Independent Thinking®

New York City: Love It or Leave It?

June 24, 2021

Editor’s note: This article is extracted from a recently published paper. Click here to read the paper in full.

There are as many opinions about the future of New York City as there are New Yorkers. The city, which was the early U.S. epicenter of the pandemic, is now the focus of discussions around the future of urban life.

Some have voted with their feet; others are certain that the city’s best days are ahead. From a fiscal point of view, the future of the largest municipality in the United States matters to investors well beyond the five boroughs. The key will be to distinguish between short-term disruptions and lasting change.

While full out-migration patterns to date are in line with previous moves, there is still potential for a permanent – and negative – shift. The trend to remote work has coincided with improved communications technology and a significant demographic shift as two giant population groups, Millennials and older Baby Boomers, transition to family and retirement life, respectively, and from the costs and other stressors of high-density living.

In addition to migration out of the city, and the considerable related existing and potential revenue implications, the city’s fiscal health will represent a big challenge for the next mayor (who will be elected in November). So too will public safety and the new awareness in all quarters of the city of the need for a more inclusive and equitable economic recovery. It is our view that New York City will remain a global center for finance, education, healthcare, technology and culture, but not without changes to its prior established position. Investment exposures should be allocated and managed accordingly.

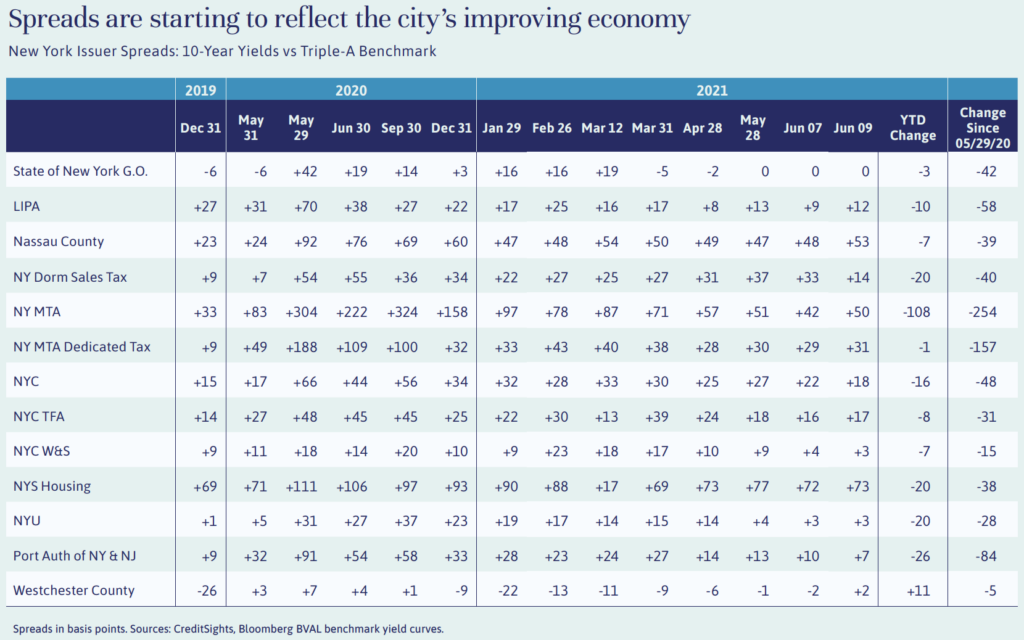

Spreads, or the difference in bond yield between the issued debt and gilt-edged AAA-rated debt, are starting to reflect the city’s improving economy, thanks to the implementation of federal programs and effective vaccine distribution (see the chart below). Still, most spreads are wider now than pre-pandemic levels at the end of 2019, which means there are still selective buying opportunities, assuming the economy continues to recover. We will continue to monitor the pace of the economic recovery and the spreads on these New York credits to determine buying opportunities.

Howard Cure is a Partner and the Director of Municipal Bond Research at Evercore Wealth Management. He can be contacted at [email protected].