Independent Thinking®

Is Demography Destiny?

August 1, 2023

The 19th-century philosopher Auguste Comte is often credited with coining the aphorism “demography is destiny.” If so, he had a point. Certainly, shifts in populations – caused by births, deaths, and immigration – can herald transformative societal and economic change. But the interconnectivity among population, innovation, and productivity can make the ramifications of that change difficult to forecast. For years, many believed overpopulation was a looming crisis – that competition for resources would drive us toward a Malthusian dystopia of war, famine, and disease.

Now we worry that declining birth rates and rising longevity in developed and the more advanced emerging market economies may signal the end to almost 80 years of nearly continuous economic growth.

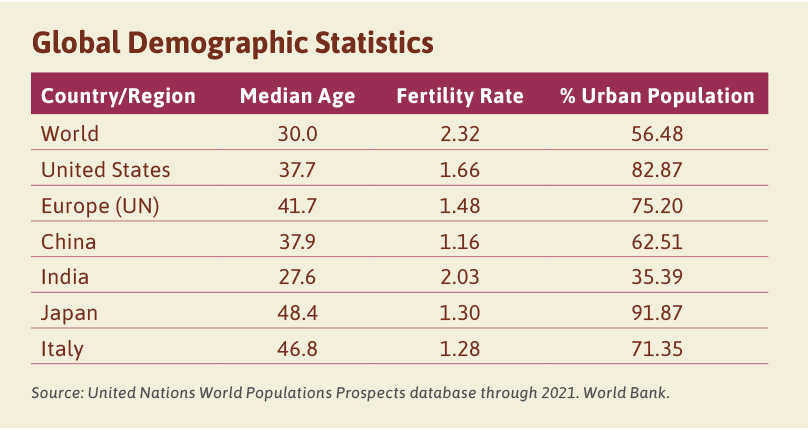

The trends that brought about low birth rates in the developed world – the increasing cost of raising children, improved access to education for girls and women, and female participation in the workforce – are unlikely to be reversed. Instead, they are taking root in many emerging economies too, and at a faster clip. If anything, we have learned that our ability as a global society to affect these developments is limited. And today, with nearly all developed world populations and many of the large emerging market populations already shrinking or set to shrink, countries may hope, in a zero-sum world, to win a relative demographic game – see chart below.

John Apruzzese describes the U.S. demographic outlook in his article, Where Are the Kids? Demographics in the United States; here’s a brief look at a few countries already confronting the challenges associated with dramatically aging populations.

CHINA

In China, until recently the engine of global growth, the unintended consequences of China’s one-child policy (1980-2016) are now playing out. The fertility rate, measuring the number of children per woman, is just 1.2, among the lowest in the world and far below the 2.1 replacement rate. In addition, China is left with a rapidly aging society, described by some observers as the world’s largest nursing home. The average age is about the same as in the United States, at almost 38 (see the chart below) but is set to rise at a much faster rate, partially due to the shortage of young women. Immigration, the other driver of demographics, is unlikely to be enough to correct the imbalance in such a large and historically insular country.

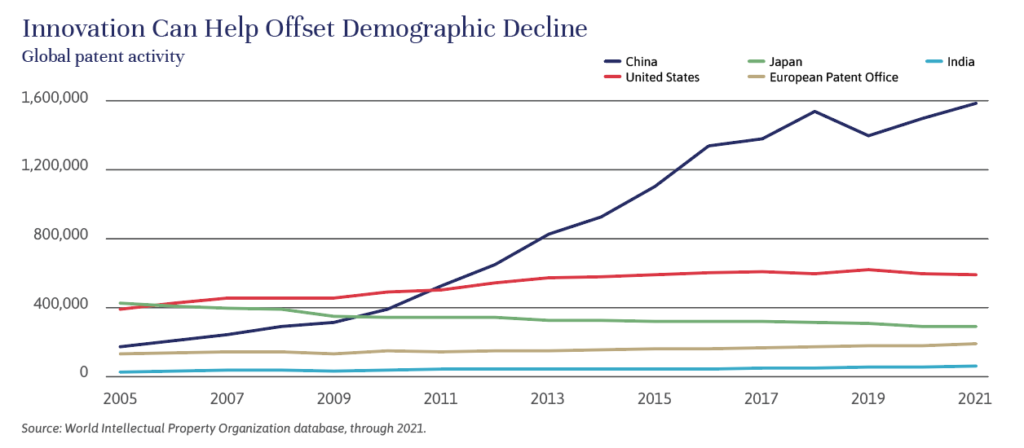

The Chinese government is addressing these challenges by focusing attention on supporting the technology sectors that will help enhance national productivity, including clean energy, robotics, and biological medicine, as demonstrated by the huge rise in patent activity in the last decade. The government also appears intent on boosting China’s ties with the large and growing populations of Africa and the Middle East, outsourcing manufacturing know-how and technology to enhance their manufacturing capabilities and grow their markets. Policy efforts to encourage further urbanization could also help continue to grow per capita GDP, cushioning some of the negative demographic impact. On balance, however, it seems likely that China’s contribution to global growth will continue to deteriorate along with its population.

If you missed our recent webinar on China with Evercore ISI analyst Neo Wang and would like to view it, please contact your Evercore Wealth Management advisor.

JAPAN

Japan has a long experience of demographic decline and has learned to live with a shrinking labor force and population. The country has the oldest population in the developed world, but its standard of living has continued to rise, partially due to its reliance on emerging market workforces. This reliance has enabled the government to retain its domestic focus on creating higher-value jobs and services. Japan is also stemming its labor force shrinkage at present by recalibrating its hitherto unwelcoming policy on immigration and female participation in the workforce. Unfortunately, the latter has coincided with a further decline in the fertility rate, making it clear that there is no easy solution to demographic decline.

In the face of the inevitable acceleration of population decline, many prefectures and cities in Japan are starting to think about how to sustainably shrink infrastructure, including housing stock, retail footprint, rail lines, and healthcare systems. There is little doubt that in Japan, already a technologically forward nation, innovation will be a big part of any solution to demographic challenges. If managed thoughtfully, a shrinking citizenry may not be all bad for this densely populated country.

As more and more of the world faces the same demographic challenges, high-quality labor forces from lower income countries will become harder to source, making it unlikely that the Japan model will be scalable.

ITALY

This past May, Pope Francis pleaded with the Italian government to enact more pro-growth population initiatives to stem one of the steepest population declines in the world. In the latest count, there are just seven births for 12 deaths; Italy’s fertility rate is the lowest in Europe, and its population among the oldest. Similar to Japan, Italy has been attracting migrants for the past few years, even as its jus sanguinis (“right of blood”) traditions have been hard to shed. As in all developed countries, the high cost of childcare is an impediment, discouraging young couples from having children. Prime Minister Meloni’s administration has proposed lower taxes for households with children, help for married couples purchasing their first homes, and initiatives for free childcare at the community level to allow parents to return to work, but the jury is still out as to their effectiveness.

The European Union has badly lagged Asia and North America in terms of patents and tech start-ups, boding ill for the region’s relative long-term economic growth.

China, Japan and Italy are previews of a global trend. Populations are rapidly aging just about everywhere in the developed world. This will likely result in a shrinking global labor force and declining economic growth. Policies encouraging net migration, female labor force participation (as described in “Womenomics” in the United States by Judy Moses here), and economic incentives for having children are in aggregate unlikely to turn the tide in any specific country, much less around the world. The most successful societies likely will be those that harness new technology to limit the potential inflationary (or deflationary) swings associated with shifts in the relationship between supply and demand in the labor force.

The United States should be among these successes. Although our median age is quite high and our fertility rate is low, the United States has historically – if not recently – excelled (despite recent policy challenges) in accepting and integrating immigrants, and in innovation. Today’s great global technology companies are nearly all founded and domiciled in the United States; many of their founders, not incidentally, are immigrants or the children of immigrants. That technological proficiency could deliver efficiency and productivity gains that will allow easier adaptation to a rapidly changing world.

As long-term investors, we are continually thinking about how demographics will impact the economic landscape. This means focusing on U.S. investments that benefit from the building of much-needed new housing stock (to support Millennial household formation), discretionary consumer spending (aging Baby Boomers), and healthcare (also aging Boomers). Demographic trends inform in part our underweight exposures to Japan, Europe, and China.

Healthcare and the developing technologies that are underpinning most innovations are undoubtedly the big medium-term opportunities. Through individual securities, a dedicated healthcare innovation mutual fund, and venture capital investments, we believe we have found attractive opportunities to invest in healthcare and technology, in both public and private markets.

There’s another way for us all to think about this shift from overpopulation to potentially declining population. If current trends continue, humans will eventually need to find ways to sustainably transition the global economy away from dependence on increasing population. Hopefully, this will be possible through the thoughtful and responsible use of productivity-enhancing technology. If we get it right, we could achieve a better balance between humans and our environment, as well as continued economic growth.

Brian Pollak is a Partner and Portfolio Manager at Evercore Wealth Management. He can be contacted at [email protected].