Independent Thinking®

Managing Executive Compensation Plans

December 5, 2023

Like professional athletes, corporate executives are often paid for performance.

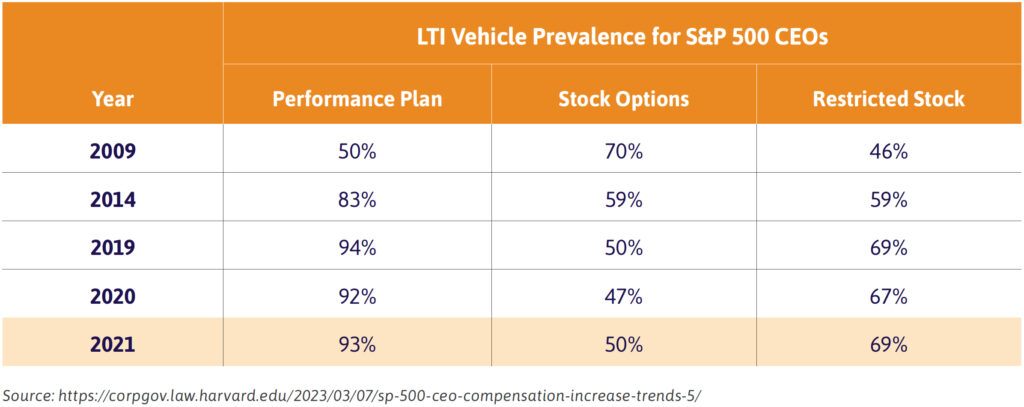

Unlike many athletes, executives may have more time on their side, thanks to deferred pay compensation structures that reward those who hang in there – and plan well. And it’s not just the top players who benefit. In recent years, companies have expanded deferred compensation packages well beyond the C-suite, in some cases to nearly all employees. Long-term incentives as a proportion of C-suite executive pay have more than tripled over the last few decades to about 70% of total pay.

That proportion is likely to continue rising in the wake of the 2022 ruling by the Securities and Exchange Commission, or SEC, on “Pay vs. Performance,” which requires companies to disclose executive compensation along four specific measures, as illustrated below. The ruling is the latest step to pay transparency, which started with the “Say on Pay” ruling in 2011 as part of the Dodd-Frank Act. Shareholders and boards want to see that executives have skin in the game, and by large, executives have benefited enormously. Let’s take a quick look at the most common types of executive compensation, along with the advantages, drawbacks,

and other considerations. Many companies will provide a mix of compensation structures, with the most common features including cash compensation with additional incentive compensation in the form of restricted stock and performance-based restricted stock.

Stock options are a powerful, tax-efficient tool to compensate executives, which gained immense popularity in the 1950s when marginal tax brackets were much higher. If the underlying stock price grows, the owner of a stock option can participate in those gains while simultaneously deferring tax until the exercise of the option. And if the underlying stock price falls below the strike price, the owner of the options can simply let them expire; the only downside is opportunity cost. Further, if the stock options are qualified incentive stock options and the holding requirements are met, the owner may be able to avoid ordinary income tax due when they exercise the options and on the difference between the sale price and the strike (purchase) price at disposition of the shares. Although, it is important to note that the exercise of incentive stock options could result in significant alternative minimum tax consequences.

Other types of stock awards also align the executive and shareholder goals. In other words, everyone makes more if the company does well. Although, noncash awards may carry more risk for the executive. Restricted stock and restricted stock units, or RSUs, are taxed as ordinary income at the time of vesting. Unless the share owner is able to simultaneously sell shares at the time of vesting, this means that the tax bill is due before the liquidity is available and cash must be used from other sources. Performance-based restricted stock units, or PSUs, vest only if the company hits certain performance targets and are thereafter taxed like RSUs. PSUs are especially appealing for companies and boards, as they motivate executives to meet performance targets while also allowing companies to present large compensation packages to attract executives.

There are several other compensation structures that are available but less prevalent, such as traditional deferred compensation plans, long-term incentive plans (or LTIPs) and performance stock plan “kickers” (whereby additional discretionary stock grants can be made for superior performance). Employees should note that forced bonus deferrals are often made to non-qualified deferred compensation plans. These plans are subject to the creditor risks of the company, which should be taken into account when considering how much to defer and how to plan for these funds. Companies often implement new compensation measures trying to balance current year fiscal reporting while competing to attract top-tier talent.

In just about all cases, employee shares in both public and private companies are often required to be held in the employee’s own name. Transfers to family trusts or family members are either prohibited or very restricted. As a result, sometimes the largest asset on an individual’s balance sheet cannot be used to take advantage of the current lifetime estate tax exemption amounts.

Therefore it is important to maximize estate planning techniques available for unrestricted assets, as well as develop a plan to incorporate company stock assets into the estate plan once they become unrestricted. Some companies do allow vested shares of common stock to be reassigned, so it is also important for employees to understand the specific policies of their incentive compensation plans.

Companies competing for talent at all levels put together enticing compensation packages but are equally motivated to push much of this compensation into long-term payout structures, thereby tying employee compensation to tenure. Further, companies have different vesting conditions in the case of termination or change of control. It is important for employee shareholders to understand how their shares vest, or don’t vest, in each of these scenarios to calculate a net present value of their compensation, which can guide future decision making.

Often, employee shareholders do not actually diversify away from company holdings until they leave that role. The bull market that we’ve seen since March of 2009 and record IPO valuations have made it easy for employee shareholders to stay invested. Without proper planning, though, employees could be left holding the bag. Employee stockholders who worked at Lehman Brothers in the first two weeks of September 2008 saw their net worth invested in company stock drop 46% before being completely wiped away in one day. More recently, the COVID-19 pandemic caused some companies’ values to soar (such as Zoom and Peloton), while others plummeted (such as airline stocks and hotel brands). Both Zoom and Peloton shares have fallen back to pre-pandemic levels, off 89% and 97% of their COVID-19 era peaks, respectively. This year, employees and other shareholders of First Republic Bank lost nearly all the value in their holdings as the share price lost over 90% of its value over a period of six weeks in February and March 2023, before losing nearly all remaining value before May. Executives at WeWork and Twitter had similar experiences as fraught management caused share values to tumble. While these examples are extreme, even lower levels of volatility can impact an individual’s cash flow plans or retirement timing.

Diversification is therefore a crucial part of the planning process for executives. However, sale restrictions, trading windows, and tacit expectations not to sell stock can often prevent employee shareholders from fully diversifying their concentrated positions, which further exposes their net worth to large fluctuations and volatility. One simple way for employees to diversify away from company stock is to elect shares to be sold upon vesting or exercise to cover income tax withholding. Some companies even allow employees to elect a higher withholding rate than the statutory federal withholding rate of 22%, thereby allowing them to fully cover their tax liability. Selling shares to cover tax withholding allows individuals to reduce their overall employee stock exposure while preserving cash and other assets outside of the concentrated stock. It is important to work with a wealth planning advisor and a CPA to properly plan for tax liabilities associated with vesting of restricted shares or the exercise of options.

10b5-1 plans are often established to allow insiders of public-traded corporations to set up a trading plan for selling company stock they own while abiding by insider trading laws. Documents pertaining to these plans set forth certain events, whether date-based or stock-price based, at which an executive’s shares will be sold. Plans can stipulate various time frames, but typically are in force for six months to two years. While it may be possible to modify and terminate an existing plan, such changes are subject to significant limitations.

Proper planning can enable executives to ensure that they are meeting lifestyle and tax liability needs through their direct (cash) payments while addressing their incentive payments in the context of longer-term goals. This planning should consider various scenarios, including those in which the company performance metrics miss their mark and shares don’t vest. With the right planning, an executive will be fully apprised of the existing and potential value of a compensation package involving stock and have the power to understand and negotiate for future roles. Most important, proper planning allows individuals to maximize their balance sheet and cash flow and make informed diversification decisions to preserve their earnings for years to come.

It’s also worth noting that different companies call these incentive plans by different names, in which case a wealth advisor could help identify the plan and its advantages and constraints.

Neza Gallitano is a Managing Director and Wealth & Fiduciary Advisor at Evercore Wealth Management and Evercore Trust Company, N.A. She can be contacted at [email protected].