Independent Thinking®

Bets Off: The Trade Behind Recent Market Volatility

March 28, 2020

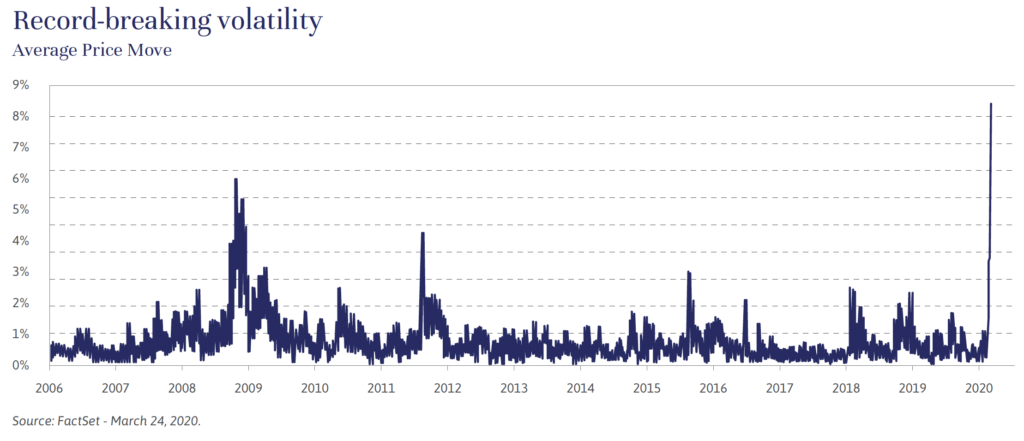

How is it possible for the stock market to swing 10% up or down in a single day, or for the entire Treasury bond yield curve to plunge by over 50% in under a month? Is it all about COVID-19, or is there more at play in the markets?

The recent level of market turbulence suggests that the most active investors are deploying a tremendous amount of leverage. Futures contracts that magnify positions by as much as twentyfold can disrupt traditional trading and leave investors reeling.

One very popular investment strategy may be especially to blame. When Federal Reserve Chairman Jerome Powell said last October that the Fed would not increase interest rates until inflation persisted above 2%, traders calculated that they could make large leveraged bets on a fall in short rates (from three months to two years). In other words, own the S&P 500 and enter into a futures contract with enough leverage to profit from, say, a 1% drop in interest rates to offset a 10% loss in the stock market.

The traders were further encouraged by evidence of the so-called Fed put; the Fed’s willingness to cut interest rates if the stock market declined. Their risk party play seemed like a sure thing; there was almost no chance that short rates would rise. By March 9, when the entire yield curve out to 10 years was no more than 0.5% and the stock market had dropped 20%, the trade had a 10% profit.

But at that point, there was no more room for rates to fall unless the Fed took interest rates into negative territory (still considered highly unlikely), so the interest rate hedge on the stock market became ineffective.

Up to $1 trillion may have been invested by hedge funds and large institutions in versions of this trade. Most of these trades have been unwound because these investors were only interested in owning the stock market when they thought they had a very good hedge. Once that was gone, they became sellers at any price.

Most of the risk parity trades have now been closed out and other highly leveraged positions have been liquidated. While the markets will still reflect intense investor reaction to the pandemic and its many associated economic headlines, we do expect a reduction in the current extreme volatility.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].