Independent Thinking®

Bridging the Disconnect: The Markets and the Economy

July 6, 2020

How is it possible that the stock market is so resilient? Approximately 20-30 million Americans are out of work, and both COVID-19 and social unrest continue, but the S&P 500 recovered from a historic shock within a month.

As remarkable as it may seem, we believe that the index is still reasonably priced. The aggregate valuation of the five most highly capitalized companies – Microsoft, Apple, Amazon, Alphabet (the parent of Google), and Facebook – is $5.6 trillion, or about 20% of the S&P 500. They are major beneficiaries of powerful and, with the COVID-19 response, now rapidly accelerating trends: internet and mobile device usage; online shopping; virtual communications; cloud computing; online advertising; and work-from-home technology. As a result, the expected growth rate of their combined revenues is 12% for this year and accelerating to 15% for 2021.

Four of the five tech giants are among the most profitable companies that have ever existed (Amazon, which is the only employee-intensive company, has a low profit margin in its core online retail business, so it effectively trades profits for growth). All have robust balance sheets with no net debt, and a combined cache of $464 billion in cash. They are continuing to fund future growth, spending a collective $116 billion in research and development in just the past year. That’s in addition to the billions of dollars spent on acquisitions that allow them to capture the latest innovations around the globe and, in some cases, eliminate competition. They also benefit from the network effect – gaining market power exponentially as they grow.

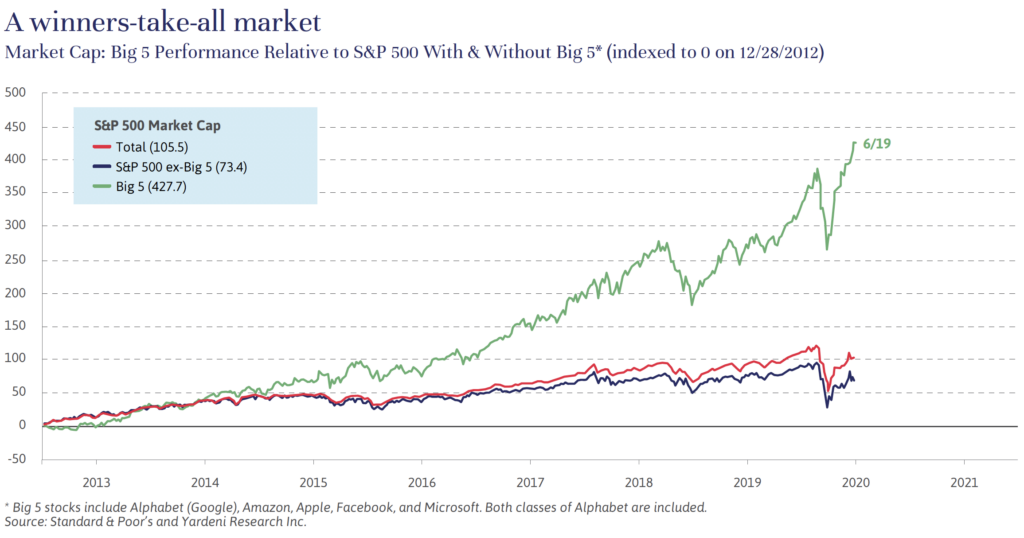

In short, the five are the winners in their respective winners-take-all markets. Take a look at the chart (above), which shows the rise of these companies relative to the broader S&P 500 index – and what the index would look like without them. Behind the big five are similar technology companies, including Netflix, that as a group make up another 10% of the S&P 500 index. The sector, together with the healthcare companies and other large companies that provide essential goods and services that have not been adversely affected by the COVID-19 crisis, represents about 50% of the S&P 500. (About 58% of Evercore Wealth Management core equity portfolio is made up of companies that currently have been either unaffected by the crisis or have benefited from the response.)

It’s another picture entirely for travel and entertainment, sports, sit-down restaurants, personal care/service and elective healthcare businesses. These companies employed over 30 million people in the United States before the pandemic, but the large public companies among them represent less than 10% of the S&P 500 by market capitalization. Those that are doing well can attribute at least part of that success to technology, such as the ability to receive online orders and serve customers stuck in their homes. In contrast, Alphabet, Apple, Facebook and Microsoft together employ just about 400,000 people; of the big five tech companies, only Amazon is a significant employer, with more than one million people.

It’s clear to us that the stock market weighted by market cap does not reflect the broad economy. Less clear is whether the technology giants are now too expensive. At 5.5 times aggregate revenues of $1 trillion this year, they certainly are not cheap. In the past year they collectively generated about $186 billion in free cash flow, of which $28 billion was paid out in dividends and $124 billion spent on stock buybacks. So the free cash flow yield is about 3.3%, and the yield on cash returned to shareholders from the dividends and stock buybacks is about 2.7%, with a reasonable probability that these numbers will grow at an annual rate in excess of 10% for the foreseeable future.

The five now have a higher valuation than before the crisis because their business fundamentals have actually improved as a result of the crisis, with accelerating revenue growth and steady or improving margins. The crisis has also resulted in significantly lower long-term interest rates – the yield on the 10-year Treasury has dropped from a range of 1.5%-2% before the crisis to 0.6%-0.9% now. Long-term inflation expectations have also fallen to well below 2%. Low inflation and low interest rates put a higher value on future cash flow, which pushes up equity valuations.

No company will be immune to the consequence of a long-term shutdown, of course. If current restrictions were to extend for multiple quarters or be reinstated, the resulting economic damage would begin to affect even the big five technology companies through, for example, reduced advertising revenue for Google and Facebook and fewer iPhone purchases. At present, however, the market is betting that the economy is going to reopen fast enough for most of the currently unemployed to get back to work before the more than $2 trillion of fiscal stimulus runs out. Certainly, that is the hope.

We continue to own Apple, Alphabet, Amazon and Microsoft, with our total portfolio weighting for the four companies about equal to the 20% weighting of all five stocks in the S&P 500 index, although the composition of individual portfolios varies. We do not own Facebook because we believe it has the most regulatory risk, and we are not comfortable with its governance structure.

There is still plenty of uncertainty in the markets, given the unprecedented nature of the response to the health crisis and the other issues roiling the country. Our core equity portfolio is part of our total asset allocation, which has been adjusted to reflect changes in the economy, and tailored within individual portfolios to meet each client’s long-term goals and risk tolerance.

John Apruzzese is the Chief Investment Officer of Evercore Wealth Management. He can be contacted at [email protected].