Independent Thinking®

Wealth Planning: Updates for Year-End 2023 and 2024

December 5, 2023

Editor’s note: Evercore Wealth Management released its legislative and regulatory guide in October to inform clients of end-of-year planning discussions in the context of overall wealth planning goals.

Highlights and subsequent relevant IRS updates are included here. Please contact your advisor for further information or to discuss your specific circumstances.

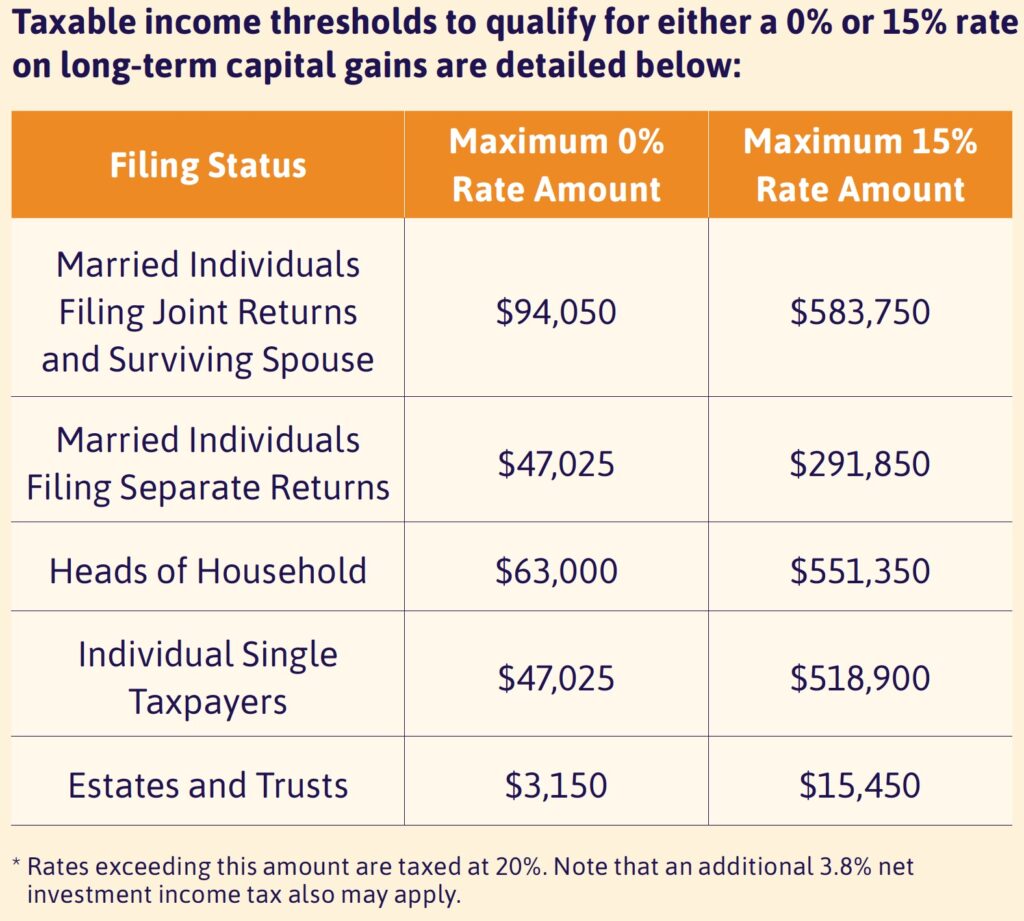

2024 Tax Rates

For tax year 2024, the top marginal tax rate remains 37% for individual single taxpayers with incomes greater than $609,350, married couples filing jointly with incomes greater than $731,200, and estates and trusts with incomes greater than $15,20

SECURE Act

The new Setting Every Community Up for Retirement Enhancement (SECURE) Act 2.0 included adjustments to required minimum distributions and qualified charitable distributions. In addition, guidance issued by the IRS addressed estate tax portability elections, and a recent tax court opinion highlighted the importance of careful planning and timing of charitable contributions ahead of a liquidity event. The age for RMDs was raised from 72 to 73 as of January 1, 2023, and will rise again to 75 on January 1, 2033.

Qualified Charitable Distributions (QCDs)

Currently, an individual who is 70 1/2 or older can make QCDs up to $100,000 directly from an IRA to a qualified charity – but not to a donor-advised fund. Beginning in 2024, the QCD amount will be indexed for inflation to $105,000.

Individuals who are 70 1/2 or older are now permitted a one-time QCD of up to $50,000 from an IRA to a charitable gift annuity (CGA), charitable remainder unitrust (CRUT), or charitable remainder annuity trust (CRAT) that benefits the participant or their spouse. For more information, please speak with your Wealth Advisor.

Inflation Reduction Act

The Inflation Reduction Act was passed in 2022 and continues to be implemented. It includes a wide variety of legislation targeting many different sectors of the economy. Among its provisions are:

- An expansion of Medicare benefits to include free vaccines and lower prescription drug costs. Most important, the law will require the federal government to negotiate prices for some drugs covered under Medicare Part B and Part D beginning in 2026.

- A new 15% minimum corporate tax and a 1% fee on stock buybacks.

- Expanded IRS tax assistance and enforcement through investment of $80 billion over the next 10 years – which could be cut by up to $21 billion pursuant to the debt ceiling agreement that was enacted in June 2023.

- Extension of the Affordable Care Act’s federal subsidies to 2025, which lowers the cost of premiums for enrollees.

Gift and Estate Tax

The 2024 lifetime gift and estate tax exemption will be $13,610,000, an increase of $690,000 from 2023 levels. Additionally, the annual gift tax exclusion amount will be $18,000 for gifts made in 2024, an increase of $1,000 from 2023.

Timely tax planning highlights

- Take advantage of current federal gift, estate, and generation-skipping transfer (GST) tax exemption amounts to make gifts outright or protected in a trust. The federal exemption amounts are currently $12.92 million per individual and $25.84 million per married couple but are scheduled to be cut roughly in half after 2025. If structured properly, the gift – as well as the future appreciation – will be excluded from your estate for estate tax purposes.

- Use estate-planning transfer strategies that take advantage of valuation discounts, such as family limited partnerships or family limited liability companies. Future regulation or legislation could limit intra-family discounts.

- Accelerate income into the current tax year and delay deductions to 2024 if your income tax rates would be higher next year. Consider the opposite approach if you will be in a lower tax bracket in 2024.

As always, we recommend meeting with your Evercore Wealth Management advisor, your attorney and your accountant before implementing new strategies to ensure that they are aligned with your long-term goals.