Independent Thinking®

Buying for the Long Term

January 8, 2019

Our equity philosophy has been constant over our firm’s 10-year history. It remains firmly rooted in fundamental analysis and focused on portfolios with a fairly small number of positions held for the long term, with few changes. We are committed to finding companies that feature high returns on invested capital, due in large part to managements that are especially thoughtful in how they allocate their capital, and that trade at attractive valuations. The best opportunities occur when there is also a catalyst at the time of purchase that leads us to find a company’s commercial and investment prospects particularly attractive.

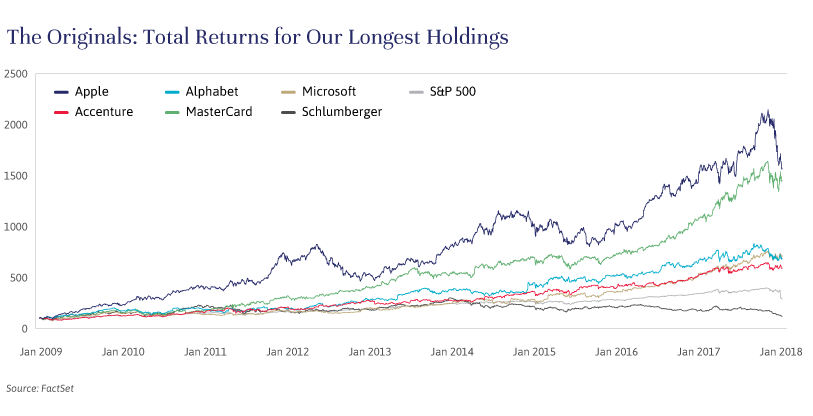

Of our original 30 portfolio holdings, we still own six in most of our client accounts. These six companies, which are listed below, have compounding profits at rates that are well above those generated by the broad stock market. While valuation matters, what contributes more to returns for very long-term investors is predicting with reasonable accuracy the trajectory of the profit growth that companies will deliver.

On average, these companies’ profits have grown at a 13% compound annual rate. This has helped their stocks to produce average total returns– share price appreciation plus dividends – of 23% a year. That compares to profit growth and total returns of 8.3% and 15.1%, respectively, for the S&P 500.

While we hope to own some or even all of these companies at our 15- and 20-year portfolio reviews, we are prepared to sell them, as we have sold many of our other holdings, should their profit growth become harder to gauge or the stocks grow so expensive that the risk/reward balance becomes unfavorable. And we are always on the lookout, with our consistent guidelines, for the next great opportunity that will power our portfolios in the future.

Charles Ryan is a Partner and Portfolio Manager at Evercore Wealth Management. He is also the co-manager of the Evercore Equity Fund. He can be contacted at [email protected].

Accenture, a consulting firm that specializes in technology and media industries, has grown its earnings before interest and taxes, or EBIT, at a 10% compound annual rate over the last 10 years and it has increased its dividend by 18% a year. Its strong growth has helped to push the stock up more than 20% a year.

Apple’s EBIT growth has been compounding at 25% a year since 2009. The company started paying a dividend in 2012 that has grown by 21% annually.

Alphabet, the parent company of Google, has seen its EBIT grow fivefold over the 10-year period, or 19% a year.

MasterCard, one of the two giant payment card companies, has experienced profit growth of 15% a year for the past 10 years as consumers spend more on cards, with earnings per share growing at an 18% annual rate.

Microsoft has demonstrated more modest profit growth over this period, at 7% a year, but its free cash flow per share – a measure of how much operating profit is left after accounting for long-term business investment – has doubled, and the dividend has tripled.

Schlumberger, an energy-services company, is the worst-performing tenured holding in the portfolio. It has struggled to consistently grow its EBIT, as capital spending by its customers, on which Schlumberger’s performance depends, has been inconsistent. This has left its share price essentially flat over the last decade. While its returns have lagged those of the broad market, the stock has still generated single-digit growth since inception.