Independent Thinking®

ESG and Inflation: Short-Term Pain, Long-Term Gain

October 19, 2021

Is ESG investing fueling inflation? As counterintuitive as it seems, the well-intentioned allocation of capital may come at a cost to investors. That’s particularly true in the energy sector. Environmental, social and governance, or ESG, investing has grown very quickly into a mainstream and increasingly dominant force in portfolios, reflecting growing concerns among investors across a range of issues from boardroom diversity to carbon footprint.

Let’s back up. This style of investing is designed to combine capital growth with long-term business and environmental sustainability. Estimates vary widely, but it seems fair to say that the 40%-plus growth over the last few years that has led to $17 trillion1 in sustainably invested assets is poised to continue apace.

Countries and corporations are paying attention. At present, 90% of S&P 500 corporations publish a sustainability report, up from 20% in 2011, indicative of both investor and management focus.2 Among the topics addressed are direct impacts like energy companies transitioning from reliance on fossil fuels, in response to investor and regulatory pressures, as well as corporate commitments to sustainability.

As a result, traditional energy production is becoming more difficult and more expensive. Oil production growth rates are falling and coal use is dwindling.

So far, so great for ESG investors. But energy transitions take time. Coal, oil and natural gas all took decades to move to peak usage. While some renewables, notably solar and wind, are now within striking distances of rivaling traditional energy sources in cost effectiveness at scale, there are still some big issues to be resolved, such as those around storage and transmission. Overall, the use of modern renewables is barely a decade along in its growth. At the same time, global demand for energy is rising. The International Energy Agency projects global energy demand to increase by more than 2% per year for the coming decade and, in the recovery from the pandemic shutdowns, almost double that rate in 2021.

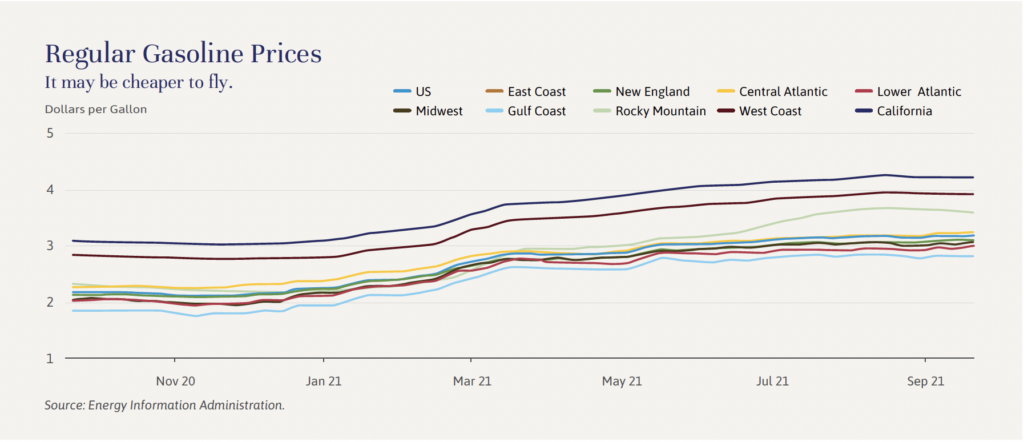

As Bill Gates describes in his book How to Avoid a Climate Crisis, the move to modern renewables is, at this time, based on environmental interests and often in the face of economic interests. A possible result is inflation and the economic pressures that go along with it. As a case in point, rising prices across most of the energy sector are contributing to increases in gasoline prices to multiyear highs, putting pressure on consumers, as illustrated by the chart below. While these price hikes may indeed prove transitory, they also serve as a reminder of the importance of considering longer-term supply-demand dynamics.

What would be the offset to this inflation? As with so many other aspects of the economy, we look to technology-driven productivity gains and the companies leading that charge. The 2020 pledge by Google parent Alphabet to carbon-free targets by 2030 was big news. Two other examples from the current Evercore Wealth Management core equity portfolio also serve as good examples of corporate change: BorgWarner, a traditional auto parts supplier, is evolving into an electric vehicle/hybrid supplier; and Microsoft’s Azure cloud segment has built a suite of software designed to drive efficiencies and safety throughout the energy industry.

Investors will be wise to monitor the extent of this green premium. Future inflationary trends and the transition to a greener future are important considerations in building portfolios meant to last.

Michael Kirkbride is a Managing Director and Portfolio Manager at Evercore Wealth Management. He can be contacted at [email protected].