Independent Thinking®

Gifting: Time to Accelerate Plans?

August 1, 2019

Giving away thousands, even millions, of dollars may be money well spent. Strategic gifting in the current tax climate can minimize federal and state transfer taxes, maximize the transfer of wealth to future generations, and protect family assets.

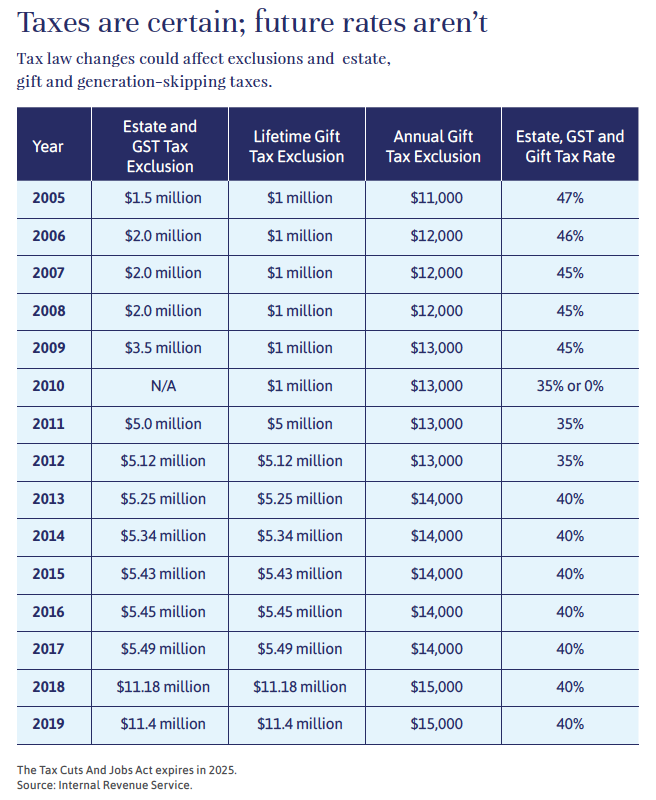

Readiness – of donors to make gifts, and recipients to receive and/or inherit – is the biggest caveat in making sizable gifts, and the subject of a number of articles in Independent Thinking. Our focus here is on timing. The elections next year may pave the way for new tax legislation that could reduce the current $11.4 million basic exclusion amount, the maximum an individual can gift free of federal estate and gift tax ($22.8 million for married couples). Tax law changes could also affect federal estate, gift and generation-skipping taxes, which are currently set at a 40% rate.

It’s worth noting in 2005 the lifetime gift tax exclusion and estate tax exclusion amounts (not yet unified) were just $1 million and $1.5 million, respectively, as illustrated in the chart here.

In any event, the current $11.4 million exclusion amount is scheduled to expire on December 31, 2025, when it will revert to $5 million, plus adjustments for inflation. The IRS has promised that individuals making gifts and taking advantage of the current exclusion amount will not be adversely impacted after 2025. In other words, there won’t be a clawback.

So, for those considering making lifetime gifts in excess of $5 million, the tax cost of mistiming the gifts could be substantial. Every million dollars not sheltered by exclusion will be subject to a $400,000 federal transfer tax (at current rates). An $11 million gift made today would not result in any federal gift tax. That same gift made in 2026 (or possibly sooner should the political landscape change post-election) could result in a tax exceeding $2 million. Further, since all future growth on gifts occurs outside of the estate and is therefore not subject to estate tax at the donor’s death, the real benefits for future generations is potentially far greater still.

In addition to the basic exclusion amount, a number of other current IRS gift tax exclusions should be considered in planning for optimal transfer tax efficiency. These include the annual gift tax exclusion, the gift tax medical exclusion, and the gift tax educational exclusion, each defined in the section titled, The Fundamentals: Other Gift Tax Exclusions.

Through the use of trusts, many of these gifting exclusions can be enhanced to provide further asset protection and/or allow the grantor to dictate how and when gifted funds are eventually spent by the recipient. In addition, valuation discounts may be used when gifting minority interests to compensate for their lack of marketability and control. Assets gifted during the grantor’s lifetime will lose the benefit of the step-up in basis at death, so careful consideration should always be given to the acquisition cost and nature of the gift (whether cash, stock, real estate, business interests, forgiveness of debt or privately held securities).

Let’s consider the options available to the Piras family, a couple with two adult daughters, one married with two children and the other single. The family recently moved to Florida from New Jersey, so state transfer taxes are not an issue, thanks to Florida’s favorable tax regime. They have a net worth of $40 million, most of which is concentrated in a rapidly appreciating private family business that they intend to eventually sell. Maximizing the amount they pass to their descendants is a priority, but relinquishing control prematurely is a concern.

The parents chose to fund a Dynasty trust to capitalize on the historically high exclusion amount and to optimize wealth transfer to future generations. They funded the trust with non-voting shares in their family business, which enabled them to retain control and benefit from a valuation discount. The trust was drafted to allow the parents to pay the income taxes it generates, even as the beneficiaries receive the income. If the business is sold while the parents are still living, they can pay the capital gains taxes on the sale proceeds. Alternatively, a mechanism in the trust agreement will allow them to opt out and let the trust pay the taxes. A properly drawn Dynasty trust can be extremely flexible and tax-efficient can and serve the family for generations.1

In addition to the Dynasty trust, the parents established Crummey trusts for their grandchildren, which will be funded each year with annual exclusion gifts. Crummey trusts have a temporary and limited withdrawal feature that allows the gifts to qualify as a present interest. Without that provision, the gift amount would chip away at their basic lifetime gift tax exclusion amount.2

Readiness should be the determining factor in making a substantial gifts, a subject that can be discussed in depth with trusted advisors. Families that are truly prepared may wish to accelerate their wealth transfer plans, given this tax and political environment.

Ross Saia is a Managing Director and Wealth & Fiduciary Advisor at Evercore Wealth Management and Evercore Trust Company, N.A. He can be contacted at [email protected].

The Fundamentals: Other Gift Tax Exclusions

In addition to the basic exclusion amount, the Internal Revenue Service provides for a number of other gift tax exclusions. Here are three of the most useful:

Annual exclusion:

Grantors can give $15,000 per year ($30,000 per married couple) to any individual in 2019 without gift and estate tax implications. For individuals who anticipate having a taxable estate, annual exclusion gifting to family members is a simple and often remarkably effective way to maximize the amount of wealth passed to the next generation. If relinquishing control is a concern, a properly drafted trust can effectively meet the present interest eligibility requirement, as well as offer the grantor control limitations.

Medical exclusion:

Payments made directly to an institution that provides medical care to an individual, or to a company that provides medical insurance to an individual, qualify for the unlimited medical gift tax exclusion. To maximize this opportunity, grantors can pay all qualifying medical expenses and medical insurance premiums for descendants. The unlimited medical exclusion does not apply to amounts paid for medical care that are reimbursed by insurance, or for most forms of cosmetic surgery.

Educational exclusion:

Payments made directly to a qualifying educational organization as tuition for the education of an individual qualify for the unlimited gift tax exclusion. (See the article by Ashley Ferriello, titled 529 Plans and the Alternatives.) To maximize this opportunity, consider directly paying all tuition expenses for children and grandchildren. As is also the case with the medical exclusion, the tuition exclusion does not impede an individual’s ability to take advantage of the annual exclusion and gift $15,000 per year. The IRS has also approved prepaying tuition for future years, as long as the prepayments were not subject to refund. Books, supplies, dormitory fees, board or other similar expenses that do not constitute direct tuition costs are not included.

Families should consult their Evercore Wealth Management and Evercore Trust Company, N.A. Wealth & Fiduciary Advisors to discuss these and other planning options. – RS

1A Dynasty trust is a long-term trust created to pass wealth from generation to generation without incurring transfer taxes for as long as the assets remain in the trust. Properly designed, it can last for many generations, theoretically forever.

2A Crummey trust can take advantage of the gift tax exclusion when transferring money or assets to another person, while retaining the option to place limitations on access to the money.