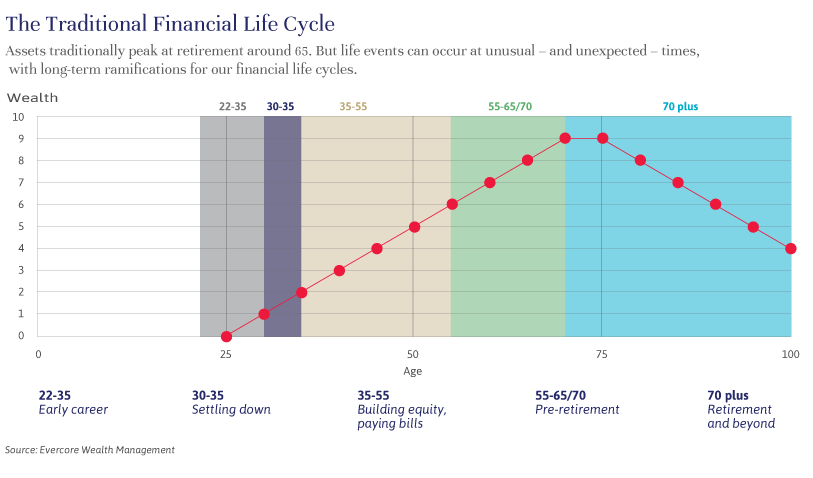

When I was young, I had the idea that experiences like these would occur in an orderly fashion, one event at a time, appropriate to my age. This traditional view still has some merit. However, I’ve long since learned that stuff happens, and when it does, it can leave us reeling.

In my own case, the first stages of my life unfolded predictably enough. College and graduate school debt, my first job and the start of paying down that debt, marriage, a starter home, children and then, happily, the beginning of wealth accumulation. Since our engagement, my wife and I have had rolling plans and matching sets of investment objectives to achieve specific goals.

The first game plan was simple. We contributed as much as we could each year to a tax-deferred profit-sharing plan and allocated it all to growth assets. I also deferred as much of my compensation as I could into growth-oriented company stock plans. At the same time, we started to accumulate some excess cash, which was always invested in short-term fixed income obligations to meet educational expenses and contribute to the cost of the next house. Eventually, the excess cash balance become larger than the deferred income and was invested in a balanced fashion.

The plans were reviewed and adjusted annually to measure progress, and to accommodate changes in our circumstances and in the financial markets. Life was good.

Then, in my late 50s, a curve ball. I was forced to leave my long-term position and had to dramatically recalibrate my wealth plan while I developed a new path forward. That meant taking some investment risk off the table – by selling some equities with minimal tax consequences and at what I hoped were not distressed prices – until I was back on the accumulation track. As it turned out, that put us in good stead, when the track itself disappeared in the financial crisis of 2008-2009.

The subsequent bull market and the creation and success of Evercore Wealth Management has relegated those days into the past, but the lessons learned remain fresh. Transitions don’t always happen when we expect them to, and they often come in multiples. Friends my age have recently been divorced, remarried, and have lost spouses after long illnesses. Others are, more predictably, selling businesses and retiring, changing domicile, managing illness – and often all at once. Our own affairs are relatively calm and our asset allocation is balanced, apart from funds set aside for younger family members, which are invested for growth.

Good wealth planning recognizes that every individual, every couple and every family is unique. We can also learn from each other, sharing our experiences and our best planning and investing practices. As Chris Zander writes in his article, Planning in a Changing Wealth Landscape, we all need to prepare for the what-ifs of changing markets and regulations, considering the real impact of taxes, fees and inflation. We also need to consider the other costs – the physical, emotional, as well as financial – associated with change in our lives and those of the people we care for. Caring for children, elders or a spouse, to take three common examples, can take years of devotion and force some very tough choices.

Our goal is to help our clients manage through life’s progressions, and in particular, during periods of important change. We recommend annual reviews, to adjust to evolving family circumstances and market conditions while staying on track to meet long-term goals.

Jeff Maurer is the CEO of Evercore Wealth Management and the Chairman of Evercore Trust Company, N.A. He can be contacted at [email protected].