Independent Thinking®

Engaging the Next Generation in Managing Wealth

September 30, 2024

Every family struggles at times to connect. There’s so much at stake: relationships between parents and grown children, relationships between siblings, relationships between partners and other family members, and the happiness of the family as a whole. Wealth, for all its blessings, can add complexity and raise the stakes.

It can get better, though. Some tried-and-true practices in engaging the next generation (and other family members) can help create, grow and preserve wealth through generations. More important still, they can help keep the peace, allowing families to pass on values and appreciate their opportunities, and enjoy each other’s company.

Thoughtful, consistent communication is the starting point. Of course, families are constantly interacting, and parents and grandparents will always make the biggest impression on younger generations through example. But regular family meetings can provide a healthy environment to discuss family members’ common values and goals.

A formal process, which wealth advisors often help facilitate, can help clarify and articulate what the family expects of the next generation and what the next generation can expect from the senior generation. Parents and grandparents have the opportunity to inspire and empower young adults, while ensuring that they have the space and freedom to shape their own lives. Since financial markets and life circumstances are constantly changing, a scheduled check-in builds knowledge and confidence.

Some families create a family mission statement; many involve the next generation in charitable and family investment discussions as a starting point. A good wealth advisor can generally manage this process, helping client families address difficult decisions. If necessary, an independent specialist also can be engaged as part of the advisory team to oversee conflict resolution and manage special circumstances, such as mental health challenges or substance abuse problems.

It’s important that each generation develops its own relationship with the family’s Wealth & Fiduciary Advisors. We can all work together to advance the extended family’s agenda and leverage the broader family plan, but a direct relationship between younger family members and their advisors can help address their individual needs, goals and objectives. Cash flow analysis, portfolio composition and performance, deferred compensation, purchasing homes, borrowing, philanthropy, retirement planning, reviewing the terms of existing trusts, and creating their own trust and estate plan – these are just some of the conversations that the rising generation of family members can engage in.

Good advisors will therefore take the time to get to know each family member, through one-on-one discussions, as appropriate. Done right, the engagement should encourage them to ask more questions and bring more ideas to the table for the benefit of the whole family. And it often makes sense to enlist the family’s broader advisory team, ensuring that the next generation knows the accountants, attorneys, property managers and other advisors – and the next generation of advisors at their firms who will one day be taking over their practices.

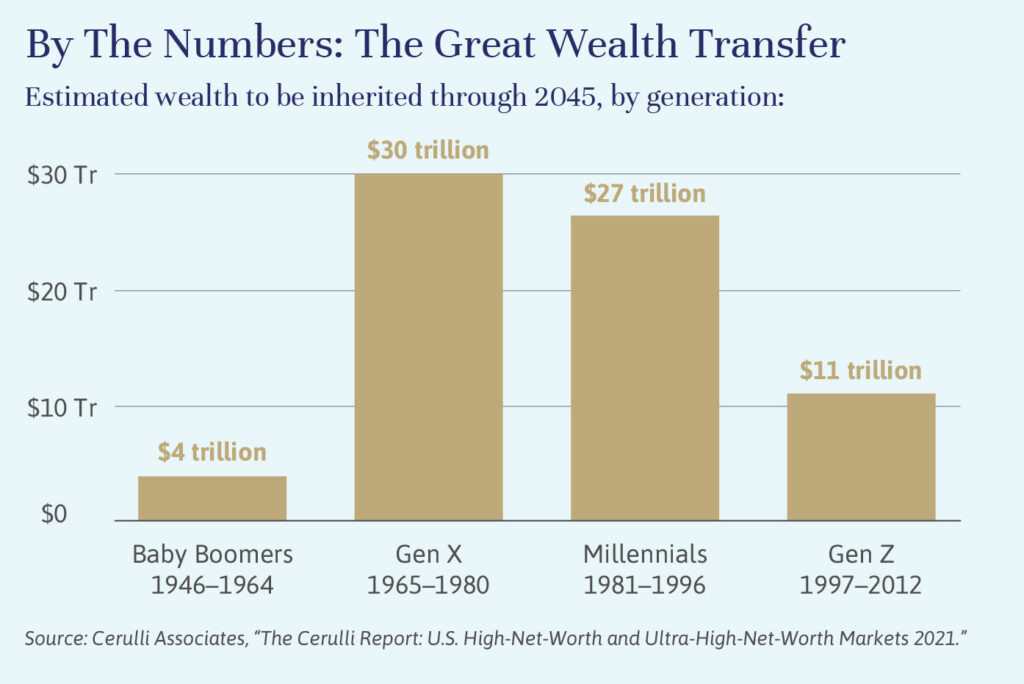

Conversations with and within multigenerational families almost always leads to much deeper planning for life’s big milestones, such as launching or selling a business, getting married, having children, and – eventually – creating a wealth transfer plan for the “next next” generation. All of us at Evercore Wealth Management and Evercore Trust Company truly enjoy engaging families in this type of comprehensive wealth planning. Our work is very personal, and it’s rewarding to be a part of a family’s advisory team across multiple generations of growth.

Ashley Ferriello is a Partner and Wealth & Fiduciary Advisor at Evercore Wealth Management and Evercore Trust Company. She can be contacted at [email protected].