Independent Thinking®

Modern Monetary Theory and a Free Lunch

August 1, 2019

As deficits expand, driving up government debt in the United States and elsewhere, a radical theory is gaining traction in Washington, including among members of Congress, even as mainstream economists dismiss it as unfeasible or downright dangerous. Modern Monetary Theory, or MMT, is built on one big idea: Large government deficits, even to levels long considered lethal to a stable, prosperous economy, are not only benign but beneficial.

MMT was considered a macroeconomic sideshow a few years ago. But with recent attention and advocacy from the progressive wing of the Democratic Party and its highest-profile member, the freshman Congresswoman Alexandria Ocasio-Cortez, it is an idea on the rise, and one we expect to gather momentum as the 2020 election cycle hits its stride.

The idea has attracted scorn in other circles, however. Financial luminaries as diverse as Warren Buffett, the New York Times columnist and Nobel economics laureate Paul Krugman, and Lawrence Summers, who served as Treasury secretary under President Bill Clinton, have written or spoken negatively about it. During Senate testimony earlier this year, Jerome Powell, the Federal Reserve chairman, dismissed MMT as “just wrong.”

So what is this economic theory that is generating so much attention and polarization? MMT’s adherents contend that any country that issues its own currency and maintains full control over it (that would include the United States and exclude members of the eurozone and jurisdictions such as China, which pegs the value of its currency to the dollar) need not worry about large deficits or debt loads unless they cause excessive inflation. This thinking quickly leads to the notion that government spending should not be constrained by concerns about how to pay for it. If the deficit becomes too large, a country that controls its monetary policy can print money to fund it or to cover the interest on its outstanding debt. Again, it can only print money without risk as long as inflation stays under control, but it will, according to the theory, unless both the public and private sectors spend too much at the same time; printing money will not cause inflation in and of itself. The role of the U.S. dollar as the global reserve currency – the one used for substantial amounts of international trade and borrowing – gives the United States even more flexibility to run up deficits, according to MMT proponents.

Faith in MMT also is rooted in the notion that every dollar of government spending, while creating a deficit on the public ledger, ends up creating an extra dollar for consumers. It then follows that government spending creates prosperity. As politicians are happy to tell voters that they can have their cake (unlimited spending, in this case) and eat it, too (without consequences), we wouldn’t be surprised to see growing interest in this idea.

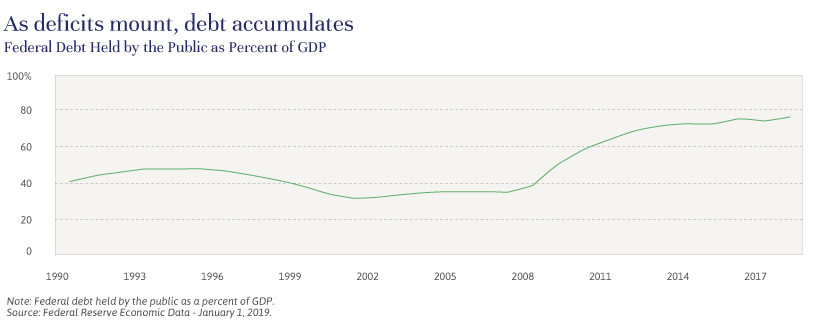

But can it work? In many ways, with deficits mounting and debt accumulating relentlessly and rapidly since the turn of the century, the government is already pursuing a form of MMT. In the 10 years through the first quarter, the fiscal debt has expanded to 77% of gross domestic product from 39%, according to the Federal Reserve Bank of St. Louis. The deficit has ranged from 2.4% of GDP to nearly 10% over that span. As John Apruzzese discusses in his article, Delayed Impact: the U.S. Deficit and Investors, although Democrats and Republicans have very different ideas of what the government should spend money on, they now appear to agree on the viability of perpetually large deficits.

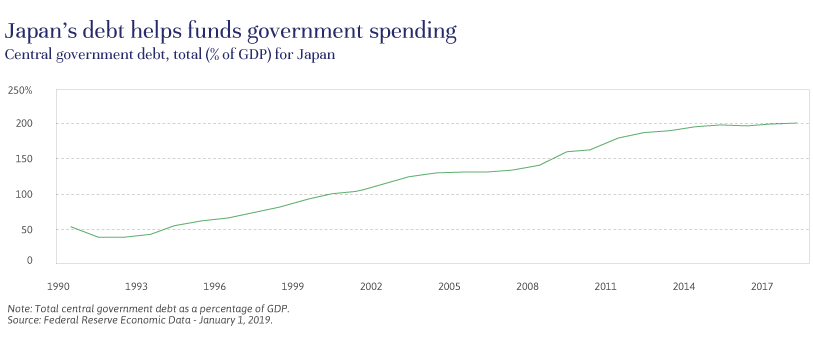

If the U.S. economy is heading in the direction laid out by MMT, it’s Japan that seems to have blazed the trail. The theory’s principles mesh quite well with the extraordinary amounts of borrowing and money creation Japan has used to fund the high levels of spending required by its aging population and shrinking labor force. Chronic deficits have driven the ratio of debt to GDP in Japan to nearly 200%, according to the World Bank, up from about 82% 20 years ago.

Japan is proof that egregious debt loads to fund government spending can be sustained for much longer than traditional economic theories predicted, at least in an advanced economy with a highly educated population and a high standard of living. Whether it will continue to work remains an open question, of course. At some point, the market may lose faith in Japanese government bonds or JGBs. Japan does not suffer from inflation, a condition that erodes the value of bonds when it flares up, but its economy is afflicted by the potentially more virulent scourge of deflation. While an aging population and a shrinking labor force are certainly factors, some economists blame the high debt loads as the primary cause of both deflation and anemic economic growth.

The stagnation has depressed Japanese equity markets, which have had an annualized total loss of about 0.5% over 30 years, underperforming JGBs. Far from suffering under the massive debt, JGBs have benefited from deflation and carry negative yields (people actually pay money to own them). But JGB holders may decide – in what might be taken as ominous foreshadowing for holders of U.S. Treasury bonds – that Japan’s extreme fiscal indebtedness makes the paper too risky to own without receiving higher yields in compensation.

The United States is not Japan. It has a much more dynamic economy, better demographic trends, and an unmatched history of creativity and innovation in business and technology. The U.S. dollar is unlikely to surrender its position as the global reserve currency, either, as each contender – the euro, yen, pound and Chinese renminbi – has limitations of one sort or another. The United States retains a privileged position because foreign governments and companies continually need its dollars, which helps fund the ever-growing fiscal debt.

And yet, the U.S. dollar has not always been the reserve currency. It replaced the British pound in the 1940s and will probably be replaced one day by something else. Washington’s unceasing profligacy, spending vast sums of money it doesn’t have, likely hastens that day.

MMT is alluring. Spending well beyond the country’s means has produced no negative consequences in this economic cycle. So why not keep doing it, and then some? After all, loss of faith in the U.S. economy and the U.S. dollar is not imminent, and is only likely to occur gradually over decades. The reason is that a precise tipping point is impossible to anticipate. An explicit MMT policy, imprudently implemented, could accelerate an erosion of confidence with little warning, depressing growth and market returns, leaving a severely indebted and enfeebled economy that may no longer respond to traditional methods of reviving it. As with other promises of something for nothing, the benefits of MMT, should it ever be fully converted from theory to practice, are likely to be far less than its advocates expect, and they could come at a prohibitively high cost. There really is no free lunch; someone always brings the bill.

Brian Pollak is a Partner and Portfolio Manager at Evercore Wealth Management. He can be contacted at [email protected].