Independent Thinking®

Encouraging Next-Generation Success

May 3, 2019

The charm of anticipated success. That’s how Alexis de Tocqueville described the American spirit, 200 years after John Winthrop laid out his vision to fellow colonists and about 100 years before a historian coined the phrase “The American Dream.” The belief that everyone in this country deserves a chance to climb resonates around the world.

Our clients are testaments to that potential. Ralph Schlosstein recounted at our recent Palm Beach event (summarized on page 20) his journey as the child of refugee parents through childhood jobs and a public school education to co-founding BlackRock and becoming the CEO of Evercore. Other stories are less dramatic, of course, but they often illustrate a similar spirit.

Many of us now worry that younger generations will not enjoy similar trajectories, in monetary terms, and perhaps in other ways as well. Economic growth just about everywhere is slowing, as John Apruzzese observes in his article, Prospering in a Low-Growth World, and there is plenty of evidence that upward social mobility is too. Not only is it harder now to achieve more than your parents, the chances of falling short seem greater.

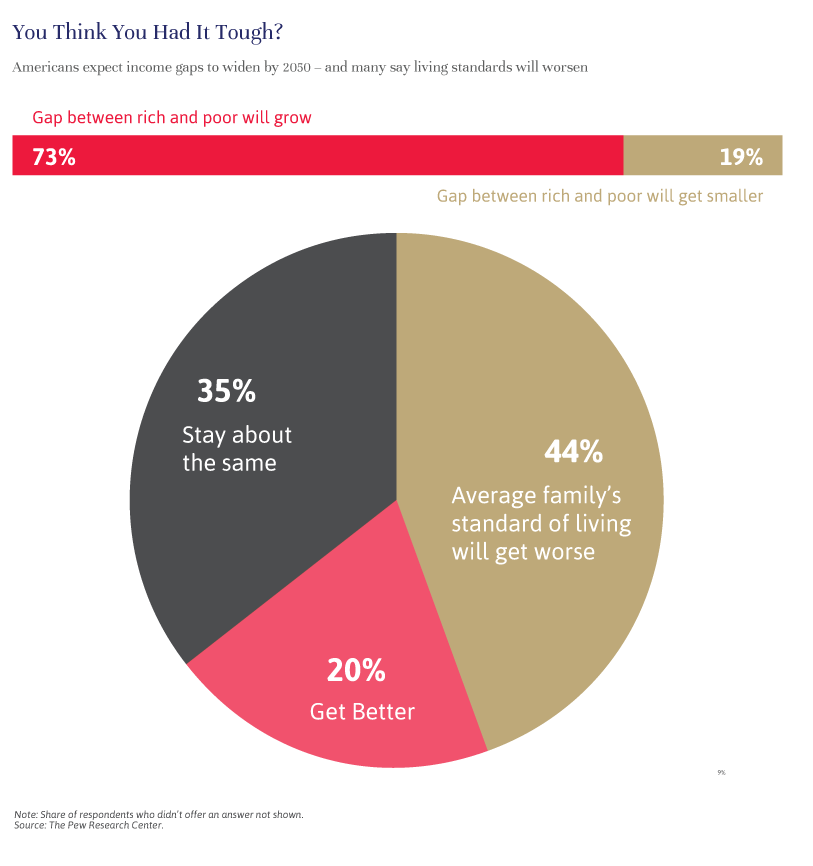

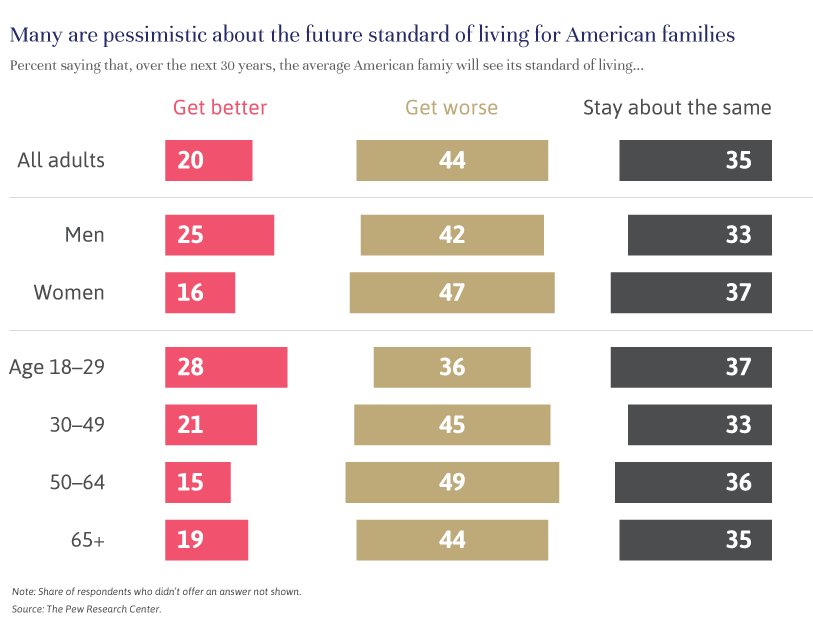

The Pew Research Center reports that Americans now have a more pessimistic view of future success for their children.1 Indeed, the largest proportion of respondents (44%) believe that the average family’s standard of living will decline over the next 30 years. Only half that number believe it will improve. For high net worth and ultra high net worth families, our clients among them, this concern is compounded by the relatively high starting point: The children of the affluent may reasonably perceive more scope to fall than to rise.

How can we help? As a wealth advisor, and as a parent and grandparent, I know enough to know that I don’t know the full answer to that question. Every family, and every relationship within that family, is unique; what was right for my children, or for Ralph’s children, may not be right for others. Broad guidelines and shared experiences may help, however, so here are a few suggestions.

Reframe success. Americans generally tend to describe success in monetary terms. And it’s true that career success often comes hand in hand with financial success – but not always. Few doctors, for example, can count themselves among the top 1% of American earners; the average doctor’s salary is now about three quarters of that threshold.2 But how many of us would discourage our children from becoming doctors? Teachers and charity workers are rarely paid much at all, but the really successful ones change the world.

Share the values that drove you. Hard work, optimism, goal-setting: These are the underlying qualities that we want to instill in our children, to support them in whatever they choose to pursue.

Share perspective: Children should understand that they are fortunate to live in an affluent environment. They should have a good idea as they get older of what things cost and how their experience to date is different from those less fortunate, as well as from those with more. If charity is important to you, make sure your family understands why and what you hope to accomplish with your time and resources.

Provide a great education. Just how you go about that and how long you are willing to underwrite an education is a personal choice. But just about all of our clients seem to believe that education is essential for future success, especially in an economy that increasingly favors the very well educated.

Prepare your children for independence, for their own sake and yours. It is important for children to know that the affluence their family now enjoys may not be available to them when they are on their own, through our choice, our necessity, or a mixture of both. As Ashley Ferriello writes here, longer lifespans mean that even ultra high net worth families risk running down their assets in their lifetimes. With thoughtful guidance and a broader application, the “charm of anticipated success” can still drive a life well lived.

Jeff Maurer is the CEO of Evercore Wealth Management and Evercore Trust Company, N.A. He can be contacted at [email protected].

1 Pew Research.

2 Medscape: The average salary of a doctor in the United States is $298,000. https://www.medscape.com/slideshow/2018-compensation-overview-6009667#1