Independent Thinking®

Affluent Baby Boomers and Inflation: The Good, the Bad, and Some Options

August 1, 2023

Baby Boomers have it pretty good. By and large, we’ve enjoyed high and full employment, exciting technological advances and extraordinary asset growth. And the best may still be to come, as affluent Americans live longer and heathier lives. Many of my generation are still working; others have embarked on retirements rich with possibilities. And a growing number of us are shaping lives that blend work and myriad other interests. Really, what do we have to complain about?

Well, maybe we can complain about inflation. While it’s ebbed considerably in recent weeks – and is nowhere near the double-digit rates we in the vanguard of our generation experienced in the 1970s when we started working – prices still seem high, notably for the goods and services that appeal to high net worth consumers. Our generation has partly brought this on ourselves, as we seem to be busy spending at least some of the $78.3 trillion gross that U.S. Baby Boomers have accumulated (see Where Are the Kids? Demographics in the United States by John Apruzzesehere). Our unprecedented numbers and wealth are driving prices higher for the things and experiences that we tend to value.

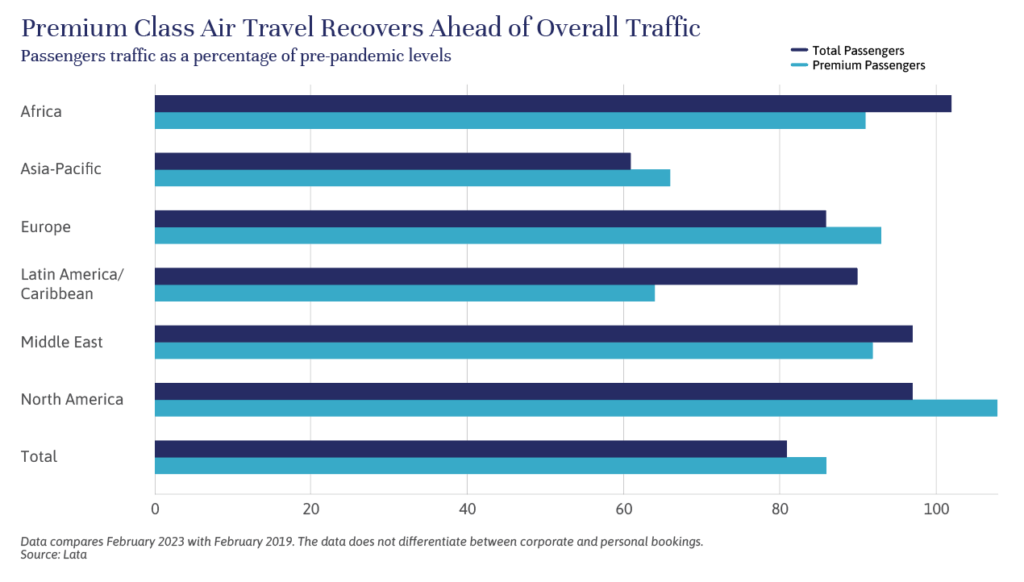

Take travel, for instance. Prices haven’t been this high in years, not because business travelers have returned (they haven’t), but because well-off leisure travelers have taken their place, willing to pay through the nose to avoid the worst of the airport crush and get some rest or experience adventure. Planes are packed, as are upmarket hotels, resorts, restaurants, and theaters and concert halls. I didn’t pay tens of thousands of dollars to see Taylor Swift, although I understand that a surprising number of Baby Boomers did, but I did pay about twice what I expected on a recent trip to Paris and Berlin.

Indeed, just about everything that high net worth Baby Boomers could want seems more expensive now. Golf club memberships, luxury clothing, accessories and cars, tutoring and summer camps; name it and it probably costs far more now. Property casualty insurance is another striking cost for high net worth homeowners, with premiums for upscale homes rising more than 10% a year in coastal communities and those vulnerable to wildfires. (We hosted a webinar on just this subject on June 22; contact your advisor for replay details.) It’s difficult to ascertain just how much the high net worth rate of inflation is, of course, since people make very different choices, but for argument’s sake, let’s say it’s twice the rate of inflation generally. Personally, I think that’s conservative.

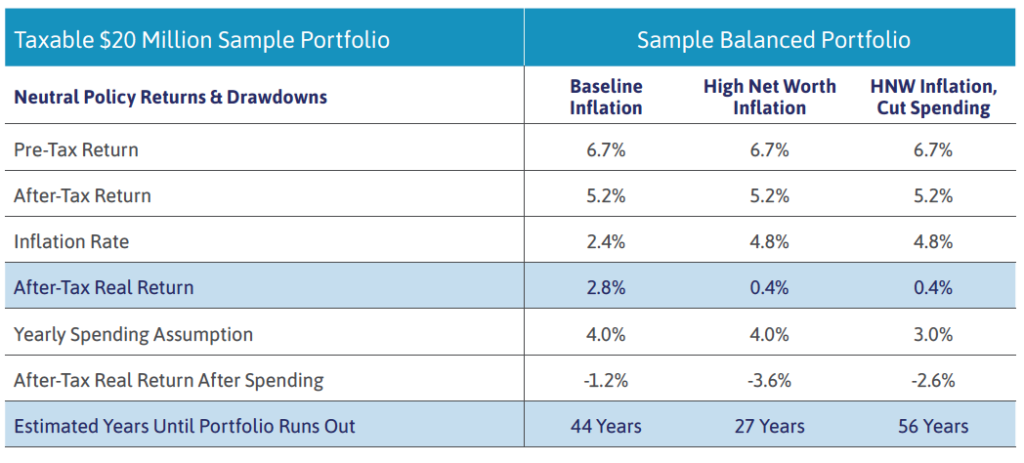

So, what does that mean for portfolios? Please see the piece below by Jake Stoiber with a couple of examples of a balanced $20 million portfolio – one based on a typical spending rate of 4% and another on a more frugal 3% of the portfolio. (These are all for New York state-based clients for tax purposes; figures will change depending on domicile and other factors.) Clearly, spending has an enormous impact on our assets, far more so than our attitudes toward risks. And spending on more inflated items has that much greater of an impact. Interestingly, when we ran these same numbers for a more aggressive accumulation portfolio, the differences were less significant.

This period of still relatively high inflation won’t last forever. Other periods of extended inflation have lasted on average for four years, and the overall inflation rate of the past 75 years is 2.5%. For those still earning, chances are you’ll be able to ride this period out, if you plan accordingly. But for the many Boomers in or approaching retirement, it’s important to consider the overall impact on portfolios of rising spending – notably on the luxury goods and services – in the context of long-term lifestyle and wealth transfer plans.

Inflation can undermine our plans for ourselves and for the people and causes we care for. It is important to budget realistically and to take into account that your spending may be rising faster than the rate of inflation. If you are spending more than our projected capital market returns, we encourage you to plan carefully. The real impact on portfolios can be managed, through close planning with a trusted wealth management team. It may be that you choose to curtail your spending, or take on more portfolio risk, or decide on a combination of both. Alternatively, you may want to revisit your goals, drawing down more of your assets if necessary to maintain your lifestyle and adjusting bequests to heirs and charity. The decision will be very personal, so it’s important to know what to expect – and exactly what your options are.

Most of our clients like to eat well and sleep well. And with proper planning, we believe they will be able to continue to do just that. Successful members of my generation – who have had it so good for so long and still have so much to look forward to – will want to keep it that way.

Jeff Maurer is the Chairman of Evercore Wealth Management and Evercore Trust Company, N.A. He can be contacted at [email protected].

Inflation: Measuring the Potential Impact

What does inflation do to a portfolio? Using our updated capital market return assumptions and our baseline sample balanced portfolio as a starting point, we put some numbers behind the impact on a hypothetical $20 million portfolio, given various inflation, spending and risk assumptions. It is important to remember that return expectations can change, and as Jeff Maurer writes above, risk appetites and spending habits can always be tailored. At current inflation rates, a portfolio can outlast moderate spending; it may be more significantly eroded – or even exhausted – by spending more typical of high net worth Baby Boomers, especially the younger members of the generation, still in their late 50s and 60s.

Further, shifting into a more aggressive portfolio doesn’t buy investors much more time – just two years – and exposes investors to greater drawdowns, which can also influence a portfolio’s drawdown path. At that point, $20 million may not feel like as much as it should. However, decreasing spending by just 1% can buy an extra decade or more. Periods of high inflation may be good opportunities to reduce spending, particularly on luxury goods and services, and/or to revisit long-term financial goals.

Hypothetical and Future Looking Statements. See important disclosures on the back of this publication. This example includes projections or other forward-looking statements regarding future events, targets, intentions or expectations. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. Estimates for each asset class used within the sample portfolio illustrated above are based on proprietary Evercore Wealth Management research and both historical return data and on various forward looking forecasts from government agencies and independent forecasters. This 10-year return forecast assumes the portfolio is invested in Evercore Wealth Management’s sample balanced portfolio asset allocation. Returns are based on the following assumptions: After-Tax assumptions: Cash and Credit Strategies taxed at ordinary income rate. Defensive Assets are exempt from taxes. Growth Assets taxed at long-term capital gains rate. Diversified Market Strategies taxed at a weighted average rate of 25% capital gains and 75% ordinary income. Illiquid Assets is taxed at a weighted average rate of 25% ordinary income and 75% capital gains. After-tax real returns are the expected returns net of estimated inflation. Asset class allocations for the sample portfolio illustrated may change. Returns are based on performance of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison. In addition, the Advisor’s recommendations may differ significantly from the securities that comprise the indices.