Independent Thinking®

Where Are the Kids? Demographics in the United States

August 1, 2023

Here’s an American story.

My mother and my wife’s mother, both children of immigrants, had seven Baby Boomer children between them. Five of the seven Boomers were women who produced nine Millennials, five of whom are women now ranging in age from 33 to 35. They, in turn, have so far produced just one child, my grandson, born last month. If you think about that in the terms used to measure fertility rates, that’s 3.5 for our mothers, 1.8 for the Boomers, and 0.2 to date for the Millennials, well short of the 2.1 replacement rate. We, like many aging families across the country, will need more comfortable chairs at the Thanksgiving table and, if this trend continues, fewer high chairs.

This U.S. demographic trend of falling fertility rates has significant economic and societal consequences. Look at the chart below, showing the changes in expected proportions of the population over 65, 75, and 85. We would need one million additional births per year to reach the replacement rate – and even that wouldn’t make much of an impact on the median age of the population, now 37.7 at the United Nation’s latest estimate, a decade older than the median age in 1960. As populations age and fertility falls here and in other developed and developing countries (see Is Demography Destiny? by Brian Pollak here), the labor force tightens.

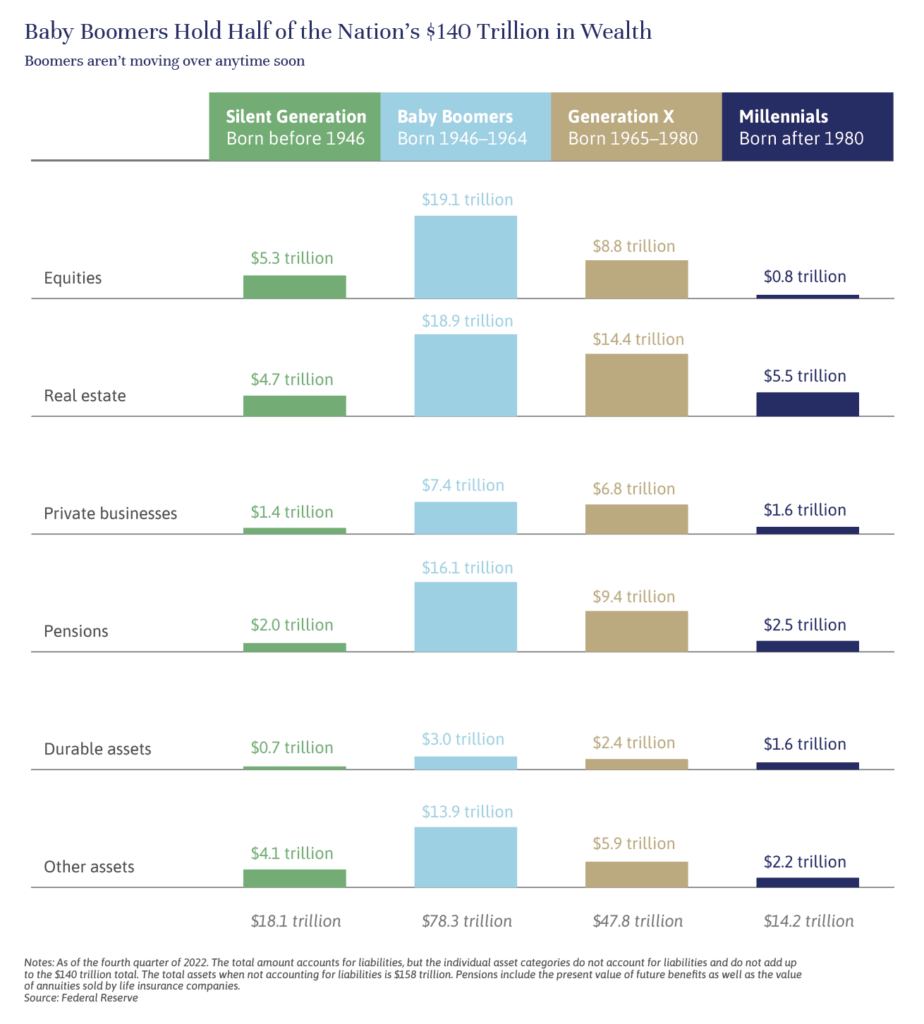

Traditionally, consumption also tapers off with age, relieving some pressure on labor. But the Baby Boomers have turned that equation (and all the related economic models) on its head, by working longer in anticipation of longer life spans and by accumulating assets – to the tune of $78.3 trillion gross, or 60% of the total household net worth in the United States.1 While many people are struggling, Social Security, Medicare, and lifetime savings means most seniors are far better off than previous generations. Their spending power is fueled by the markets, rather than earned income, and they are spending in record numbers on restaurants, travel and leisure, as well as healthcare – all areas in which the labor force is particularly tight and getting tighter, with large numbers of unfilled jobs. (Please see Affluent Baby Boomers and Inflation: The Good, the Bad, and Some Options by Jeff Maurer here.) All told, the number of job openings outnumbers unemployed Americans by almost two to one.2

A well-designed immigration policy would go a long way toward alleviating the persistent labor shortage, but unfortunately the politics around immigration make that unlikely. Instead, the best hope for a solution comes from increased capital investment and the resulting productivity – and the good news is these prospects are enticing. We are witnessing a capital spending boom exceeding $3 trillion per year, accelerated by advances in Artificial Intelligence – as billions of dollars are being spent on upgrading data centers with the latest high-speed chips and software development3 – and recent legislation that provides large tax incentives to bring supply chains closer to home and to support investments in green energy.

The record household net worth relative to GDP can provide the capital at reasonable cost through our highly developed capital markets, including the public stock and bond markets, private equity and venture capital funds, as well as rapidly growing private credit funds that are a new source of capital as an alternative to bank loans.

Recently released large language models such as ChatGPT are creating a lot of excitement around AI, but there are many other models that will be tuned to perform many mundane and more advanced tasks that hold the promise of broadly increasing productivity. (Please contact your advisor for a replay of our recent webinar on AI and visit our website to learn more about our planned event on technological developments for seniors.) These advances in AI will reduce and eliminate many tasks and jobs, but they will also create many new jobs. The catch is that the new jobs will require higher levels of education and training. And this is where it gets especially interesting – it just might be the case that education will be a leading beneficiary of an AI productivity boom. Education productivity has lagged far behind most sectors of the economy, which has caused costs to spiral out of control. AI holds the promise of reinventing how we educate and train the next generation.

Our portfolios should continue to benefit from owning both healthcare leaders and the mega tech companies that are at the forefront of creating AI. We control position sizes to avoid the risk of these stocks becoming overvalued as excitement and adaption around these prospects grows. The real work going forward will be finding and investing in the best-managed companies that will lead industry sectors that embrace AI early and achieve a competitive advantage before the technology becomes pervasive. As always, investing in the winners and avoiding the losers will greatly enhance investment returns.

The demographic trends in the United States are already weighing on economic growth. While we may wish for more high chairs at the table, we are optimistic that capital investment trained on productivity-enhancing technology will provide a counterbalancing growth accelerant.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].

1 Yardeni – Distribution of Household Wealth in the US, June, 2023 Data as of Q1 2023

2 U.S. Bureau of Labor Statistics – Job Openings and Labor Turnover Survey, May 2023 Data as of 5/31/23

3 Yardeni – US Economic Indicators: Capital Spending Indicators, July, 2023 Data as of 5/31/23