Independent Thinking®

Beyond the Balance Sheet: Planning for Generations

October 29, 2020

From shirtsleeves to shirtsleeves in three generations is a line that everyone knows – and for good reason. Empirical studies of economic mobility suggest that inherited wealth generally erodes with each generation.

But it doesn’t have to be that way. Families can buck the trend with comprehensive planning. There’s a lot more at stake, far beyond the family’s current balance sheet. What are the goals of each generation? How are they evolving? And how do they affect other family members and the family as a whole? Individuals may agree on a family ethos but harbor very different ideas on priorities and timing.

The best multigenerational wealth plans start with conversations, from informal one-on-one meetings to structured family gatherings with trusted advisors, to frame objectives and allay anxieties. The holidays may be a good time to initiate these discussions, whether in person or virtual. (It’s also a good time to initiate early discussions around the transfer of family leadership, a subject we will explore in depth in the next edition of Independent Thinking.)

Once everyone is more or less on the same page, it’s time to plan. The role of the wealth and fiduciary advisor is to analyze the data, provide a blueprint for the family’s wealth structures and a protocol for financial decision-making, and help establish solutions, such as multigenerational trusts that enable each generation to engage with their trustees. Advisors should also educate and support individual family members as appropriate, while always maintaining the objectivity of experienced fiduciaries.

For the first generation, the planning focus is likely to be based on detailed estate and gifting analyses and related wealth transfer strategies, a subject on many families’ minds as we approach the election and a possible change in the gift and estate tax exemption (see the article by Julio Castro and Jen Tse here). Adding to existing trusts (or consolidating older trusts into new ones more reflective of current circumstances) is also top of mind for many families at present, especially as many trusts were set up in 2012 at the point of another major gift and estate tax inflection. An experienced trustee should be able to recognize when existing or evolving circumstances warrant potential change.

For the next generation, those in middle age, the focus tends to be on retirement and domicile. What’s the right time to take Social Security, purchase or add to life insurance policies, perhaps with long-term care insurance riders? Is now the right time to upsize to work more effectively from home, downsize, buy a vacation home and/or move to a more tax-friendly state? Distributions from dynasty trusts help support this generation’s goals, but trustees must be mindful of tax and the potential effect on the assets available for future generations. As this is the generation with the most hands-on responsibility for others, there’s often also plenty to discuss around the care of aging parents, especially during this pandemic, as well as around efficiently funding tuitions in a dramatically changing higher education landscape and helping buy first homes and establish businesses.

Their children – generation three – may be preoccupied with establishing careers, homes and families. The entrepreneurs among them may be seeking access to capital, with their parents and grandparents as potential sources through intrafamily loans or loans from existing trusts – an option that requires thorough analysis for everyone’s benefit. Those employed by established companies might need some help in reviewing benefit packages and investment plans.

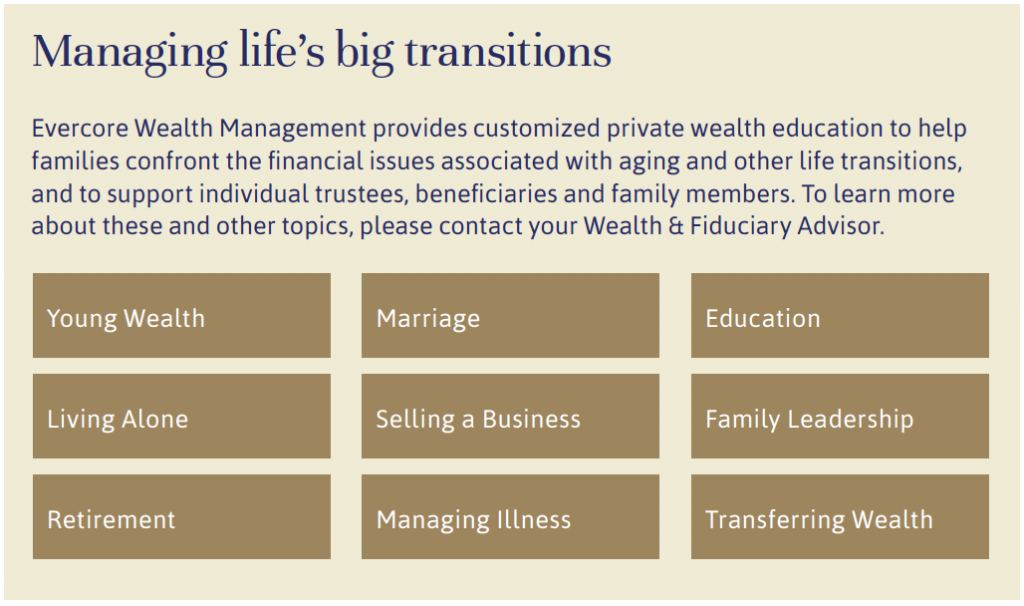

And for the very youngest members of a four-generation family, it may soon be time to start learning the value of a dollar – and adding to their financial education every year. That’s likely to be something everyone in the family will agree on, and may wish to support or explore for themselves as they face the life transitions illustrated below. We all have something to learn, after all.

Multigenerational family wealth is often complex, bringing responsibilities as well as advantages to its members. At Evercore Wealth Management and Evercore Trust Company, we work with families to help preserve harmony while securing lasting legacies.

Kate Mulvany is a Partner at Evercore Wealth Management and a Wealth & Fiduciary Advisor at Evercore Wealth Management and Evercore Trust Company. She can be contacted at [email protected].