Independent Thinking®

The Duality of Artificial Intelligence: An Investment Perspective

April 17, 2024

Is Artificial Intelligence making life better?

It’s certainly not making it any calmer, with AI-generated disinformation stoking two horrific hot wars and threats to democracy around the world. And only 10% of Americans recently surveyed by Pew said that they were more excited about AI than concerned. But investors have a different take.

Mounting evidence that the United States is in the early stages of a productivity boom that may rival the great booms of the past is, in our view, driving the stock market to new highs. And the latest software advances in AI, coupled with an exponential increase in computer power thanks to a new computer architecture designed by Nvidia, are just starting to be implemented.

The dissemination of these new capabilities is happening at a dizzyingly rapid pace as the mega cap tech companies – Amazon, Google, Meta, and Microsoft – are racing to invest billions of dollars in AI computer power and software development, much of it presumably on semiconductor chips made by Nvidia, the biggest winner to date in AI adoption.

The productivity potential of AI is coming at an opportune time. Changing U.S. demographics have created a structural labor shortage and, in turn, a significant need for increased productivity. The benefits at present are largely accruing to the software companies themselves. In just the last quarter, Meta revenues increased by 25% year over year, while pivoting away from its metaverse mistake and reducing staff by roughly the same proportion.

More broadly, software companies are generally forecasting significant productivity gains among software engineers and coders exploiting AI. Nvidia, which enjoys a near-monopoly in the most advanced AI computer systems, has credited the development of H100, its latest systems design, to the aid of AI. Microsoft, Google, Amazon, and Adobe are also early winners in the AI rollout, as they can charge their cloud customers for the AI software that they are embedding in their services. (We own these four companies and Nvidia in our core equity portfolio.)

Longer term, we expect widespread AI adoption to transform U.S. and other countries’ industries, including helping companies fortify their supply chains and wean themselves off imports from China.

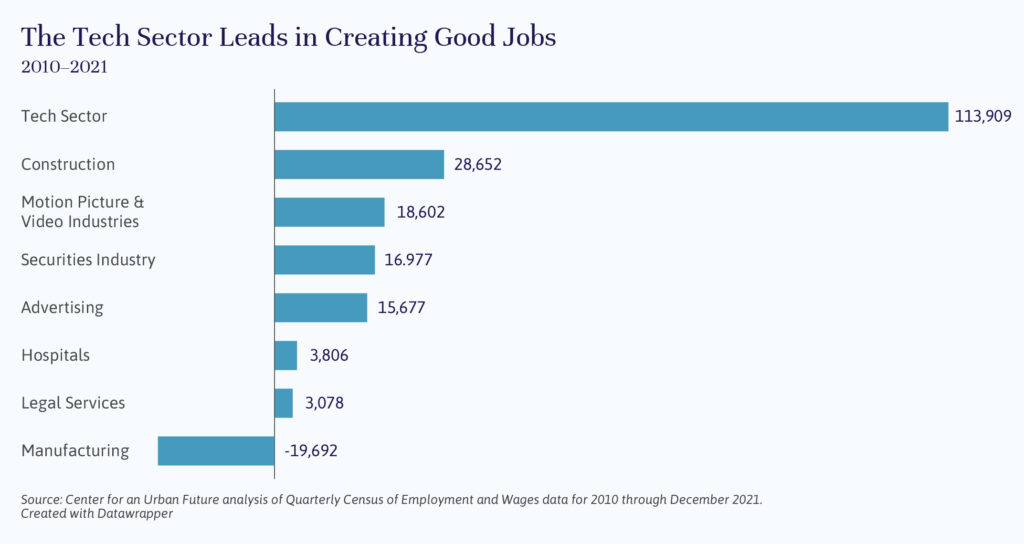

Change of this magnitude is never easy, but the timing is fortunate in this regard too. Unemployment remains low in the United States, at 3.8% as of March 2024, mitigating the usual concerns that a powerful new technology will destroy more jobs than it creates. That has been the case, as illustrated in the chart below, but only over the short term. Longer term, technological advances create new, higher paying jobs.

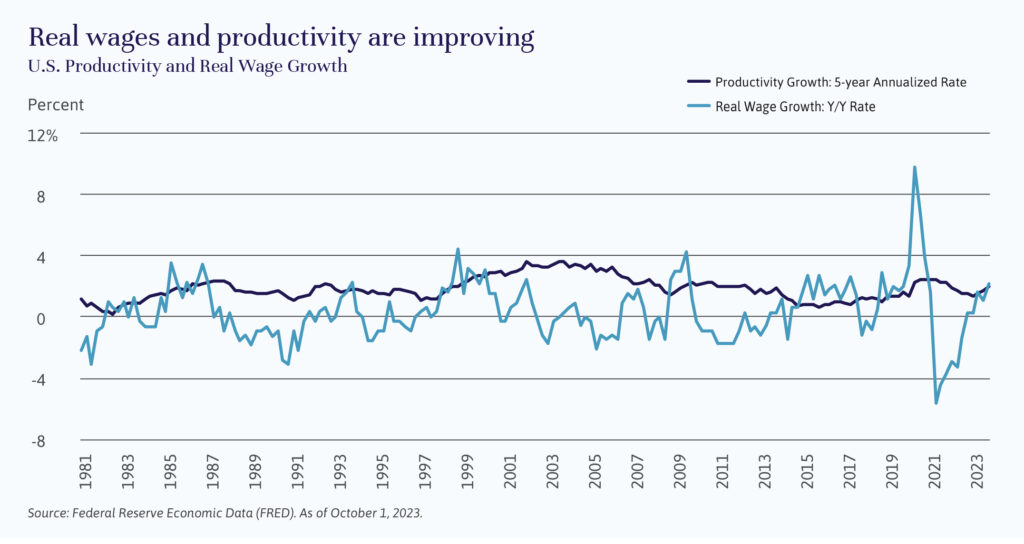

It is difficult to measure productivity trends over short periods of time because of the volatile nature of the two determinants: total economic output and hours worked. Five-year rolling averages, as illustrated by the chart below, are a better indicator of productivity trends.

Real wage growth is an excellent, albeit indirect, way to measure more current productivity trends, as it’s the major positive coincident result of growth in productivity. And, as we can see in the same chart, real wages are improving as the burst of inflation recedes.

In short, we believe there is a better than 50% chance that we are at the beginning of a major productivity boom. This boom could generate 3% or higher annual productivity growth across the economy. If – and this is a big if – the U.S. educational system improves to meet the changing demands of the workplace, the net result in the United States will be an even more robust economy, with even greater economic self-sufficiency and a higher standard of living.

So, life may be getting better. However, it is still early days for long-term investors in AI. We remain mindful that the market can get ahead of itself. (Indeed, many of the companies that were the eventual big winners in the growth of the internet were overvalued during the 90s tech boom.) We intend to have exposure to this exciting area but also to keep our enthusiasm for AI in check and our equity portfolios well diversified.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].