Independent Thinking®

California Goes to the Polls, Again

October 27, 2014

Investors in California debt will be focused on the first two of the six initiatives1 before state voters on November 4. Proposition 1 (The Water Quality, Supply and Infrastructure Improvement Act) would authorize the issuance of $7.5 billion in statewide general obligation bonds to finance a safe drinking water reliability program. Proposition 2 (The Rainy Day Budget Stabilization Act) proposes to institutionalize increases in the rainy day budget stabilization fund. Both seem to us as reasonable as they sound.

Proposition 1

Due to the recent and prolonged drought, the state needs to increase and improve water supplies, arguably now more than ever. Passing Proposition 1 would ultimately reduce some capital burdens on regional and local water authorities. While the broader “Delta Question”2 still needs to be addressed, the projects financed from Proposition 1 should improve water supply.

California urban water districts–a sector in which Evercore Wealth Management has investments in– have been addressing their capital needs over many years and will continue to do so. Most of these districts have the financial capacity to handle these capital costs. Agricultural districts, which Evercore has avoided for the most part, are generally less attractive to investors, as they are vulnerable to cuts in their water allotments during droughts and don’t always have the financial flexibility to develop new and improved water sources.

We expect this proposition to pass and, in conjunction with the recent passage of legislation regulating groundwater use, we will reassess, on an individual basis, bond investment in agricultural water districts. There’s no sure thing in the California voting system, however, and heavy rains in the interim could lull voters into a false sense of water security.

Proposition 2

Our hope is that Proposition 2 will also pass, but it may face more opposition than the water proposal. Proposition 2 would help the state continue to devise a structurally balanced budget. However, related prospective impacts on public school districts are fueling opposition. (School districts in general are nervous about lost or restricted state funding.) Still, we believe that the financial stability afforded by the passage of the proposition is more important to the state as a whole than the school funding issues.

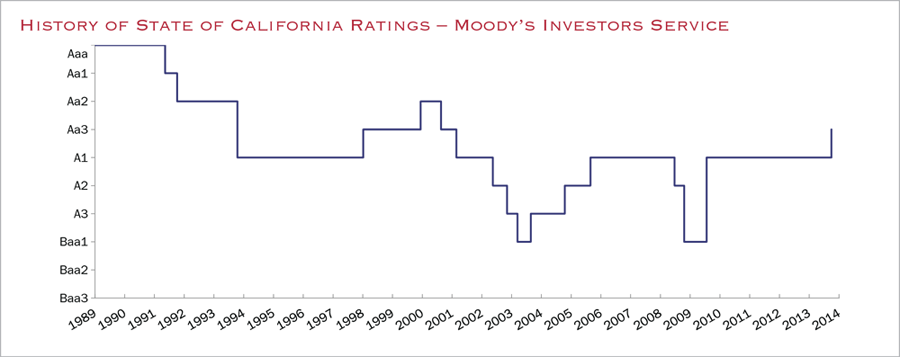

If this proposition were to fail, state spending will continue to swing between excess and draconian cuts – which has been California’s problem in the past, and creates a climate that does not serve bondholders well. (See state ratings chart, which shows how volatile the ratings have been for California – the most volatile of any state in the country). School districts could also be subject to the same volatility and bondholder risks may lead to a selling opportunity before financial flexibility is potentially diminished.

Next Steps

Passage of both propositions will continue to help stabilize the state in terms of budgetary controls (Proposition 2), as well as provide additional resources in dealing with the current and any future droughts (Proposition 1).

If Proposition 1 fails, we suspect local and regional water agencies will continue to issue debt to increase treatment, reuse and capacity needs. While most systems can accommodate these increased costs, there will be a limit to these capital expenditures and we will need to reassess our water revenue bond holdings.

If Proposition 2 fails, the state will lack the institutional mechanics to deal with a highly volatile revenue base. This handicap, in conjunction with a lack of spending discipline, and a decline in sales and income tax rates once Proposition 30 sunsets, could cause the state to revert to its old profligate ways. While we have no expectations of California defaulting on its own debt, underlying government entities that are partially reliant on the state for funding (school districts, public universities, counties) could potentially suffer.

Establishment of a Meaningful Rainy Day Budget and Stabilization Fund

Summary of key changes if Proposition 2 passes

State Debts

- Requires state to spend minimum amount each year to pay down specified debts. After 15 years, debt spending under Proposition 2 becomes optional. Amounts that otherwise would have been spent on specified debts would instead be put into the Budget Stabilization Account or “BSA”.)

State Reserves (provides more teeth to existing Rainy Day Fund mechanism)3

- Changes amount that goes into a state budget reserve account

- Increases maximum size of the BSA

- Makes more restrictive rules for when state can put less money into the BSA

- Changes rules for taking money out of the BSA

School Reserves

- Creates state reserve for schools and community colleges

- Sets maximum reserves that school districts can keep at the local level in some future years

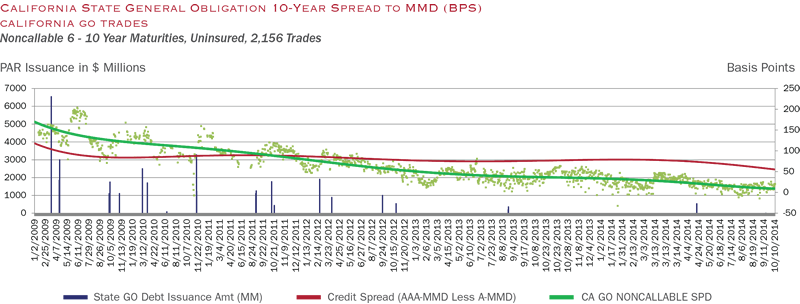

Effects of Recession on State Budget Reserves. The worst economic downturn since the 1930s began in 2007, resulting in a severe recession. For several years, the state had large budget problems and took many actions to balance the budget. Because of these budget problems, California’s governors decided not to put money into the BSA. California had no state budget reserves at all for several years. This year, for the first time since the recession, Governor Brown decided to put money into the BSA. As discussed later, the result has been the tightest spread on California general obligation bonds in many years.

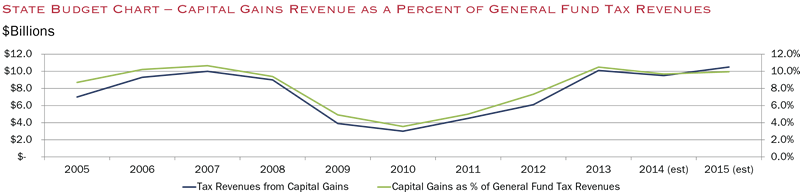

In California, a tendency to make long-term spending commitments in flush times without setting much aside for a rainy day, combined with a heavy reliance on capital gains taxes, has led to volatile fiscal performance and, as a consequence, volatile ratings. Much of California’s revenue volatility arises from its reliance on capital gains taxes. A revision of a reserve proposal would fund the reserve through excess capital gains tax revenue. The measure could also help improve the state’s credit quality. These two attributes of California’s finances – a weak or absent reserve fund mechanism combined with a volatile revenue base – have undermined the state’s credit quality over the years.

(See Footnote on Mechanics on Rainy Day Fund and Proposition 98.)4

Source: California Legislative Analyst’s Office

Water Quality, Supply and Infrastructure Improvement Act of 2014

Providing clean water throughout California while protecting the environment presents several key challenges. First, water is not always available where it is needed. For example, water from Northern California is delivered to other parts of the state, such as farmland in the Central Valley and population centers in the San Francisco Bay Area and Southern California. Second, the amount of water available can change widely from year to year. So, when less water is available in dry years, it can be difficult to provide all of the water that people need throughout the state. This can include providing enough water to maintain natural habitats–such as wetlands–for endangered species, as is required under state and federal laws. However, in very wet years, the state can sometimes experience floods, particularly in the Central Valley. Third, water is sometimes polluted, making it unsuitable for drinking, irrigating crops or fish habitat. Fourth, parts of the state’s water system have affected natural habitats. For example, providing more water for drinking and irrigation has reduced the water available for fish.

Recently, an extraordinary drought that has strained California’s water supply spurred a concerted push for a new water bond. Lawmakers moved to replace an $11.1 billion measure originally written in 2009 previously slated for the ballot, convinced that voters would reject its high price tag. Instead, voters will see a $7.5 billion measure.

The bond measure provides funding to (1) increase water supplies, (2) protect and restore watersheds, (3) improve water quality, and (4) increase flood protection. The bond money would be available to state agencies for various projects and programs, as well as for loans and grants to local governments, and private water users.

Despite the drought, major metropolitan areas in Southern California and the Bay Area are still doing relatively well, thanks to significant investments in conservation, supply diversification, and new infrastructure that allow communities to share water during emergencies. However, in northern and central parts of the state, communities that do not have diverse water sources will be facing sharp cutbacks in water use. One important way to conserve is to reduce water for landscaping, which currently makes up roughly half of all residential water use. At Evercore, we are mindful of the challenges faced by local California water agencies and, for the most part, are comfortable with most organizations’ approaches to water management. Consequently, we have invested in this sector for our clients.

Source: Loop Capital Markets

As indicated above, the municipal market appears to recognize the progress made by the state based on trading values for 10-year California general obligation debt compared to the AAA scale. It should also be noted that, at first (2009-12), the narrowing was partially attributed to less debt issuance than average during the prior few years. However, the narrowing trend continued for 2012 to present, even with the continuation in California state issuance, which partially reflects the continued improvement in state finances. At the widest spreads in 2009, the state was in abysmal financial shape. A voter initiative to raise taxes, similar to the one passed recently, failed miserably. California was also running record deficits and had to resort to delaying payments to local governments, state employees and vendors to manage its cash flow crisis during one of the worst recessionary periods in the state’s history. Significant fiscal improvements that occurred under the Brown administration–with cuts in programs, ease in passing budgets with a simple majority now required and voter approved tax increases, have stabilized financial operations. An improving economy and the potential for establishment of a more stringent Rainy Day Fund should continue, or at least maintain, this trend. It should also be noted that the red line shows the general narrowing of spreads between the AAA-rated compared to the A-rated Municipal Market Data spreads.

1The other four Propositions include Proposition 45 “Public Notice Required for Insurance Company Rate Initiative”; Proposition 46 “Increase the Cap on Damages that can be Assessed in Medical Negligence Lawsuits to Over $1 Million”; Proposition 47 “Reduces the Classification of Most Nonviolent Crimes From a Felony to a Misdemeanor”; and, Proposition 48 “Ratification of Gaming Compacts with the North Fork Rancheria of Mono Indians and the Wiyot Tribe.”

2The Bay Delta Conservation Plan (BDCP) is a part of California’s overall water management portfolio. It’s being developed as a 50-year habitat conservation plan with the goals of restoring the Sacramento-San Joaquin Delta ecosystem and securing California water supplies. The BDCP would secure California’s water supply by building new water delivery infrastructure and operating the system to improve the ecological health of the Delta. Besides this $7.5 billion in water projects from Proposition 1, the Governor has a proposal for twin tunnels – 40-foot-wide, 35-mile project that would siphon fresh Sacramento River water under the Delta and divert it into the San Joaquin Valley and Southern California (estimated cost $15-$25 billion). This project is very controversial and may never come to fruition.

3Proposition 58 of 2004. The state has had budget reserve mechanics in place for many years but they have proven to be largely ineffective. In 2004, voters passed Proposition 58 to create a new reserve, the BSA. Currently, Proposition 58 requires the Governor each year to decide whether to let 3% of General Fund revenues go into the BSA reserve. Right now, 3% of General Fund revenues equals a little over $3 billion. The state can take money out of the BSA with a majority vote of the legislature. There is currently no limit on how much the state can take out of the BSA in a single year.

4In years when capital gains-related tax receipts would otherwise trigger a deposit to the reserve, the proposal allows the governor and legislature to instead repay certain types of debt. The policy would also allow the state to make supplemental payments against unfunded pension or retiree health care benefit liabilities.

It should also be noted, however, it may be more difficult to create and preserve the reserve for schools and community colleges. Under current constitutional provisions, the state requires that at least 40% of general fund revenues go toward public education funding. In down years, when the state’s budgeters aren’t able to meet that requirement, California goes into a debt of sorts and must make up the difference by funding in excess of 40% in good times. In relation to Proposition 2, if the state still owed school districts funds from previous years, it wouldn’t have to make a deposit in the state’s education reserve. This brings into question just how often transfers will be made to the school reserve fund and is the basis of organized opposition from various education and parent groups.

Proposition 98 constitutionally establishes a minimum K-14 funding level each year from the state, largely dependent on state revenue performance and economic growth. Besides strengthening the state’s rainy day fund, Proposition 2 creates a Proposition 98 reserve. Although the reserve is conceptually a good idea, there are related provisions that may weaken its practical benefits. First, as the state’s Legislative Analyst’s Office noted, the reserve may only be occasionally funded based on certain state revenue threshold. In addition, there will be a statutory fund balance cap on local school district reserves, which would be triggered any year following a reserve deposit without regard to the size of the deposit.

Howard Cure is the Director of Municipal Research at Evercore Wealth Management. He can be contacted at: [email protected].

Important Notice

Evercore Wealth Management, LLC (“EWM”) is registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. EWM prepared this material for informational purposes only. It is not an offer to buy or sell or a solicitation of any offer to buy or sell any security/instrument, or to participate in any trading strategy. This material does not constitute financial, investment, tax or legal advice and should not be viewed as advice or recommendations with respect to asset allocation or any particular investment. EWM may make investment decisions for its clients that are different from or inconsistent with the analysis in this report. EWM obtained this information from multiple sources believed to be reliable as of the date of publication; EWM, however, makes no representations as to the accuracy or completeness of such third party information. EWM has no obligation to update, modify or amend this information or to otherwise notify a reader thereof in the event that any such information becomes outdated, inaccurate, or incomplete. Specific needs of a client must be reviewed and assessed before determining the proper investment objective and asset allocation, which may be adjusted to market circumstances. The securities/instruments discussed in this material may not be suitable for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. Any recommendations, opinions and analysis herein reflect our judgment at the date of this report and are subject to change as there are changes in relevant economic, legal or political circumstances. Any specific holdings discussed do not represent all of the securities purchased, sold or recommended by EWM, and the reader should not assume that investments in the companies identified and discussed were or will be profitable. Upon request, we will furnish a list of all securities recommended to clients during the past year. Past results are not an indication of future performance. This material does not purport to be a complete description of our investment services. This material may not be sold or redistributed without the prior written consent of EWM. © Copyright 2014