Independent Thinking®

The AI Payoff: What Investors Can Expect

June 18, 2025

Lawyers now spend seconds on contract reviews that used to take hundreds of (billable) hours. Data center cooling costs are being slashed. And digital agents are helping customers unlock productivity at an exponential scale. These are just three examples of Artificial Intelligence, or AI, driving meaningful change in corporate America. Potential further advances – in medicine, robotics, vehicles, marketing, you name it – suggest that the surface has barely been scratched.

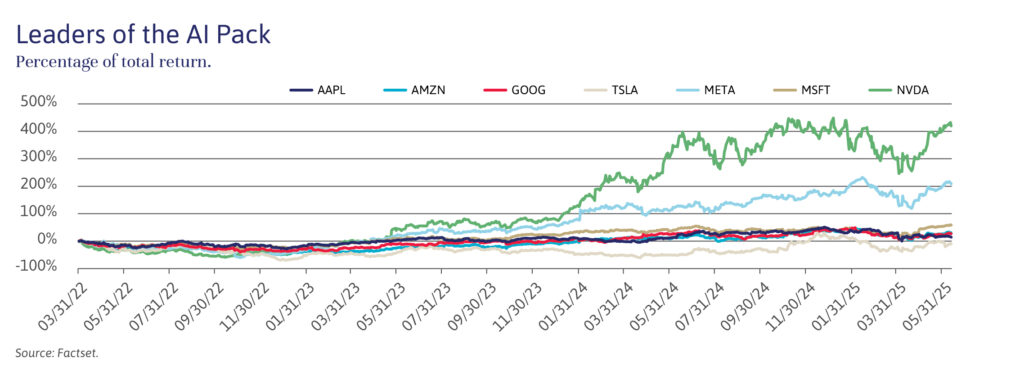

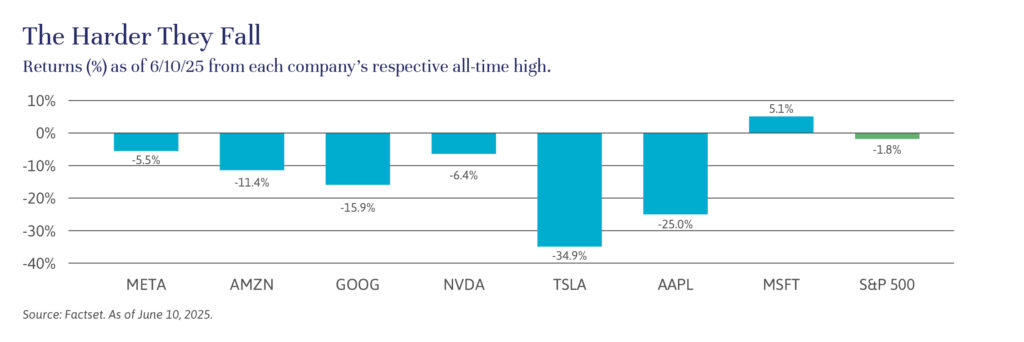

Still, AI has tested investors’ patience lately. After years of dramatic market outperformance, the share price of most members of the so-called Magnificent Seven – Amazon, Alphabet, Apple, Microsoft, Nvidia, Meta and Tesla – tumbled in recent months, as illustrated by the chart below. Though several have recovered appreciably, investors are clearly looking for a payoff.

It’s still early, though. Microsoft CEO Satya Nadella recently noted the evolving deployment of AI and the cloud, pointing out that most companies are early in the process of moving from the AI training phase of adding data and teaching models to understand specific data and processes, to the “inference” phase, in which AI models are deployed to actively drive results. Think of it as moving from learning how to ride a bike to actually riding it.

The gains we’re seeing today may be relatively simple compared to what’s coming. Nvidia CEO Jensen Huang and others have been focused on the next wave of AI: agentic AI, robotics, and autonomous vehicles. Agentic AI refers to systems that can make decisions and act autonomously to complete tasks. A customer service agent that automatically replies to emails, processes returns and updates records without human intervention would be an example. In robotics, companies like Boston Dynamics use AI to help machines navigate terrain, recognize objects, and perform complex functions like warehouse automation. In the world of autonomous vehicles, Tesla and Waymo use AI for real-time decision-making, enabling cars to detect obstacles, follow traffic rules, and operate without human drivers.

At a recent investor conference, Uber CEO Dara Khosrowshahi said that he was seeing a shift from “little optimizations that increase some efficiency by five percent [to] 20%, 30%, 40% increases in efficiency.”1 As these use cases scale, powered by Nvidia chips housed in hyperscaler data centers owned by Amazon, Microsoft and Google, the broader payoff grows more tangible.

Crucially, the pace of innovation is accelerating. Each breakthrough builds on the last, compounding gains and shortening the time between invention and implementation. AI adoption has quickly risen to the top of the corporate priority list, with many seeing it as essential to staying competitive, agile, and efficient in an increasingly digital world. Success will be measured by improvements in margins and operational output. For hyperscalers, it will come down to revenue growth and free cash flow. Microsoft, for one, is seeing stronger-than-expected AI revenue growth in its Azure cloud division, but time will tell if the revenues come to justify the scale of its investment.

There will be bumps along the way. A slowing economy is causing CIOs to tighten budgets. Trade tensions are complicating supply chains and investment strategies. Regulatory issues will take years to settle. Even as open-source breakthroughs like DeepSeek challenge AI incumbents, they also reinforce the sector’s immense potential and, by extension, the long-term value of cloud infrastructure and leading-edge hardware.

In the end, the promise of revolutionizing business operations is simply too great for most companies to ignore. At Evercore Wealth Management, our portfolios include both companies providing AI technology and beneficiaries. For patient investors in companies positioned to take advantage of the AI revolution, we believe that the potential for gains should be well worth the wait.

Michael Kirkbride is a Partner and Portfolio Manager at Evercore Wealth Management. He can be contacted at [email protected].

1 Uber, Morgan Stanley TM&T Conference March 3, 2025.