Independent Thinking®

The Beauty of Investment Diversification

March 17, 2023

For almost 13 years, the very best investment returns came from some of the best-known components of the easiest-to-invest-in asset class. From the beginning of 2009 to the end of 2021, the larger the allocation to four companies – Alphabet/Google, Apple, Amazon, and Microsoft – generally, the better the returns.

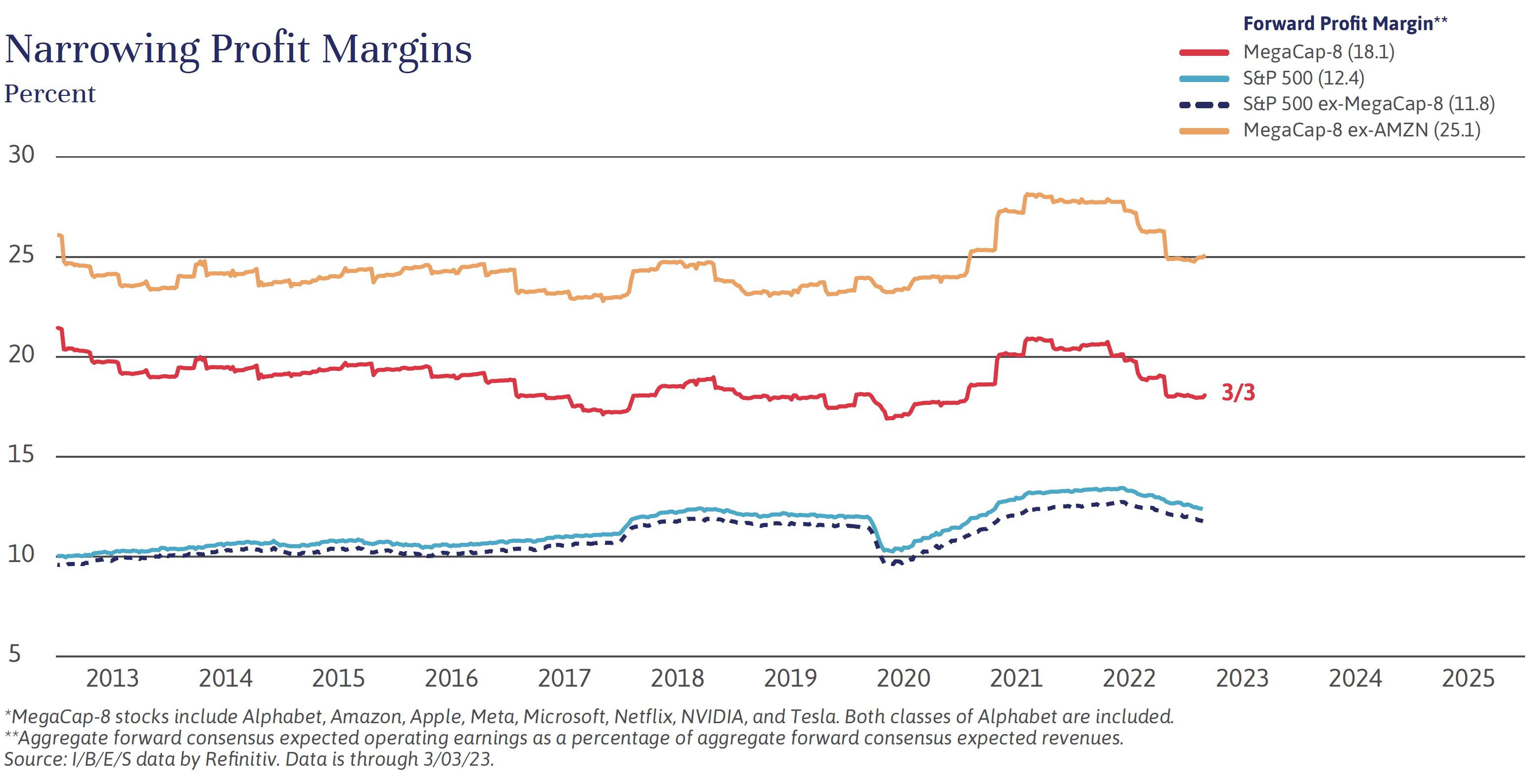

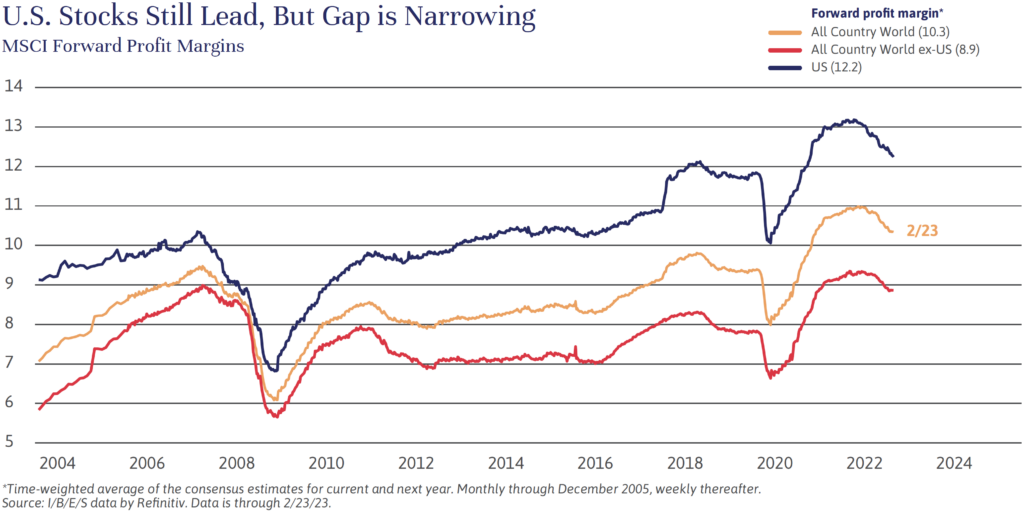

These household names dominated what became known as the mega caps, the three dozen or so companies valued at more than $200 billion, most based in the United States. Together, the four accounted for more than 20% of the S&P 500, with annual profit margins of around 18% for MegaCap-8, or 1.5 times the S&P 500 average and two times the MSCI World Large Cap average, as illustrated by the charts below. They were, as we wrote a year ago in Independent Thinking, among the most successful companies in the 200-year history of limited liability corporations.1

That era ended a year ago, on March 16, 2022, when the Federal Reserve started reversing monetary policy to combat rapidly accelerating inflation. The S&P 500 index fell 25% between January 3, 2022, and October 12, 2022, and the mega caps fell harder still. One reason was that the big companies had much higher valuations than the broader market at the peak, and higher interest rates devalued investors’ perceptions of future growth.

Today, the valuation gap between these companies and the rest of the market looks likely to continue to narrow, as their growth rates decline from the technology spending boost caused by the pandemic and the extraordinary success of cloud computing – and as governments around the world attempt to rein in their near monopolistic power.

Although we continue to believe that the power, resilience, and business models of many of the biggest U.S. technology companies will lead to strong future returns, we do not expect a return to the recent level of U.S. mega cap dominance. Instead, it seems to us that the better diversified a portfolio, generally, the better the likely future returns. We are trimming our exposures to the mega caps that have served our clients so well in favor of three asset classes: international equities, credit, and illiquid assets. Let’s take a brief look at each.

International (excluding U.S.) equity markets, which significantly underperformed U.S. stocks over the previous era, have reached historically low valuation levels in absolute as well as relative terms. A warm winter in Europe has helped the region avoid a major energy crisis and bought European Union countries time to wean themselves off Russian natural gas. And a faster-than-expected reopening in China has offset the economic impact of the country’s three-year zero-COVID policy. At the same time, the U.S. dollar is well off the highs of last year, which takes the pressure off most emerging markets that borrow in dollars. We recommend allocations to equities in developed international and emerging markets, but still at a weight far below the approximately 40% exposure in the MSCI All-Country World Index. Due to the long-term underperformance in international stocks, in many cases we are actively rebalancing international weightings back toward policy, which is approximately 15% of equity portfolios.

Interest rates have moved up dramatically across the major fixed income markets since the Federal Reserve started increasing rates last March, and they are beginning to show attractive real rates based on consensus long-term inflation expectations of about 2.7%. A Credit History, Built on Trust and Innovation by Brian Pollak and the interview with David Golub of Golub Capital explore opportunities becoming available in the credit markets. For balanced portfolios, we currently recommend a portfolio allocation of between 5% and 10% to liquid public and illiquid private credit.

Of course, we cannot assume that inflation is reverting to 2% in a straight line; it will be important to orient part of the portfolios to investments that should do well in an elevated inflation environment. We have moved our core equity portfolio weighting to commodity producers, significantly higher, and on the fixed income side we are looking for opportunities to enter positions in inflation-protected bonds, to complement our exposures to Treasuries and municipal bonds.

We also continue to search for additional opportunities within the private equity, venture capital, private debt and real estate markets within balanced portfolios that can bear illiquidity risk, including diversified private real estate, private equity secondaries funds, and distressed or special situations debt funds.

In the interim, where appropriate, we will continue to take gains, if available, from the big-cap tech stocks as tax efficiently as possible and to rebalance portfolios. The era we are entering should present many investment opportunities, as well as many risks. We believe thorough diversification is the best strategy to deal with the rapid changes, risks and opportunities that investors currently face.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].

1 https://www.evercorewealthandtrust.com/powering-technology-continues-drive-markets/