Independent Thinking®

Wealth Planning in Markets Too Good to Last

October 19, 2021

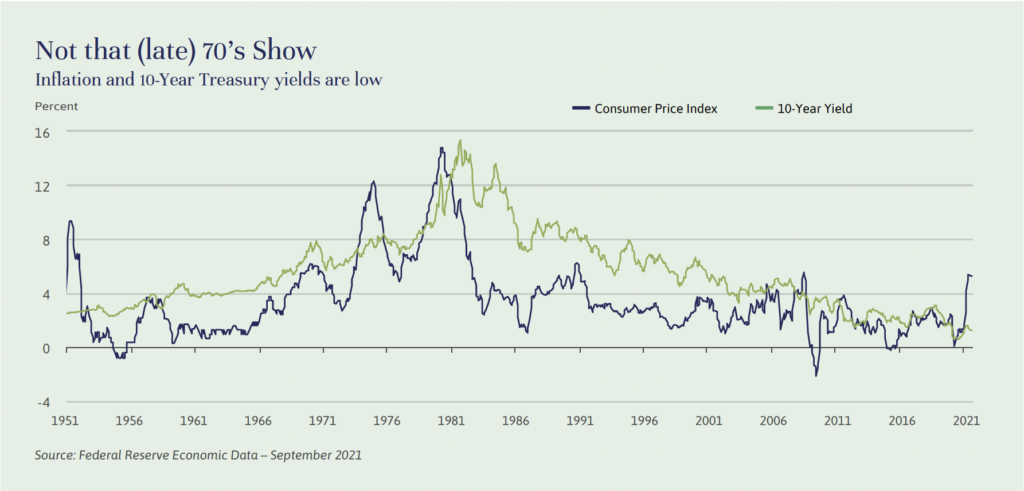

This is not “That ‘70s Show”. I know that not because I’m familiar with the popular television show of that name, but because I started my career in 1970. It was a decade of poor economic growth and poor equity performance, accompanied by runaway inflation of as much as 13 percent. Interest rates also rose over the decade as the Federal Reserve attempted to fight inflation; by September 30, 1981, 40 years ago, the Treasury 10-year note yielded 15.82%, a record high.

The focus of wealth managers then was to keep investors from losing too much ground while remaining positioned to benefit from future growth. So the recent, and we believe temporary, run-up in inflation to around 5% certainly bears watching, but it doesn’t keep me up at night.

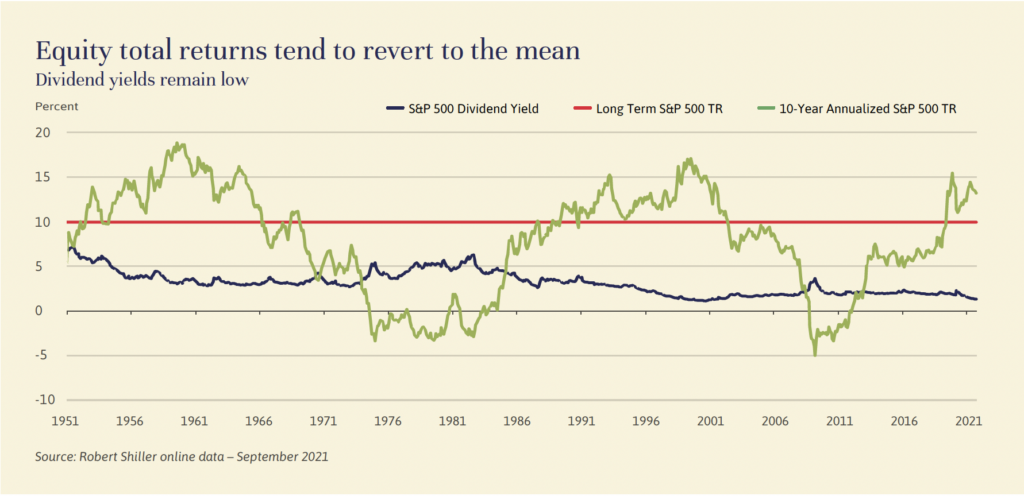

This is not “That 2010s Show” either. That decade was marked by extraordinary returns in several asset classes, notably equities, which enabled balanced investors to stay on track to meet their financial goals, despite historically low dividend and fixed income yields. The S&P 500 index rose 14.5% on an annualized basis from the beginning of that decade to this year to date. (From fashion to social mores to investing, most decades seem to end a year or two into the next.) Our balanced account strategy compounded annually at 9.0% net of fees, outperforming its benchmark, which itself returned 7.7% over the same period.1

These returns have been just too easy to get used to. But at some point, the S&P 500 is likely to revert to its 10% annualized growth mean, illustrated by the chart below, and balanced accounts will move accordingly. In addition to rising inflation risk, income and capital gains taxes look set to rise. Domestic policies seem to swing in long arcs based on election cycles; the pandemic and related global supply chain issues only add to the uncertainty now. While we certainly hope to continue generating strong investment returns, we are under no illusions that it’s going to be easy.

From my vantage point, as Chairman, and as the Partner at our firm with the longest memory, this seems like a crucial time to review lifestyle, family, business and other goals in anticipation of a changing environment. That means revisiting lifestyle needs, circumstances and risk appetites. It’s our job to help our clients manage through personal change, as well as change in the markets. A close review of each client’s circumstances and perspectives will, along with our capital market assumptions, inform financial plans and direct investment recommendations.

For some, a close review may result in putting off retirement for a few years or viewing philanthropy differently. Others may elect to increase their portfolio’s return potential by investing in more illiquid assets, trading liquidity for potentially higher returns. Some will consider a change in domicile to a more tax-friendly state. Many should review estate plans in light of proposed estate and gift taxes, as Justin Miller observes in his article, Estate Tax Planning: Act Now, Before It’s Too Late. Investors who rely on their portfolios to fund all or part of their lifestyles and have been trimming equity positions to cover spending requirements, as well as to rebalance portfolios and reduce risk, may need to reduce their spending.

We may be at the beginning of an inflection point, so now is the time to make or review wealth plans. There’s no substitute for a conversation. Please make time to sit down, virtually or in person, with your Evercore team, to plan for this decade – and the years to come.

Jeff Maurer is the Chairman of Evercore Wealth Management and Evercore Trust Company. He can be contacted at [email protected].

1 The EWM Blended Global Benchmark consists of 50% MSCI All Country World Index, 30% Bar Cap Municipal Short-Intermediate 1-10 Year Index, 10% BofA MerrillLynch 3-month Treasury Bill Index, and 10 Wilshire Liquid Alternative Index. The current benchmark has been used for reporting since July 1, 2017. You cannot invest directly in the benchmark.