Independent Thinking®

529 Plans and the Alternatives

August 1, 2019

As the cost of an education at a private college continues to outstrip inflation1, funding a 529 plan can make good sense. However, investors will want to first examine both the tax advantages and the constraints, as well as the alternatives.

A 529 plan is a state-sponsored education savings account. Contributions can be invested, and earnings growth is free from federal and state taxes to the extent that proceeds are used toward qualified college expenses. (Some states now also allow up to $10,000 per year toward K-12 tuition.) While contributions are not federally tax deductible, several states offer a full or partial tax deduction when a donor uses an in-state plan.

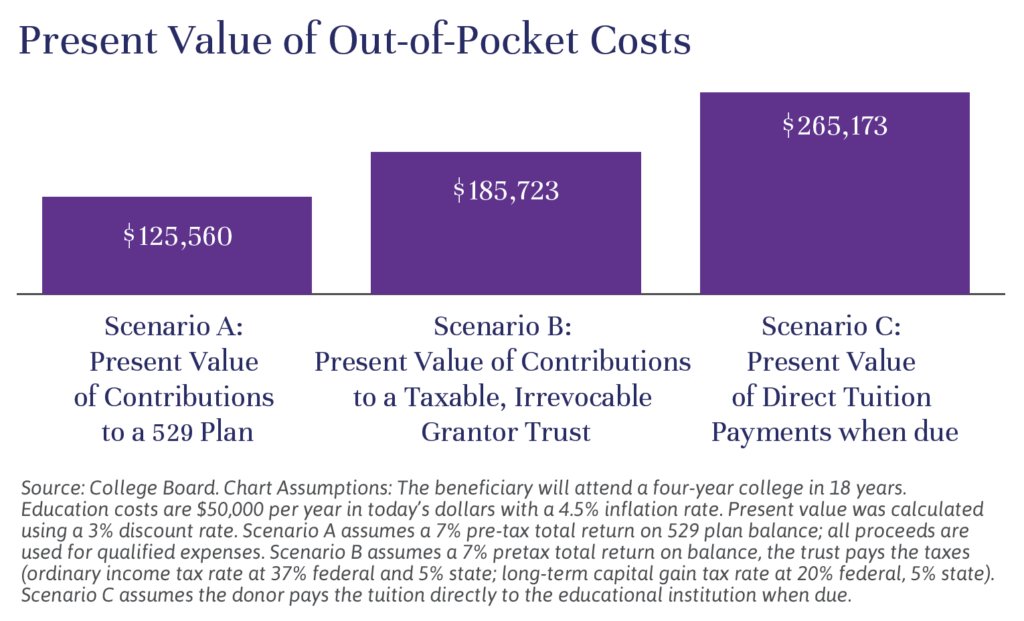

Let’s consider three options for parents, grandparents or others who wish to set aside funds for a child’s education: funding a 529 plan early; creating and funding an irrevocable grantor trust; or paying the tuition directly when payment is due under the unlimited educational gift tax exclusion.

FUNDING A 529 PLAN

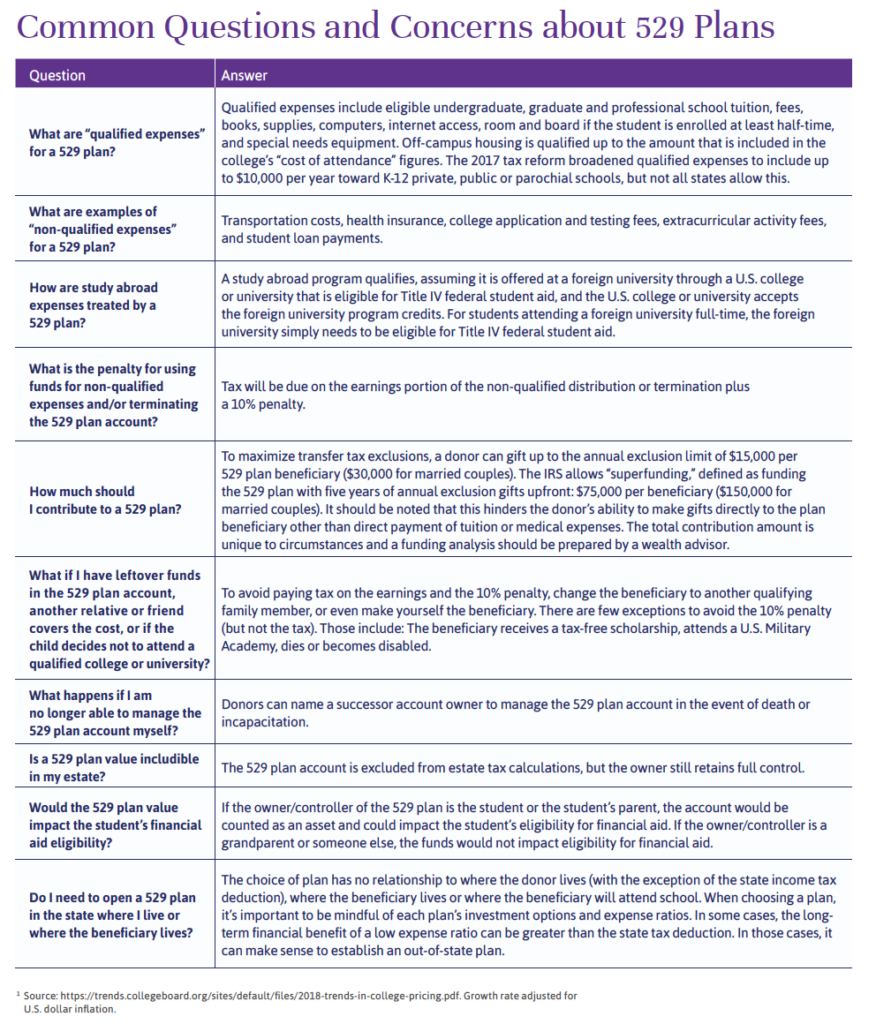

Pros: The tax benefits can be considerable. In addition, the IRS allows investors to frontload the account by contributing five years of annual exclusion gifts upfront ($15,000 per year, per beneficiary, for a total of $75,000 per beneficiary; married couples can fund up to $150,000). While this type of gift hinders the donor’s ability to make annual exclusion gifts to the plan beneficiary over the next five-year period, there can be emotional value in segregating savings for such a large, looming expense. The donor retains control over the 529 plan account; the investment fees are generally pretty low; and any excess funds can be redirected to another family member beneficiary.

Cons: The tax benefits only work if the beneficiary goes to college and has qualified educational expenses (see chart below for specific details). Otherwise a tax on earnings and a 10% penalty are due on withdrawals. Further, investment options can be somewhat limited, depending on the plan.

FUNDING AN IRREVOCABLE GRANTOR TRUST

Pros: This approach can offer access to more investment opportunities, as well as the flexibility to apply funds to educational or non-educational purposes, as stipulated in the trust agreement, thereby avoiding the potential penalties otherwise due in a 529 plan arrangement. Grantors often choose to leverage the gift by paying taxes on behalf of the trust, which allows the trust assets to compound tax-free to support the current beneficiary or grow for the next generation. An irrevocable trust can also provide asset protection for the beneficiary. The trust term can last as long as the donor specifies subject to state law requirements.

Cons: Irrevocable trusts have administrative costs; the trust terms cannot be changed or revoked; and the investment income and gains are taxable.

PAYING THE TUITION DIRECTLY

Pros: This can make sense for those who wish to maximize the use of their estate tax exclusions. Some individuals may choose to make annual exclusion gifts to a trust or other savings vehicle during a beneficiary’s life and make direct tuition payments when due under the unlimited educational gift tax exclusion. (It’s important to note that 529 plan contributions do not qualify for the unlimited educational gift tax exclusion.) This approach allows for additional tax-free wealth transfer, as well as flexibility over investments and expenses.

Cons: There can be financial and emotional risks in not pre-funding education costs.

Education funding is not a one-size-fits-all solution. Thoughtful consideration and planning should address each family’s unique circumstances.

Ashley Ferriello is a Managing Director and Wealth & Fiduciary Advisor at Evercore Wealth Management and Evercore Trust Company, N.A. She can be contacted at [email protected].

Homework for Young Adults:

Some important paperwork comes with adulthood. In addition to registering to vote and, for males, registering for Selective Service, young adults age 18 and over – and their parents – should consider creating the following documents before leaving home.

- Health Care Proxy: In many states, parents do not have the legal right to make health care decisions for their children once they are 18 years old without going to court. Consider drafting a health care proxy in order to appoint parents, a family member or a close friend to make medical decisions for the student should he/ she become incapacitated or otherwise unable to make those personal decisions. Be sure to include HIPAA authorizations as applicable.

- Power of Attorney: As above, many parents will be limited on what they can do in terms of legal and financial decisions for their child once they are 18 years old. Consider drafting a power of attorney in order to appoint an agent to step in.

- Family Educational Rights and Privacy Act of 1974 (FERPA) Form: FERPA is a federal law that protects student education records. Once the student is 18 years old, even if the parent continues to pay for the education, the school is not required or allowed to release the grades or other educational records to parents. Adult children and their parents can consider filling out the particular school’s form to allow the parents access to the records.

1 Source: https://trends.collegeboard.org/sites/default/files/2018-trends-in-college-pricing.pdf. Growth rate adjusted for U.S. dollar inflation.