Independent Thinking®

The Case for Private Equity: The Evercore Wealth Management Private Equity Access Fund

November 21, 2025

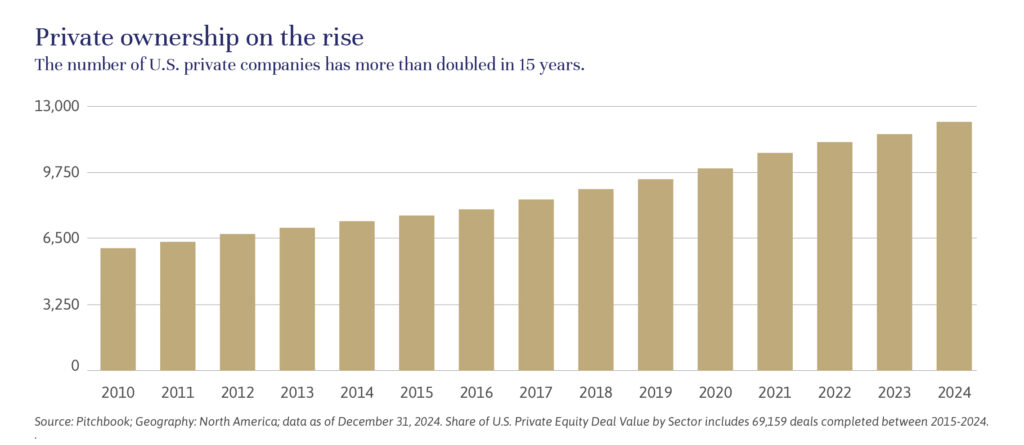

Private equity is an increasingly attractive and important asset class for most ultra high net worth investors — and for good reason. The asset class has matured over the last 30 years and now represents a large segment of U.S. corporate ownership. As illustrated here, the number of private equity-backed companies in the United States has more than doubled in the past 15 years, to over 12,000. Many successful founder-owned firms that would have gone public in the past have instead found a home within private equity funds.

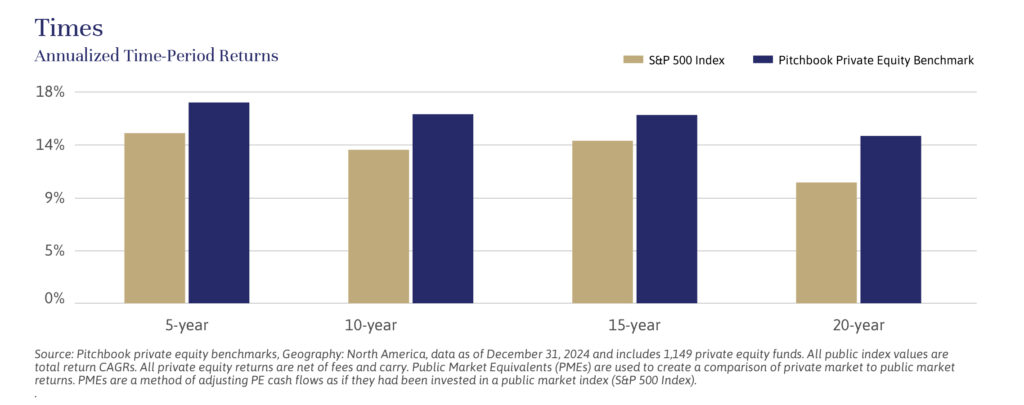

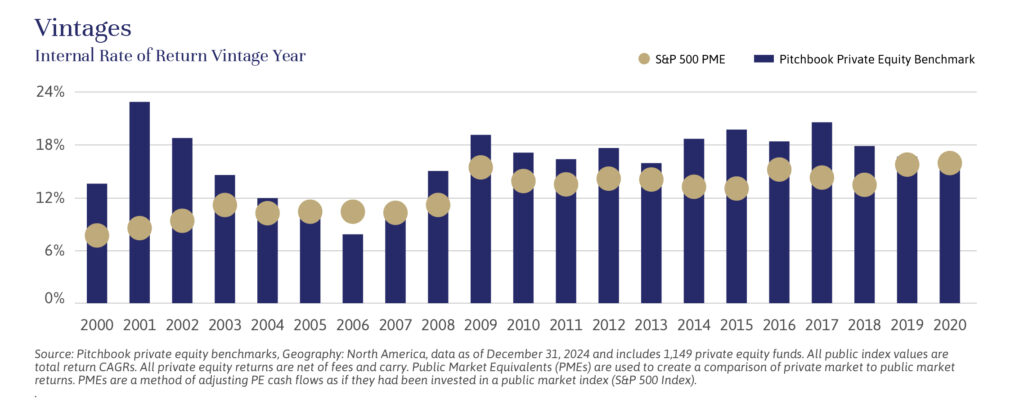

From an investor’s point of view, private equity has historically outperformed U.S. public markets over a variety of time horizons, reflecting the more hands-on, longer-term approach of private fund managers. (See the charts below.) Private equity-backed companies also have the ability to tap into the robust ecosystem of private credit, to provide flexible funding for expansion or realigning their capital structure.

Public companies do face high costs, unrelenting short-term performance pressure, and increased regulation. Because private equity fund managers are able to invest through a full market cycle and maintain a long-term investment horizon, private equity offers well-aligned interests between owners and business managers, with a focus on long-term value creation.

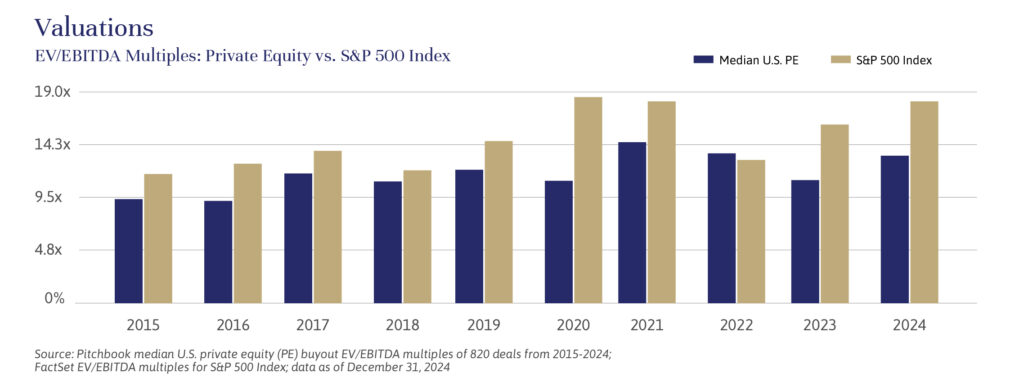

At the same time, private equity valuations remain lower than those in the public markets, as also illustrated in the chart “Valuations”, below. While the S&P 500 is dominated by the largest companies and is, as of this writing, close to all-time-high valuations, private equity-owned companies have far more reasonable valuations.

The advantages of private equity aren’t new. In fact, there was a significant over-allocation of capital to private equity by large institutions three years ago, which is now causing a cyclical slowdown. This suggests that now may be a good time to commit capital to be invested over the coming years at attractive valuations. That’s why we’ve launched the EWM Private Equity Access Fund, as described in the sidebar, “One Fund, Multiple Private Equity Exposures”.

Another advantage for private equity investments in small and mid-market companies is that there are multiple paths to exit — many of these companies are acquired “up the food chain” by larger private equity firms or corporate strategics, often at elevated multiples, or they can be positioned for an IPO.

For investors with a long-term investment horizon and tolerance for illiquidity, allocating to private equity can add diversification and potential for outsized growth. As investment advisors, we work closely with our clients to consider factors such as total portfolio liquidity needs, sizing and timing of commitments, and exposure across vintage years and strategies.

One Fund, Multiple Private Equity Exposures

The EWM Private Equity Access Fund is designed to invest in four and six private equity funds in a single vehicle. Manager selection is key, as top-performing fund managers are better positioned to attract and retain talent, as well as access unique and proprietary deal flow. The fund targets managers that are typically hard to access and often require institutional-sized committments.

This curated portfolio is expected to allocate to funds across private equity sectors, vintages, and strategies — built to complement our broader asset allocation. The operational process is relatively simple: a single subscription, single K-1, and centralized capital calls, with the goal of bringing institutional-quality investing to our clients without the administrative complexity normally associated with this asset class. At present, the EWM Private Equity Access Fund is expected to concentrate on two core areas:

- Private equity buyouts – Funds that invest in established businesses with stable cash flows. Managers of these funds typically pursue portfolio companies that require operational improvements, geographic or product expansion, cost rationalization, or bolt-on acquisitions. Buyouts often involve controlling stakes and use more leverage.

- Growth equity – Funds that invest in fast-growing companies with proven models, recurring revenue, and high customer retention. Growth equity fund strategy generally involves minority stakes and uses limited or no debt

Within these two strategies, the fund targets very specific kinds of opportunities:

- Funds that invest in industries with compelling valuations, secular growth trends, or strong potential for operational improvement. This includes high-growth sectors such as tech-enabled business services, healthcare, and essential services. In addition to being scalable businesses with efficient cost structures, these areas tend to have less direct exposure to international trade and tariffs.

- Within buyouts, we focus on funds targeting small and middle-market companies — where valuations are often more attractive and operational value creation is more impactful. These businesses often lack fully built-out management teams or systems, leaving room for private equity managers to add real value by improving operating margins and growing revenues.

The EWM Private Equity Access Fund will allocate selectively to funds across 2025, 2026 and 2027 vintage years. The fund’s current pipeline is targeting private equity managers that EWM believes know how to navigate complexity and unlock value, and are focused on companies with strong fundamentals and real potential for transformation.

Please contact your Wealth & Fiduciary Advisor to learn more about the EWM Private Equity Access Fund and to evaluate how private equity could help you meet your long-term financial goals.

Stephanie Hackett is a Partner and Portfolio Manager at Evercore Wealth Management. She can be contacted at [email protected].