Independent Thinking®

A Different Perspective on the Markets

October 23, 2017

It is not true that the U.S. market is overvalued by every metric. Factor in inflation, and stocks are fairly valued, trading right around historic averages.

Most investors don’t account for inflation when evaluating the stock market. While there is widespread agreement that low inflation generally justifies a higher price-to-earnings ratio, the P/E ratio itself, along with other, less commonly used metrics, does not reflect inflation. Indeed, it’s unfortunate that investors settled on the convention of using the P/E ratios, because just about all other investments are evaluated based on their expected rate of return, or yield. For example, the 10-year Treasury bond is described as selling at a 2.15% yield, not at 46.5 times its coupon.

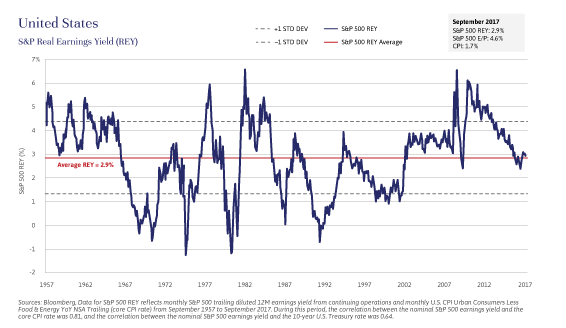

To better understand the relationship between the valuation level of the equity market and rate of inflation, we need to use the reciprocal of the P/E ratio – the earnings yield. By taking the earnings yield of the market over the last 60 years and subtracting the concurrent inflation rates, we discover the real earnings yield, or inflation-adjusted earnings yield of the market. The current real earnings yield of 2.9% is pretty much bang on the 60-year average, as illustrated in the chart below. Stocks aren’t cheap at this level, but they aren’t overvalued either.

Investors who focus exclusively on P/E ratios and other metrics that don’t take inflation into account are understandably worried about an imminent correction. The P/E ratio is at or near all-time highs (excluding the nonsensical valuations in 2000 at the top of the tech/telecom bubble), giving rise to headlines like CNBC’s recent “Any Way You Look at It, This Market is Overvalued.”1 But again, their ways of looking at it don’t reflect continued low inflation.

Our approach certainly doesn’t rule out a change in the markets. While we believe that inflation will remain low for some time (see Brian Pollak’s article here), and that a recession in the next two or so years seems unlikely, there are always risks on the horizon. If inflation, currently 1.7%, returned to its long-term average – of about 3.7% – the stock market valuation would come down considerably.

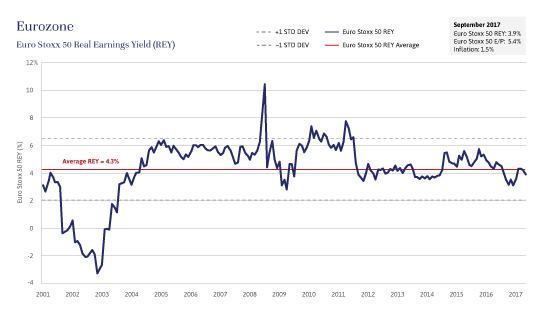

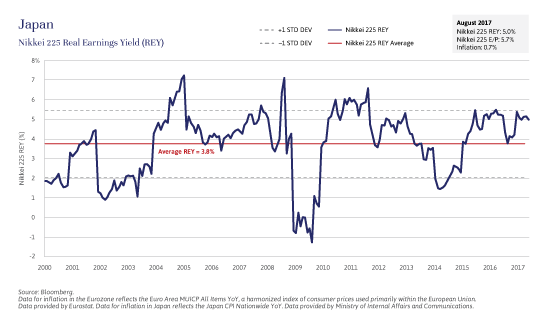

Still, it is more accurate to use the stock market’s real earnings yield when comparing the valuation of the stock market to other asset classes, or various expected growth rates or various levels of inflation. On this basis, U.S. stocks are at present not overvalued. The valuation level of the international markets similarly appears reasonable in the context of local inflation rates. Most of the developed markets are also trading close to their long-term average valuations when adjusted for inflation.

Market commentators generally compare stock market valuations to those of the bond markets and leave inflation aside. However, the bond markets have their own dynamics, including heavy manipulation by the central banks. Central banks in most developed markets are having a harder time manipulating inflation in recent years, and that’s not for lack of trying. Indeed, after eight years of Federal Reserve investment, the U.S. Treasury market still looks expensive, even when current low inflation rates are taken into consideration. Treasuries with maturities of five years or less now have negative real interest rates.

This is not normal – nor do we view it as any kind of “new normal.” We are generally conservative investors and are not interested in justifying high prices for their own sake. Instead we are accounting for inflation in determining valuations, which most other investors fail to do.

For these reasons, it is our view that the U.S. stock market is, as a whole, reasonably priced. Of course, the usual amount of risk in the market remains. Earnings could go down because of an economic recession or inflation could increase if the economy overheats. While we do not see any indications of either of these events at present, we remain vigilant. In the interim, as inflation rates remain near record lows, we continue to maintain our policy allocation to growth investments in our client portfolios, adjusting for individual and family circumstances, and for appetites for risk.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].

1 https://www.cnbc.com/2017/07/24/any-way-you-look-at-it-this-stock-market-is-overvalued-goldman.html

Thriving & Surviving in a Low-Inflation Environment

By Tim Evnin

Continued low inflation permeates many aspects of business, impacting corporate earnings and stock prices. The companies that innovate, grow units and lower costs will have a better chance at thriving in this environment. Others may not survive.

The most robust contenders are driving value for consumers by attacking cost and inefficiencies, while improving their ease of use. Amazon and Google are giants among this group, but much smaller companies, such as commercial food equipment supplier Welbilt, are also navigating this economy.

Amazon delivers often amazing convenience, especially through its Amazon Prime offering, and focuses on driving prices down for its customers, as other, more traditional retail companies know all too well. Google’s search capabilities and increasingly focused advertising platform are making price discovery simple. And Welbilt offers smaller, more efficient and more automated equipment than its rivals to help its customers cut space, energy, and manpower costs.

Consumer staples companies are generally not faring as well in this low-inflation world. This sector thrived for years in large part by increasing prices over and above the rate of inflation to augment unit growth. Low inflation makes these price increases much harder to implement. We have very little exposure to this sector, focusing only on the few companies able to generate earnings without having to raise prices. Lamb Weston, a recent spin-off from ConAgra and the maker of what it describes as innovative frozen potato products, is a recent addition to our portfolio.

Tim Evnin is a Partner and Portfolio Manager at Evercore Wealth Management. He can be contacted at [email protected].