Independent Thinking®

A Thing of Beauty: Art & Estate Planning

July 20, 2017

For many art collectors, the most significant decision is often the last: how to dispose of the works. Collections, like the works themselves, are the product of passion, as well as a considerable investment of time and money. This aspect of estate planning can be difficult, but it’s a necessary step for anyone who doesn’t want to leave the decision to his or her executor.

Essentially, there are three broad options for securing an artwork’s next home: sell; donate to a museum or other charity; or gift or bequeath to family or friends.

Sell

Some collectors expect to eventually sell their artwork through an auction or consignment house during their lifetime. As with any sale of an appreciated asset, they will be subject to tax, along with any sales fees or commissions. Collectors, as opposed to investors or creators of art, who have held an artwork for over one year will pay a federal tax rate of 28% on the appreciation from the date of purchase.

Artworks sold as part of an estate will, under current estate tax law, receive an increase, or step up, in cost basis if they have increased in value since their purchase by the decedent, effectively decreasing any tax that may be due upon a sale. However, as a family in Minneapolis recently discovered in appraising the abstract expressionist art in a grandmother’s estate, the current market value is included in the estate for estate tax purposes. The matriarch, who had bought her first work of art as a student in Europe in the early 1950s, had built up a sizeable collection over time, sharing her interest and her knowledge with her children and then her grandchildren.

The risk for any long-term collectors is that the art, especially ones of significant emotional value, may need to be sold at an inopportune time to pay estate tax or to resolve an estate bequest, if the beneficiaries cannot or do not want to hold the artwork. Advance planning can mitigate this risk. The Minneapolis family was able to use a combination of charitable gifting, family bequests, and auction sales to keep the works they valued most in the family and dispose of the rest in a tax-efficient manner.

Donate to Charity

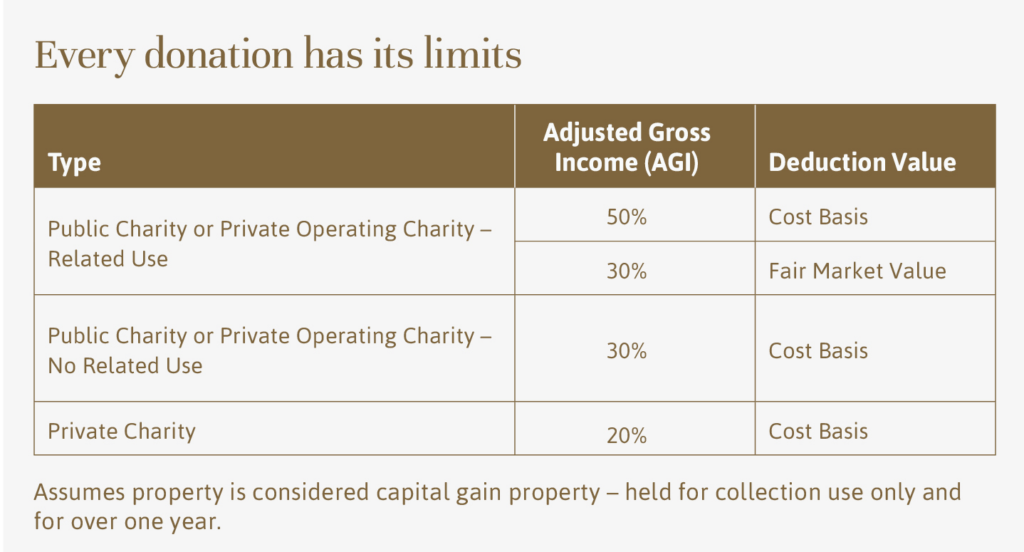

To avoid or offset the tax on the appreciation, collectors may wish to consider giving pieces away to charity during their lifetime. It is important to consider the attributes of the charities that are the intended recipients, as there are limits on the amount of charitable deductions that can be taken in one year and in the value of the deductions. Charitable deductions that exceed any of the limitations in the current year can be carried forward for up to the next five years, to apply to future tax returns.

Collectors who know that they want to donate their artworks to a charity but have not yet identified the specific recipient could consider establishing a donor advised fund.1 This enables the collector to take the associated tax deduction but delay the actual transfer. There are typically no required annual distributions from these vehicles, which means that collectors can, in time, determine the ultimate charitable beneficiary. Private foundations offer similar avoidance of capital gains tax but differ from donor advised funds in that the private foundation will have an annual requirement to pay out to qualified charities.

It’s worth noting that if a public charity sells the piece within three years of the gift, collectors who took a deduction for the full fair market value will be required to amend their previous tax return to only take the original cost basis as a deduction.

There’s more to selecting a charitable beneficiary for a collection than tax, of course. An artwork may have particular meaning to a foundation that supports a related subject, for example. But the options should be considered in light of the likely impact on the collector’s current tax profile and in connection with both future taxable income expectations and additional planned charitable gifting.

A bequest to charity at death will result in a full fair market value deduction on the estate tax return, with no limitations. Collectors who don’t plan to gift the works in their lifetime can reduce the estate tax on the value left in their estate by giving to charity at their death. In the interim, many museums or galleries will take pieces on loan for display. While these do not generate a charitable deduction, it is nevertheless a popular option for many collectors who are happy to see and even influence the public display of their works.2 An estate plan can later direct an official – and deductible – gift to the institution.

Give to family and/or friends

Collectors with artwork that is valued within the current annual gift tax exemption of up to $14,000 for each individual, per donor, can start giving now without incurring a gift tax. If the item is valued at over the annual exclusion amount, the excess can be deducted from the allowable lifetime gift exclusion.

Should the collector decide to transfer the artwork to family and/or friends at their death, advance planning can facilitate this process. Some examples include:

- Specifically directing what happens to each and every piece.

- Giving to a surviving spouse, who can receive the artwork with the step-up in cost basis but with no estate tax through the unlimited marital deduction, with a related plan to be implemented at the second death.

- Setting up a life estate in which the surviving spouse can continue to enjoy the artwork during life, but the ultimate disposition occurs at his or her death as directed by the first decedent.

- Organizing a lottery for heirs to draw numbers to determine the order of selection. Each selection is valued based on the federal estate tax appraisal and equalized at the end of the selection process with other liquid assets in the estate.

- Engaging a qualified fiduciary to oversee a fair and equitable division to avoid potential family conflict.

If the work of art is very valuable, consideration should also be given to a gift of a fractional interest to either a charity or a family member. There are complicated procedures to follow, but it may be worth the effort. For example, a New England family that winters in Florida could consider a fractional gift that allows the art to be kept with a family member or on display at a charity during the winter months.

Many people spend years finding just the right pieces for their collections. Early planning for the art’s next home should prevent a forced decision and avoid family conflict, helping to keep the art a joy forever.

Stacie Price is a Partner and Wealth & Fiduciary Advisor at Evercore Wealth Management. She can be contacted at [email protected].

1Not all donor advised funds may allow gifts of artwork and collectibles. Each sponsoring organization will have requirements for accepting artwork and collectibles.

2Sales and use taxes may apply and depend on state law.