Independent Thinking®

Orienting in a Changing Investment Landscape

November 28, 2022

The 2020s have so far brought us some of the best times in the markets and some of the worst.

As we look to 2023 and beyond, it’s worth taking stock and reviewing our asset allocation.

There are plenty of factors at play, but the biggest by far is inflation. Unacceptably high and surprisingly persistent inflation, the consequence of poor fiscal and monetary policy in response to the pandemic, has forced the U.S. Federal Reserve to increase short-term interest rates sharply, with promises of more rate hikes to come. That’s driven up long-term interest rates from very low levels, to 3.8% from 1.5% in just 11 months, and forced down valuations across all major asset classes.1

When the Fed increases interest rates at this clip, a recession usually follows. At this juncture, the question really is whether it will be a mild recession – sometimes referred to as a rolling recession, in which case earnings are flat to slightly down – or a more meaningful recession, with earnings down 10%-20%. If it is a mild recession, then chances are that we have probably seen the market low for this bear market. However, if we have a recession that causes earnings to fall by 10% or more, we would expect the market to fall to new lows.

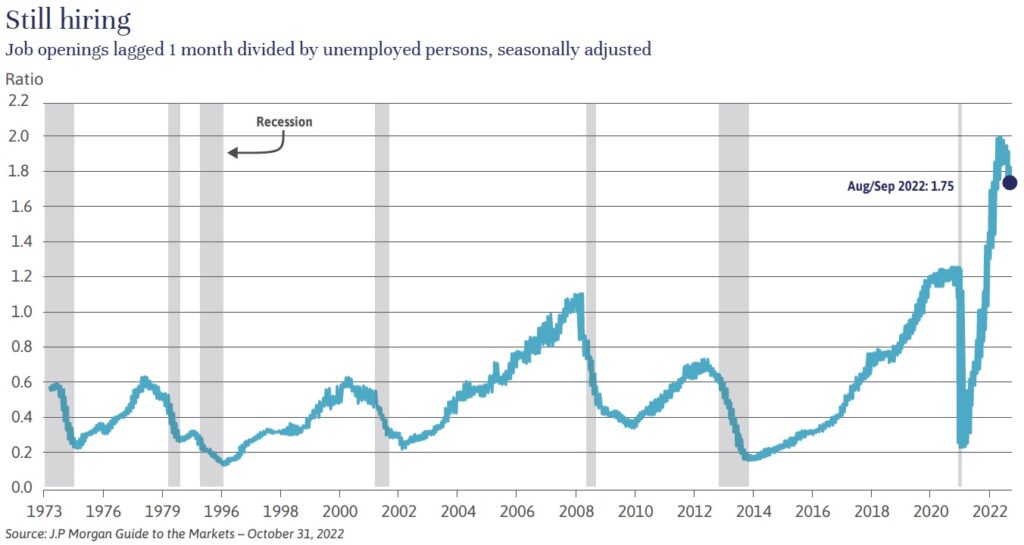

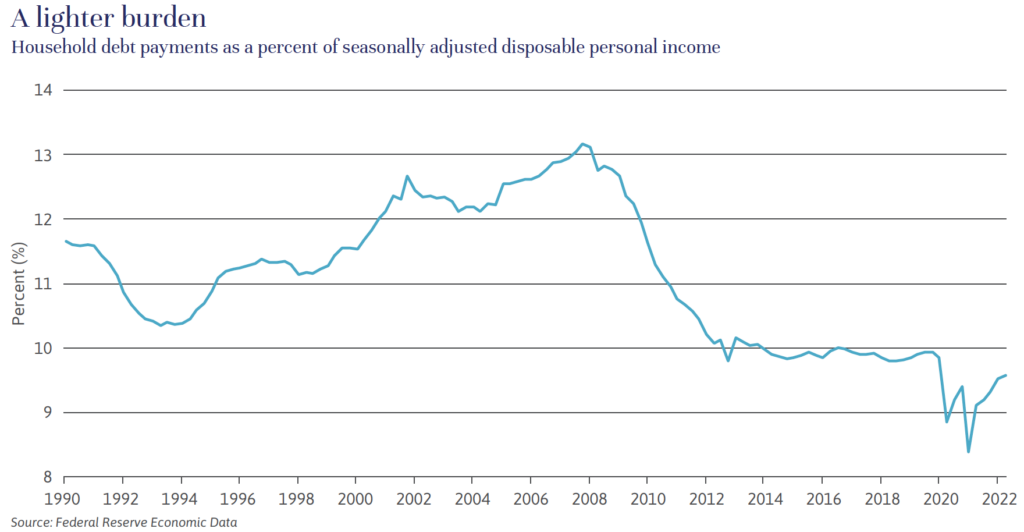

There are a number of reasons why we put a slightly higher probability on a mild recession, several of which are illustrated below.

First, we have a very strong jobs market, with a record number of open jobs relative to unemployed workers, and strong wage growth. So, we are a long way from a large increase in the unemployment rate that would usually accompany a major recession.

Second, U.S. household balance sheets are very strong, with relatively low debt levels, high net worth and considerable excess savings lingering from the government largess during the pandemic.

Third, a deep recession is almost always accompanied by a financial crisis. While it is admittedly difficult to identify a financial crisis before it happens, we do not see the early signs of one in the United States. The use of excessive debt, which is the usual precursor to a crisis, is at the government level this time around – as opposed to the corporate or household level. This has significant implications long term but should not cause the more typical financial crisis in the private markets.

Fourth, the pandemic and shift to remote and hybrid work has helped hone some great American companies. Superb management teams are generating record-high profit margins, even adjusting for low interest rates and taxes, and corporate earnings growth well in excess of overall economic growth. With reduced future profit expectations, it follows that solid returns can be achieved in the future if markets rise, a good thing considering that higher normal future returns will be required to overcome higher rates of inflation. This is an important positive factor worth keeping in mind against an admittedly still difficult backdrop.

Further good news is that even with a recession on the horizon, our 10-year expected returns for all the major capital market asset classes are up considerably from a year ago. We now expect close to 4% or more on cash equivalent investments. And we expect about a 4% tax-free return on high-quality municipal bonds, up from 2% or lower not that long ago, and about a 7% taxable return on credit strategies that take on credit risk. Most important, now that the valuations on stocks are back to, if not slightly below, historical averages, we believe the 10-year expected returns on stocks are close to the long-run returns of 9%-10%.

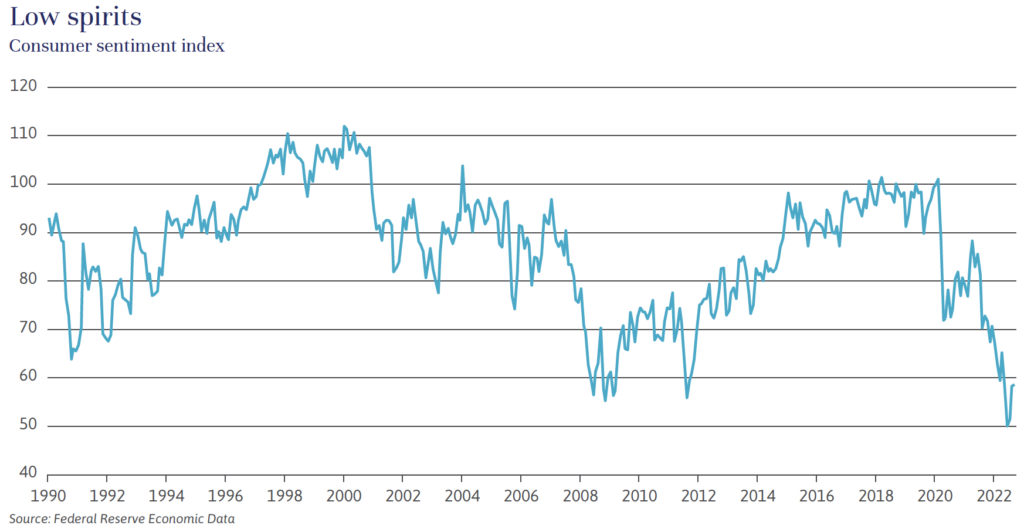

Here’s another, counterintuitive, positive. Negative news – which we have had plenty of this year – breeds negative sentiment, which historically bodes well for the markets. At present, we are at record lows on many measures of sentiment, which are reflected in current reasonable-to-cheap valuations. Lower valuations may set us up for favorable long-term future returns. Even the expected returns for international equity markets are up, due to extremely low valuations, which could be argued fully reflect current challenges – energy prices and a very strong U.S. dollar. (See Dollar Exchange Rates: Too Much of a Good Thing? by Brian Pollak here.)

There’s no doubt that 2022 has been a tough year in the markets. But we need to retain our perspective, keeping in mind that we previously enjoyed a 10-year strong bull market and truly extraordinary gains between March 2020 and the end of 2021. We are continually evaluating our portfolios and evaluating whether to take losses where possible to offset any realized taxable gains. We do see opportunities, among individual stocks that are at valuation levels well below their historical averages, and in extending maturities within our bond portfolios. We are also continuing to invest in real estate and other carefully selected illiquid alternative investments, which generally represent about 10% of our balanced portfolios.

The Fed has made it very clear that it will do whatever it takes to get inflation back down to an acceptable level. No one knows how long that will take. But we do know that, historically, high net worth investors are best served by riding out downturns and staying invested, remaining focused on long-term goals.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].

1 Source: FactSet

Note: Market yield on a 10-year U.S. Treasury bond. 10-year yield at 1.51% on December 31, 2021 and 3.81% as of November 18, 2022.

Disclosure:

Expected returns described are based on capital market assumptions and calculated net of fees. Stocks are defined as growth assets. Please refer to important additional information available on the disclosure page.