Independent Thinking®

Watching the U.S. Debt: The Implications for Investors

December 5, 2023

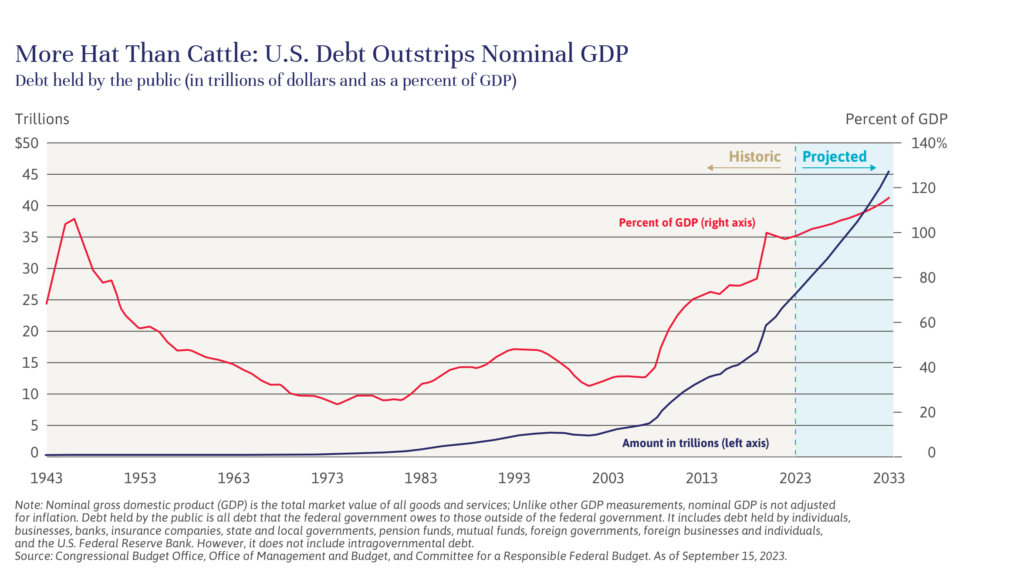

“A national debt, if it is not excessive, will be to us a national blessing,” said Alexander Hamilton in 1781. What might he have made of our $26 trillion debt? At the current clip, U.S. federal debt held by the public will soon exceed nominal GDP, as illustrated below. Without a radical change in the federal budget, we risk entering a terminal fiscal crisis, in which the rising average interest on the debt causes the debt to grow faster than nominal GDP.

Recession, still a possibility, would make matters worse, forcing nominal GDP down while likely driving the federal deficit higher. Like Greece over the last 10 years, the U.S. federal government would eventually be forced into austerity.

There are reasons to think that Congress may act before it’s too late. First, some politicians took note back in June when the bond vigilantes “saddled up,” as Ed Yardeni, the economist who coined the term back in the 1980s, recently put it. The idea is that the vigilantes, concerned about profligate fiscal policy, drive bond yields high enough to create a debt crisis and a recession. Rising yields exacerbate the debt problem, of course, but may also force Congress to tackle it. Efforts to create a bipartisan commission to address the deficit and debt are still in the works, but it’s a start.

Second, the alternative to acting is too grim for just about any politician to bear. When the Social Security program was founded in 1940, U.S. life expectancy was 60.5 years for men and 68.2 years for women. Every year for 39 years, the Social Security Trust funds took in more from payroll taxes than they paid out in benefits, contributing the surplus to the Treasury’s consolidated budget, in exchange for what is essentially an IOU. Today, with over 76 million Baby Boomers in or approaching retirement, and life expectancy at 73.5 years and 79.3 years, respectively, Social Security is in trouble, running an ever-increasing annual deficit that should exhaust its $2 trillion reserve within 10 years. But slashing Social Security benefits by the 25% to 30% it would take to match the program’s revenues is something no politician wants. Lawmakers will have to act, and soon.

So, what would radical change look like? It seems likely that Congress will follow the playbook established in 2013 when it bolstered the Medicare trust fund through the elimination of the wage cap and the application of a 3.8% payroll tax on all unearned income above $250,000. An equivalent remedy for Social Security would be to eliminate the current $160,000 cap on wages ($166,600 in 2024) and apply some or all of the 12.4% Social Security payroll tax to unearned income.

Currently the highest marginal federal income tax rate on unearned income is 40.8% (37% plus the Medicare tax of 3.8%), and the highest marginal federal tax rate on long-term capital gains is 23.8%, which also includes the 3.8% Medicare tax. Benefits could be reduced by a further increase in the retirement age and/or means testing. In any case, at this juncture, all long-term financial planning should consider the very real possibility of higher tax rates on unearned income and capital gains. We do not yet know how high the tax rates could go, but the prospect does potentially reduce the attractiveness of income deferral tactics. (See an extract of our annual year-end wealth planning guide here.)

Clearly, much is riding on how long the Federal Reserve must keep short-term interest rates above 5% to fight inflation, as well as how high long-term interest rates go to clear the market, so there is no excess supply or a shortage. The 10-year Treasury recently spiked to 5% before settling back a bit as the market adjusts to the prospect of ever-larger Treasury debt actions.

We are actively extending maturities in our bond portfolios to take advantage of higher long-term interest rates, but we will extend gradually because we recognize the possibility that interest rates may rise further. After all, in the six years prior to the Great Financial Crisis, rates averaged 4.5%. We may simply be returning to a more normal rate environment.

We believe persistent high interest rates will put pressure on equity valuations. However, the U.S. economy remains extraordinarily resilient in the face of very restrictive monetary policy. There are many reasons for this, including stimulative fiscal policy, robust household and corporate balance sheets, and a structurally tight labor market. Corporate earnings remain healthy and we believe are likely to resume growing at about 8% next year.

We are in the process of increasing our allocation to credit strategies. High-yield bonds and other noninvestment grade fixed income securities are now yielding 8%-11%, which is an attractive yield, assuming the United States does not enter full recession within the next two years. At present, we believe this is a reasonable assumption.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].