Independent Thinking®

A Time to Diversify: Reassessing the 60/40 Portfolio

October 29, 2020

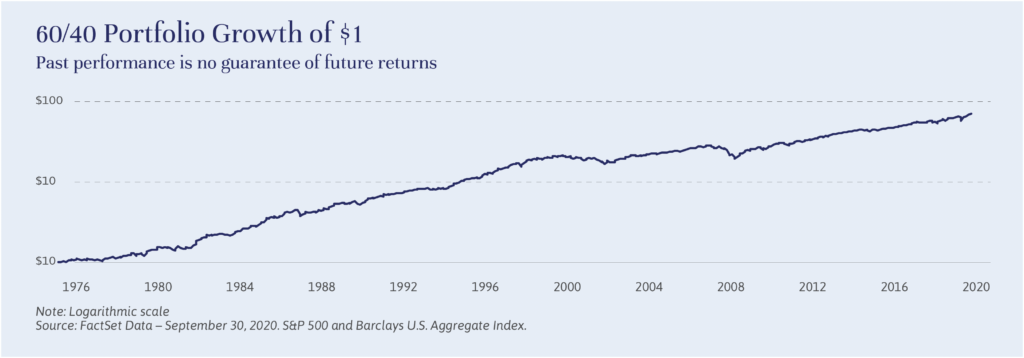

For as long as most investors can remember, portfolio construction has started with a 60% allocation to equities and a 40% allocation to bonds, with adjustments then made for those looking for more capital appreciation or preservation. This classic balanced portfolio worked well, with each asset class partially offsetting the periodic downturns of the other to generate a combined annualized return of 10.0% (see chart) since the Barclays U.S. Aggregate benchmark index was established in 1976.

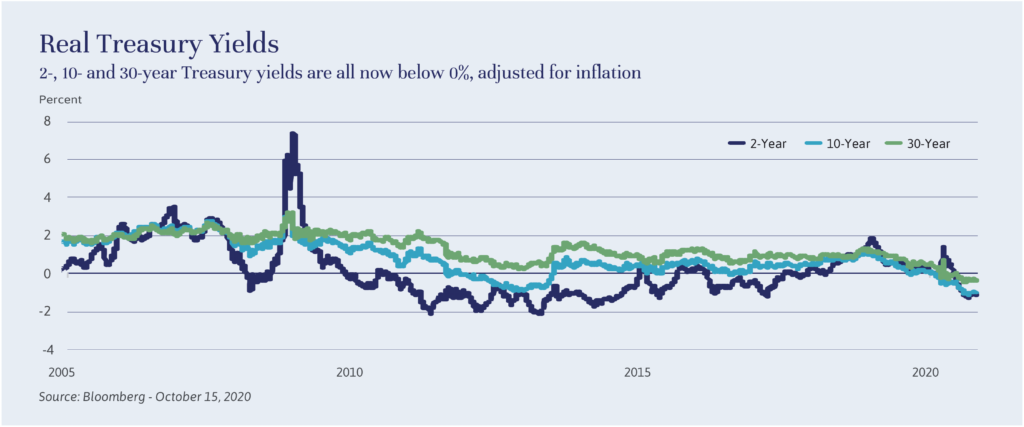

That was then. Now, investors need to reconsider the 60/40 portfolio. Apart from the extremes of the stock market, with some companies trading at heights difficult to justify and others at very justifiable lows (click here to view), the case for equities as the largest allocation in a balanced portfolio remains reasonable. But short-term bonds are not providing investors with adequate yield (or total return opportunities), and long-term investment-grade bonds can no longer provide much of a hedge against equity price volatility while their yields are pinned down to historically low levels by the Federal Reserve.

It seems to us that investors have to come to terms with the fact that bonds and other defensive assets (including cash) are likely to generate a negative real return (or a return that is less than the rate of inflation) over the next two to three years. This leaves us with three options. First, we can accept that hedging risk assets with an allocation to risk-free or defensive bonds now has a cost in real terms, not just an opportunity cost. Second, we can increase the allocation to growth assets and, with it, the overall portfolio risk. Or, third, we can increase the allocation to other asset classes, notably credit strategies, diversified market strategies and illiquid assets, while retaining some allocation to bonds.

For most investors, this third option is likely to prove the best bet. We believe there are still good reasons to invest in bonds (see chart below), albeit around the 20% or 25% level, for a balanced portfolio that we have been recommending for some time (now at the lower end of that range). But we believe that diversification beyond traditional stocks is as important as it ever was. To achieve it, we are focusing on three areas:

Growth diversifiers: This area of the portfolio is meant to complement the equity allocation by providing attractive, equity-like returns along with equity-like risks, albeit illiquid. Examples of these investments include private equity, venture capital and real estate, providing exposures difficult to attain in the public capital markets.

Pure diversifiers: Here we attempt to identify asset classes in which the return stream itself is uncorrelated to traditional markets and typically returns 3%-5% above the risk-free rate of return. Either passive or active investment vehicles, in either mutual fund or limited partnership/hedge fund structure, may be appropriate. Examples include the uncorrelated, such as catastrophic reinsurance risk; solar infrastructure development; dollar hedges, such as cryptocurrency investments or precious metals; and alpha-focused investments, such as market-neutral long/short hedge funds or option arbitrage strategies.

Income diversifiers: The main goal here is to find investments that provide higher yields than traditional high-quality bonds, but do not take on imprudent levels of risk. Liquid credit markets, such as corporate high-yield bonds and secured loans, high-yield municipal credit and securitized consumer and real estate credit, are candidates. In addition, private market investments with high levels of consistent income also present opportunity. These investments, such as triple net lease real estate and corporate or real estate direct lending, fit somewhere between traditional equities and bonds in terms of both risk and return, but provide important diversification if chosen prudently.

This larger allocation away from defensive assets does increase the overall portfolio risk and is generally less tax and fee efficient, but that difference in risk should be marginal if the individual investments are selected carefully and are well diversified, and if the total return is high enough to overcome the higher tax rate. The 60/40 portfolio has worked well for decades and could continue to do so in decades to come. But with the current yields on bonds below the rate of inflation, we believe that rethinking the allocation to high-quality fixed income in favor of other assets, for at least a portion of the portfolio, makes sense now.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management; he can be contacted at [email protected].

Brian Pollak is a Partner and Portfolio Manager at Evercore Wealth Management; he can be contacted at [email protected].

The Case for a Continued Allocation to Bonds by Brian Pollak

How do we justify owning bonds as a core (approximately 20%) holding in our balanced portfolio in this environment?

In uncertain times, allocating a portion of the portfolio to securities that have certain cash flows – between semiannual coupon payments and known maturities – and a yield above that of cash supports overall portfolio construction. Active management is essential in this environment, to control for interest rate and inflation risk in portfolios by keeping duration risk relatively short, investing in high-coupon or callable bonds to speed up return income and shorten duration, and reinvesting principal and semiannual income from maturing bonds at higher rates.

While the hedge that bonds provide has diminished, longer duration bonds can still provide a hedge if interest rates turn negative – and this could happen if Fed policy moves interest rates negative on the short end or if market expectations of longer-term deflation push market rates to negative territory. While these scenarios at present don’t strike us as likely, they are possibilities.

The additional yield available to investors over and above the yield on Treasuries, while still below the rate of inflation, is attractive on a relative basis. Due to COVID-19 related credit concerns, municipal bonds yields currently yield 128% of the Treasury yield. This yield has averaged around 94% over the last 20 years. When additionally adjusting for top federal and state income tax rates, the yield that can be achieved in a high-quality municipal bond portfolio is more than double the yield available in Treasury securities in the intermediate to longer part of the curve. If income tax rates were to rise, the value of the tax exemption provided by municipal bonds would increase. This could compress the ratio between high-quality municipals and Treasuries, and is another reason municipals offer relative value today. For more on how a portfolio of municipal bonds fits into the overall asset allocations in this environment, click here.

Finally, the high liquidity and low volatility inherent in bonds provides investors with the framework to ride out drawdowns in the equity market with the knowledge that a portion of the portfolio is safe and liquid – and the confidence to stay invested in, or even add to, equities when prices are falling.